- United States

- /

- Biotech

- /

- NasdaqGS:BCRX

How New Pediatric APeX-P Data at BioCryst (BCRX) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- BioCryst Pharmaceuticals recently announced new one-year data from its APeX-P trial, highlighting that ORLADEYO (berotralstat) treatment led to early and sustained reductions in hereditary angioedema (HAE) attack rates in children aged 2 to under 12 years.

- The results also underscored the significant psychosocial impact of HAE on pediatric patients and their caregivers, further supporting the importance of effective therapies for this population.

- We'll explore how these clinical findings in pediatric patients may reinforce BioCryst Pharmaceuticals' case for expanded adoption and regulatory support for ORLADEYO.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BioCryst Pharmaceuticals Investment Narrative Recap

Investors in BioCryst Pharmaceuticals need to believe in the potential for ORLADEYO to achieve sustained revenue growth, particularly through regulatory approvals and market expansion in underserved patient groups. The latest pediatric data from the APeX-P trial may strengthen near-term prospects for FDA approval of ORLADEYO granules, but does not materially resolve the key risk of heavy reliance on a single drug for the bulk of BioCryst’s revenue.

The most relevant recent announcement is the FDA’s ongoing review of ORLADEYO’s oral granule formulation for children, with a decision expected in December 2025. This pending regulatory milestone has direct implications for expanding the drug’s accessible market and could serve as a near-term growth catalyst, while underscoring the concentration risk should approval not be granted.

However, despite the optimism around clinical developments, investors should also be aware that increasing competition in the HAE treatment market remains a concern if...

Read the full narrative on BioCryst Pharmaceuticals (it's free!)

BioCryst Pharmaceuticals' narrative projects $777.6 million in revenue and $212.3 million in earnings by 2028. This requires 11.7% yearly revenue growth and a $248 million increase in earnings from the current -$35.7 million.

Uncover how BioCryst Pharmaceuticals' forecasts yield a $20.40 fair value, a 186% upside to its current price.

Exploring Other Perspectives

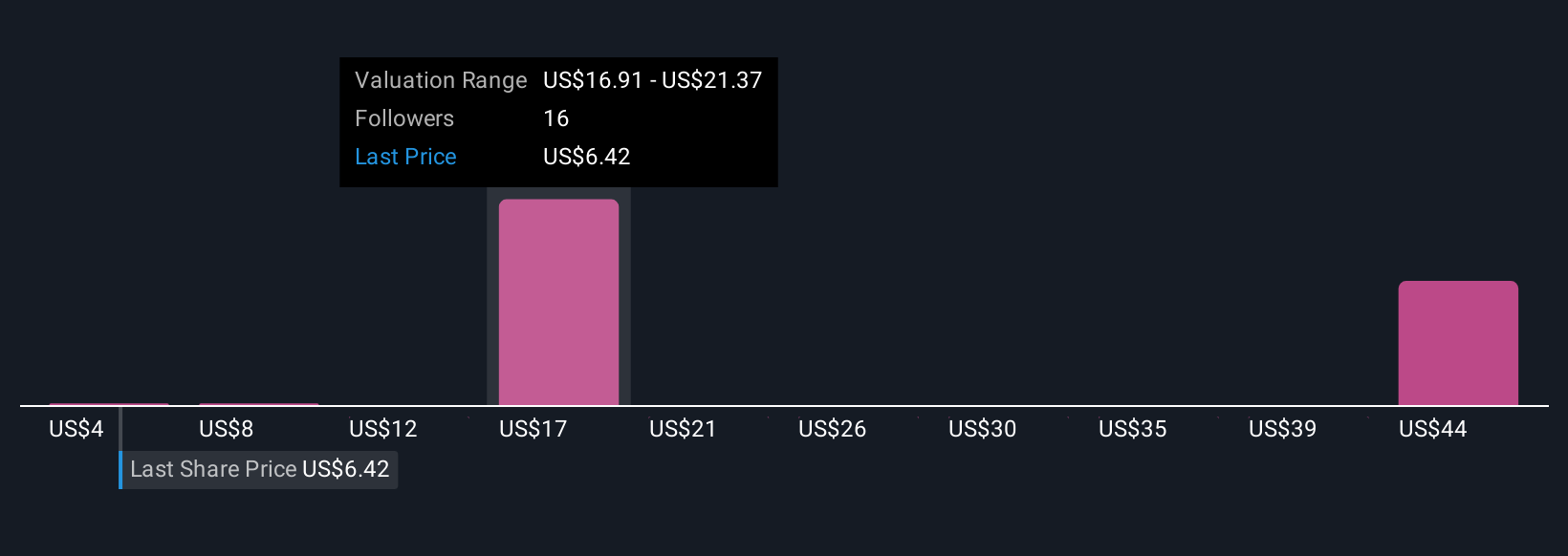

Fair value estimates from five Simply Wall St Community members range widely, from US$3.53 to US$67.63 per share. Amid this spectrum, you should weigh how ongoing FDA decisions for pediatric use could affect BioCryst’s dependence on a single product, and consider multiple viewpoints when assessing future potential.

Explore 5 other fair value estimates on BioCryst Pharmaceuticals - why the stock might be worth over 9x more than the current price!

Build Your Own BioCryst Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BioCryst Pharmaceuticals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BioCryst Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BioCryst Pharmaceuticals' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioCryst Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BCRX

BioCryst Pharmaceuticals

A biotechnology company, develops oral small-molecule and injectable protein therapeutics to treat rare diseases.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026