- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

Evaluating BridgeBio Pharma After 122% Rally and Clinical Trial Breakthroughs

Reviewed by Bailey Pemberton

- Wondering if BridgeBio Pharma is now a bargain or still too risky? You’re not alone. Let’s dig into what the numbers and latest movements tell us.

- The stock has had quite a ride, soaring 15.4% over the past week and an impressive 122.1% year-to-date. These figures point to both significant growth potential and changing perceptions about risk.

- Recent headlines have been driving interest in BridgeBio Pharma, with new milestones in clinical trials and positive regulatory developments capturing investors’ attention. These achievements have contributed to the sharp changes in stock price as expectations for future growth are being reassessed.

- Currently, BridgeBio Pharma scores a 2 out of 6 on our valuation checklist, which means there is room for debate about whether it is truly undervalued. We will break down what goes into that score using different valuation methods, and at the end, introduce an even better way to get the full picture.

BridgeBio Pharma scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: BridgeBio Pharma Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company’s stock should be worth by projecting its future cash flows and discounting them to today’s value. This method helps investors assess intrinsic value based on anticipated financial performance rather than market trends.

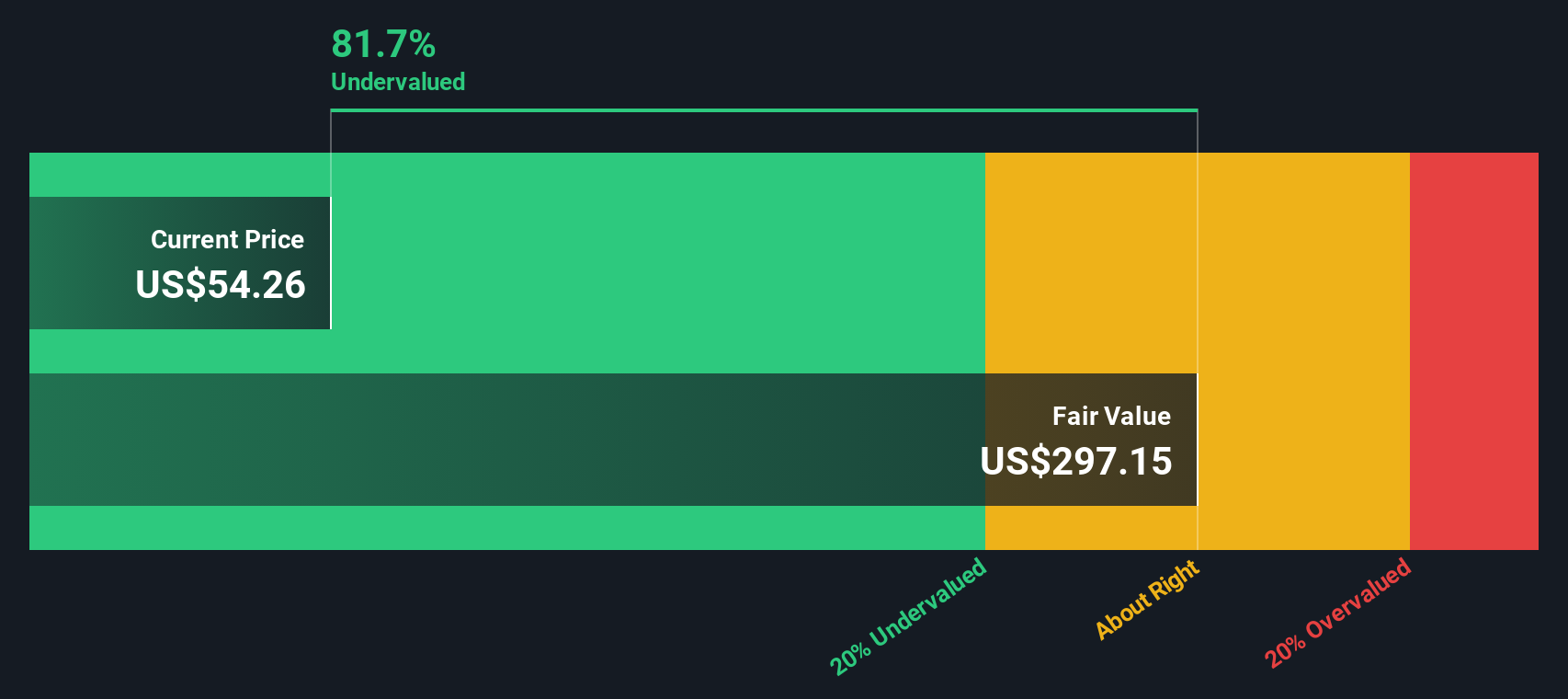

For BridgeBio Pharma, the DCF model uses a two-stage Free Cash Flow to Equity approach. According to the latest data, the company's last twelve months (LTM) Free Cash Flow was $597 Million in the negative, highlighting its heavy reinvestment phase. Analyst estimates suggest that by 2029, BridgeBio’s Free Cash Flow could reach $1.5 Billion. Projections for the next five years are based on analyst consensus, while subsequent years are extrapolated to reflect expected growth rates.

Using this model, the estimated fair value for BridgeBio Pharma stock is $326.08 per share. Based on the current share price, this represents an intrinsic discount of 80.8%, indicating the stock may be significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BridgeBio Pharma is undervalued by 80.8%. Track this in your watchlist or portfolio, or discover 835 more undervalued stocks based on cash flows.

Approach 2: BridgeBio Pharma Price vs Sales

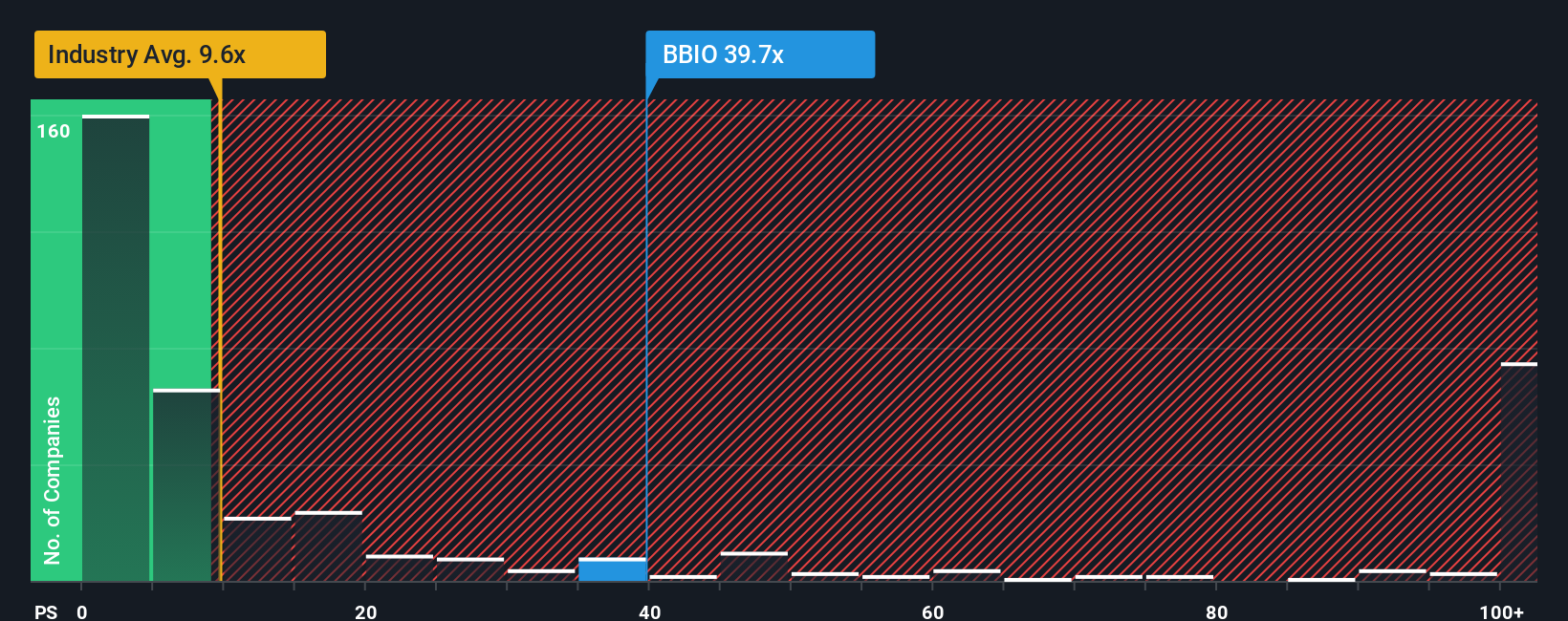

The Price-to-Sales (P/S) ratio is often the preferred metric for valuing biotech companies like BridgeBio Pharma, especially when consistent profitability is not yet achieved. This multiple shows how much investors are willing to pay for each dollar of a company’s sales, making it well-suited for rapidly growing firms in reinvestment phases or those yet to reach positive earnings.

Growth expectations and risk factors play a major role in determining what a “normal” or “fair” P/S ratio should be. Higher anticipated revenue growth, less risk, or stronger market positioning can push the ratio higher, while elevated risks or industry challenges bring it down. Comparing multiples across peers and the broader industry helps provide context, but only tells part of the story.

Currently, BridgeBio Pharma trades at a P/S ratio of 34.1x. For reference, the average for its biotech industry peers is 20.7x, and the industry overall averages 11.3x. At first glance, this suggests BridgeBio is priced at a significant premium.

Simply Wall St’s Fair Ratio offers a more tailored comparison. This proprietary metric reflects what a company’s P/S ratio should be, based on its expected revenue growth, profitability outlook, size, risk profile, industry norms, and more. Unlike a plain peer or industry comparison, the Fair Ratio delivers a nuanced valuation signal that adapts to the unique characteristics of the business and sector.

In BridgeBio’s case, the Fair Ratio is 25.5x, meaning the current P/S of 34.1x is above the level that would be justified by its fundamentals and outlook. This suggests that, when considering all relevant factors, the stock appears overvalued on a sales basis at current prices.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BridgeBio Pharma Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more dynamic tool available to all investors on Simply Wall St’s Community page. A Narrative is a simple story or perspective that you, as an investor, create to back up your view of what a company is really worth. Instead of just crunching numbers, you can link what you believe about BridgeBio Pharma’s future (like new drug launches, profit margins, and risks) directly to a financial forecast and fair value estimate, making it easier to explain your reasoning and track your thinking over time.

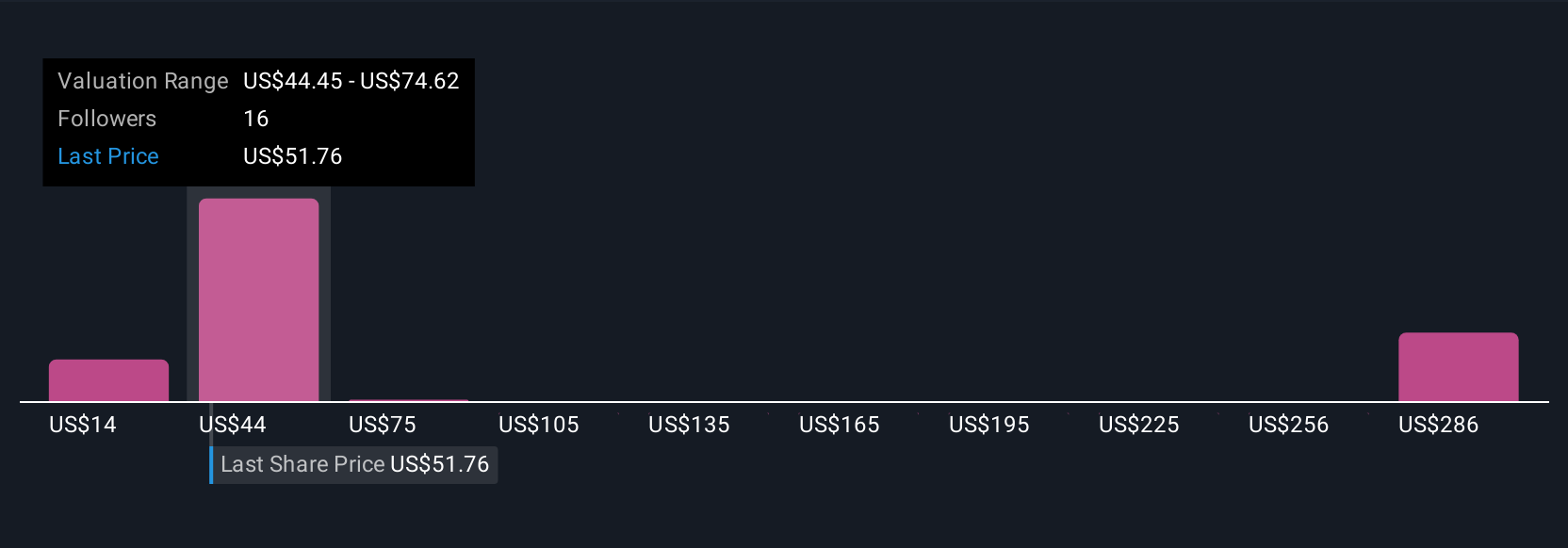

Narratives help you make more confident decisions about buying or selling by comparing your own Fair Value to the current market price. They are updated automatically whenever important news or data comes in, so your viewpoint always stays relevant. For example, some investors using Narratives expect BridgeBio Pharma’s fair value to be as high as $95 based on bullish views of revenue momentum and pipeline breakthroughs, while others see it as low as $41 due to concerns around risks and commercial execution, capturing the full spectrum of perspectives in real time.

Do you think there's more to the story for BridgeBio Pharma? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives