- United States

- /

- Biotech

- /

- NasdaqGM:BCAX

Why Bicara Therapeutics (BCAX) Is Up 18.6% After FDA Breakthrough Therapy Designation for Cancer Drug

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Bicara Therapeutics announced that the U.S. Food and Drug Administration granted Breakthrough Therapy Designation to its investigational cancer therapy, ficerafusp alfa, in combination with pembrolizumab for certain patients with head and neck squamous cell carcinoma.

- This regulatory milestone signals the potential for an expedited development timeline, highlighting growing industry attention in the EGFR bispecific antibody field and analyst optimism surrounding Bicara's clinical progress.

- We’ll explore how the FDA’s Breakthrough Therapy Designation strengthens Bicara Therapeutics’ investment profile and outlook for innovative cancer treatments.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Bicara Therapeutics' Investment Narrative?

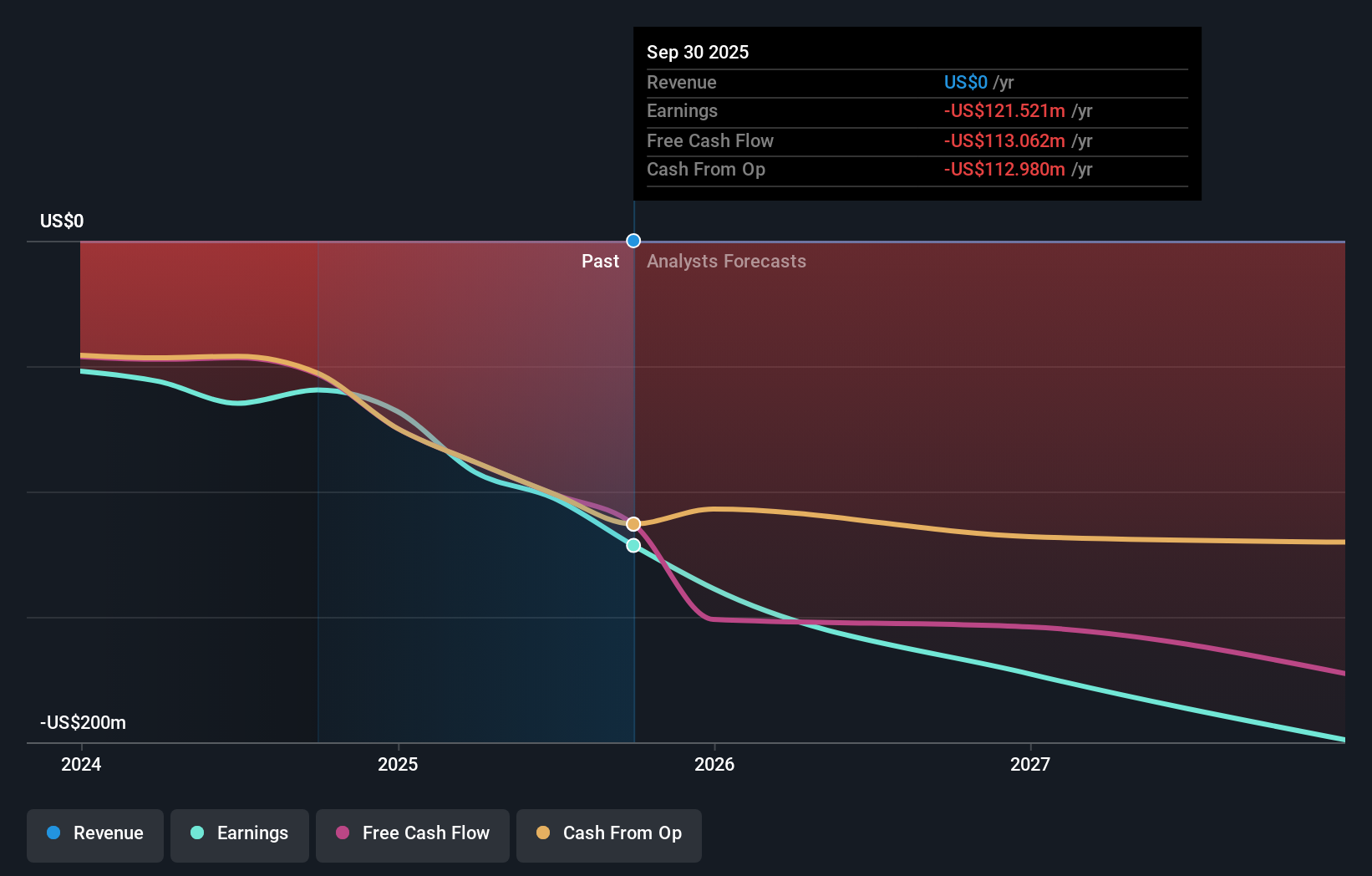

For those considering Bicara Therapeutics, the big picture is all about faith in breakthrough innovation and the company’s ability to translate clinical milestones into real-world value. The FDA’s Breakthrough Therapy Designation for ficerafusp alfa could accelerate its path to market and act as a significant near-term catalyst, potentially boosting visibility and support from both investors and analysts. Given the company’s history of financial losses, lack of revenue, and management turnover, Bicara’s progress hinges heavily on continued success with its lead asset and the strength of upcoming clinical data. The influx of attention following the latest regulatory win may shift focus away from Bicara’s unprofitability and volatile share price, though sustainability remains an open question. Ultimately, the FDA’s recognition is a clear positive for sentiment and timing, but financing needs and execution remain the main risks.

However, funding constraints could still challenge long-term ambitions if clinical progress slows or costs rise.

Exploring Other Perspectives

Explore another fair value estimate on Bicara Therapeutics - why the stock might be worth as much as 76% more than the current price!

Build Your Own Bicara Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bicara Therapeutics research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Bicara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bicara Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bicara Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BCAX

Bicara Therapeutics

A clinical-stage biopharmaceutical company, engages in the development of bifunctional therapies for solid tumors.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success