- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Is Azenta a Hidden Opportunity After 39% Share Price Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Azenta could be a hidden value opportunity or a stock to avoid? You are not alone. Let's dive into what really matters for investors watching today's market.

- Azenta's shares have struggled lately, losing 6.4% over the last week and over 39% so far this year. This has many asking if the market is overlooking its future potential or simply pricing in new risks.

- Recent headlines have focused on Azenta's strategic moves, such as its increased investment in cutting-edge life sciences storage solutions and ongoing expansion into new markets. These developments are shaping the outlook surrounding the stock and fueling debate about the company's ability to turn innovation into returns.

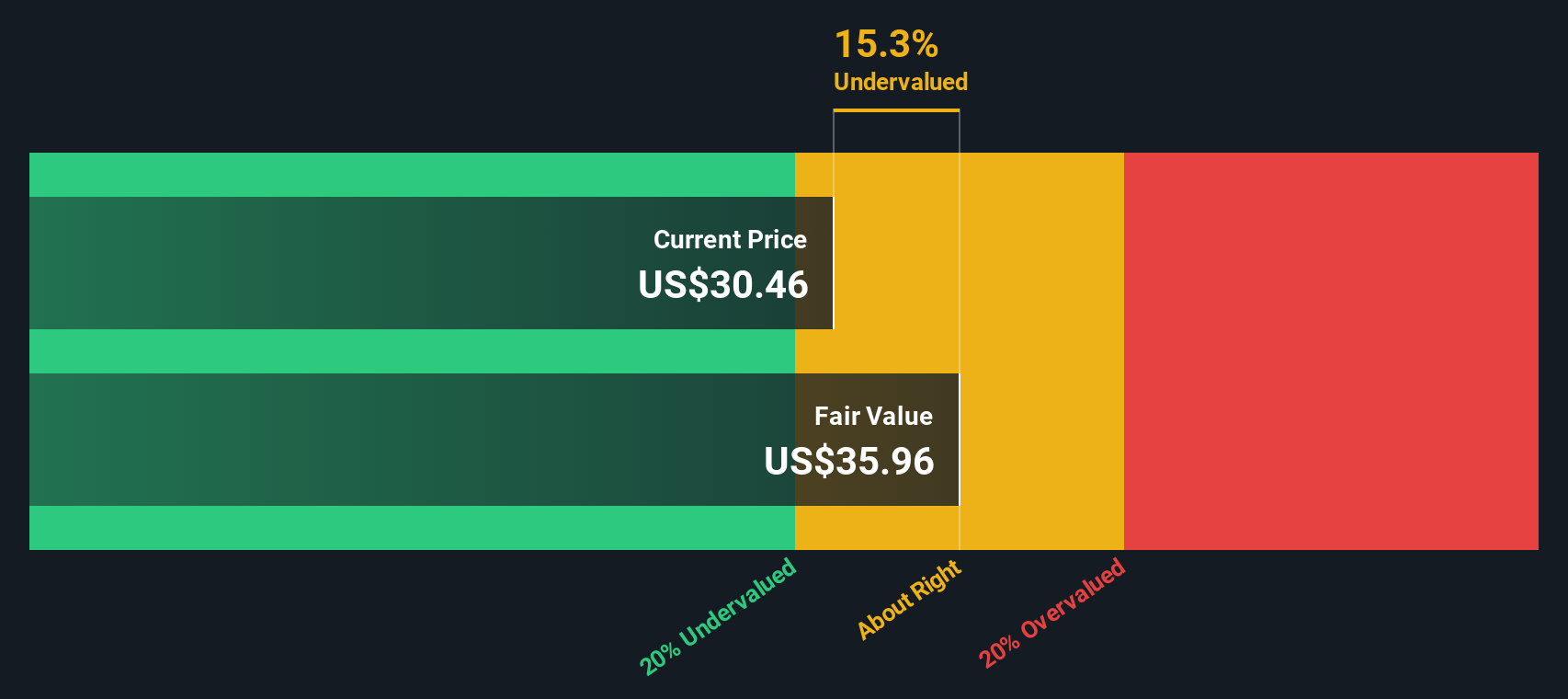

- According to our latest checks, Azenta achieves a valuation score of 4 out of 6, indicating it may be undervalued in several key areas. Next, we will break down the valuation from a few classic angles. Keep reading for an even smarter way to see what the market is missing.

Find out why Azenta's -26.7% return over the last year is lagging behind its peers.

Approach 1: Azenta Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company's stock should be worth today by projecting its future free cash flows and then discounting those figures back to their present value. This approach offers a forward-looking view of value and is especially useful for companies focused on long-term growth.

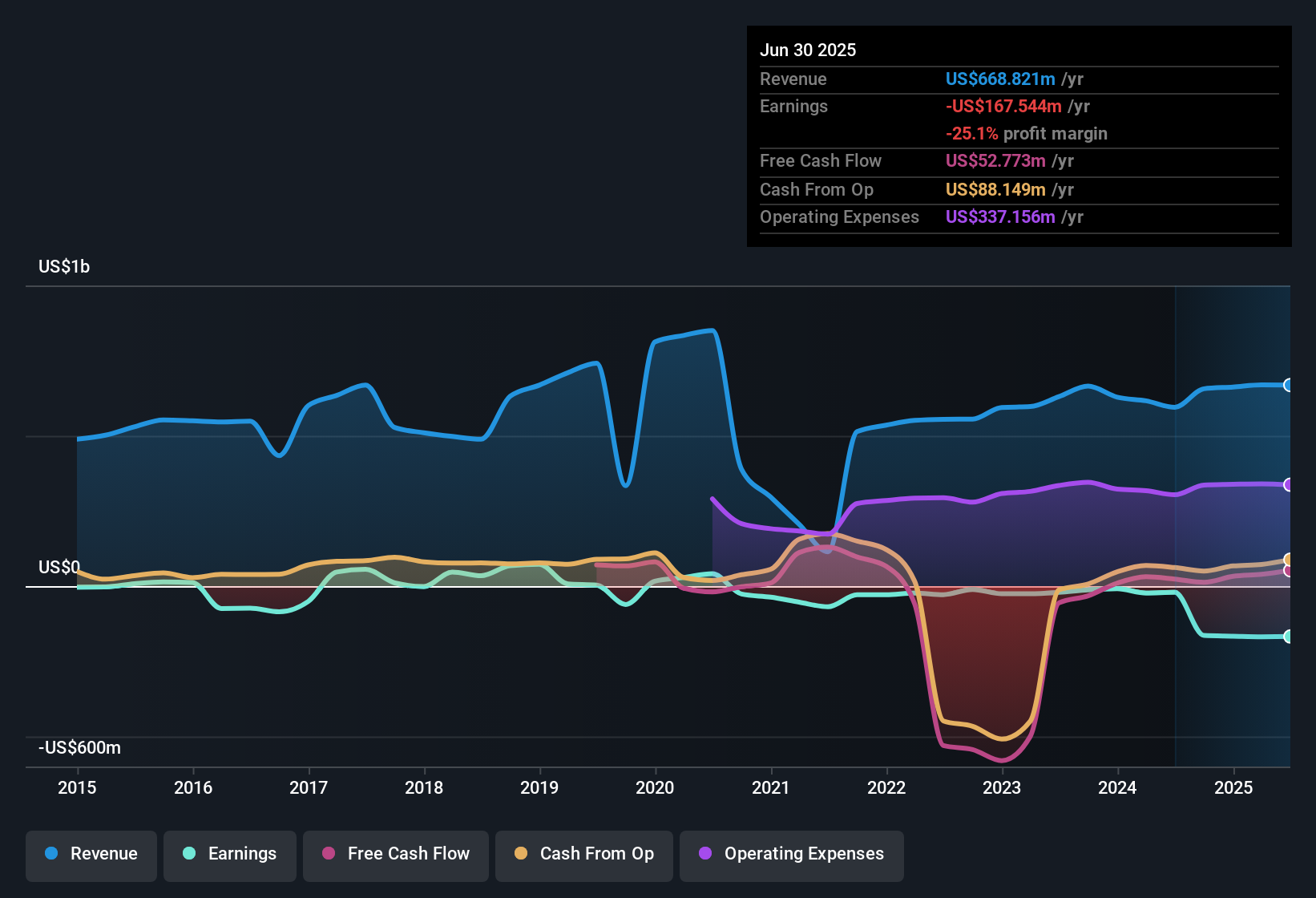

For Azenta, the current Free Cash Flow stands at $47 million. According to analyst estimates and Simply Wall St projections, Azenta's Free Cash Flow is expected to grow steadily, reaching about $93 million by fiscal 2035. These projections are based on assumptions such as analyst-led forecasts for the first five years and reasonable extrapolations beyond that period.

Applying this two-stage DCF model, the estimated intrinsic value per share is calculated at $35.19. Given recent share prices, this suggests the stock is trading at a 14.2% discount to its underlying value. In other words, according to the DCF analysis, Azenta appears to be undervalued by a notable margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Azenta is undervalued by 14.2%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Azenta Price vs Sales

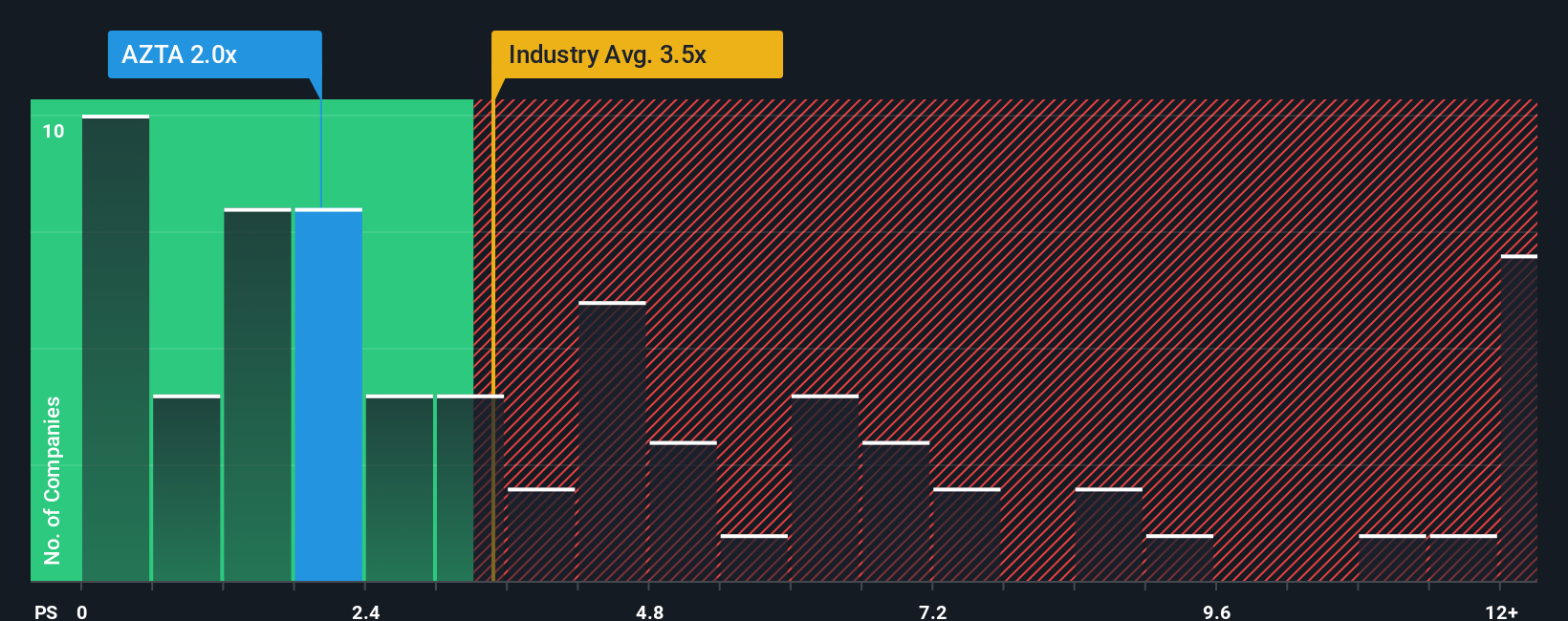

The price-to-sales (P/S) ratio is a popular valuation tool for companies like Azenta, especially when profits are inconsistent or earnings can be lumpy due to growth investments. The P/S multiple lets investors focus on comparing sales generated per dollar of market value, making it a useful way to evaluate companies in fast-changing sectors such as Life Sciences.

Growth expectations and perceived risks play a major role in what investors consider a “normal” or “fair” P/S ratio. Higher ratios often signal excitement about future expansion, profitability, or unique products, while lower ratios can reflect caution about risks or slower growth.

Azenta's current P/S ratio sits at 2.07x, significantly below the Life Sciences industry average of 3.67x and well under the peer average of 6.63x. This suggests the market is either cautious on Azenta's prospects or overlooking something others find valuable in its peers.

Simply Wall St’s proprietary Fair Ratio for Azenta is 2.22x. This estimate goes deeper than a surface-level comparison, as it benchmarks what Azenta’s P/S should be considering its growth outlook, profit margins, market cap, and specific risks. Because it is tailored to the company, the Fair Ratio offers a more reliable gauge of true value than peer or industry figures alone.

With Azenta's actual P/S multiple just 0.15x below the Fair Ratio, it appears the stock is generally priced in line with its fundamentals, making it neither a standout bargain nor significantly overvalued based on this metric.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1415 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Azenta Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is your personal investment story that connects what you believe about Azenta as a business, how you think its revenue and profits might evolve, and what you estimate as its fair value today. This turns raw data into your unique perspective.

Rather than just following numbers, Narratives allow you to link the company’s story, industry dynamics, and upcoming catalysts directly to a financial forecast and valuation. This provides a clearer reason for your investment decisions.

On Simply Wall St’s Community page, millions of investors access and create Narratives. It’s an accessible, interactive tool that updates dynamically as new earnings results, news, or analyst forecasts roll in, helping you adjust your view as reality changes.

By comparing your fair value estimate to the current price, Narratives reveal if it’s time to consider buying, selling, or holding shares, all based on your own chosen assumptions about Azenta’s future.

For example, recent analyst Narratives for Azenta span a bullish target of $40.00 per share, driven by optimism on biopharma demand and margin expansion, to a more cautious $30.00 view reflecting concerns about execution risks and industry headwinds. This shows how Narratives empower you to invest with context, not just consensus.

Do you think there's more to the story for Azenta? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences market in the United States, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives