- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

BridgeBio Pharma (BBIO): Assessing Valuation After Promising Acoramidis Data at AHA and in JAMA Cardiology

Reviewed by Simply Wall St

BridgeBio Pharma (BBIO) has unveiled fresh clinical results for acoramidis at the American Heart Association Scientific Sessions and in JAMA Cardiology, highlighting significant reductions in all-cause mortality and hospitalization for variant ATTR-CM patients.

See our latest analysis for BridgeBio Pharma.

BridgeBio’s momentum is tough to ignore: shares have surged 137% year-to-date, while the one-year total shareholder return sits at an impressive 199%, fueled in part by headline-making clinical results like those just presented at the AHA. Investors seem to be recalibrating their risk appetite as the company continues delivering on key milestones, which could be a sign that optimism around its long-term outlook is building.

If clinical breakthroughs and sharp rallies catch your interest, you may want to broaden your search and discover See the full list for free.

But with BridgeBio shares already vaulting higher after this latest round of compelling data, investors are left to consider the core question: Is there still undiscovered value here, or has the market already priced in the company’s next phase of growth?

Most Popular Narrative: 19.5% Undervalued

The current fair value cited in the most popular narrative is $83.11, with BridgeBio shares last closing at $66.90. This sizable gap is fueling conversation on whether the market is underestimating the company’s upside, especially as clinical catalysts accelerate.

The company's late-stage pipeline, with three Phase III readouts imminent across high unmet need rare disease indications, positions BridgeBio to leverage advancements in biotechnology for potential first-to-market and best-in-class therapies. This creates the opportunity for multiple revenue inflection points and margin improvement as the portfolio diversifies.

Want to know the secrets behind this bold narrative price tag? Forecasts hinge on rapid expansion, fatter margins, and financial leaps more often seen in breakthrough tech. Discover the exact projections that fuel this optimism and what analysts see on BridgeBio’s horizon. You might be surprised what’s driving that fair value higher.

Result: Fair Value of $83.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, BridgeBio’s growth story still faces hurdles, including heavy reliance on a single drug as well as the uncertainty of upcoming clinical trial outcomes.

Find out about the key risks to this BridgeBio Pharma narrative.

Another View: Multiples Suggest Expensive Valuation

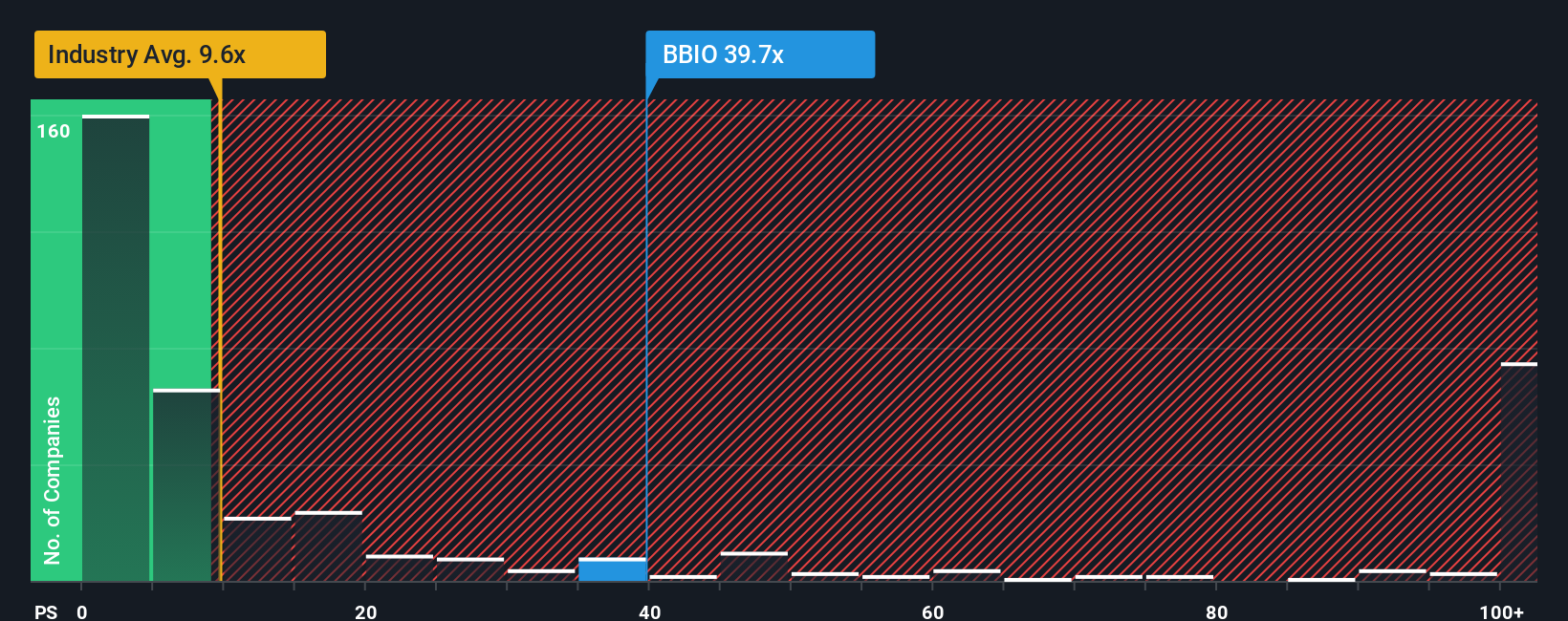

While the fair value narrative highlights undervaluation, taking a closer look at the company’s price-to-sales ratio presents a different perspective. BridgeBio trades at 36.4x sales, which is significantly higher than both the industry average of 11x and the peer group’s 16.9x. The fair ratio is 24.5x, indicating that the current market enthusiasm may be outpacing the company’s underlying sales performance. What will it take for the fundamentals to catch up, or is momentum likely to fade?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BridgeBio Pharma Narrative

If our take doesn't align with your outlook, or if you're keen to dig into the numbers yourself, you can shape your own view of BridgeBio Pharma in just a few minutes. Do it your way.

A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Seize the Next Opportunity: Handpicked Investment Ideas Await

Smart investors rarely settle for just one winning stock. Take your momentum further by tapping into themed ideas you might be missing right now.

- Lock in stable returns by checking out these 18 dividend stocks with yields > 3% offering solid yields and a track record of reliable payouts.

- Get ahead of the tech curve by uncovering rapid movers among these 27 AI penny stocks poised to benefit from the explosive growth in artificial intelligence.

- Catch future leaders trading below their worth by reviewing these 894 undervalued stocks based on cash flows making waves with strong fundamentals and attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives