- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Insider and Institutional Moves Ahead of Q4 Results Might Change the Case for Investing in Azenta (AZTA)

Reviewed by Sasha Jovanovic

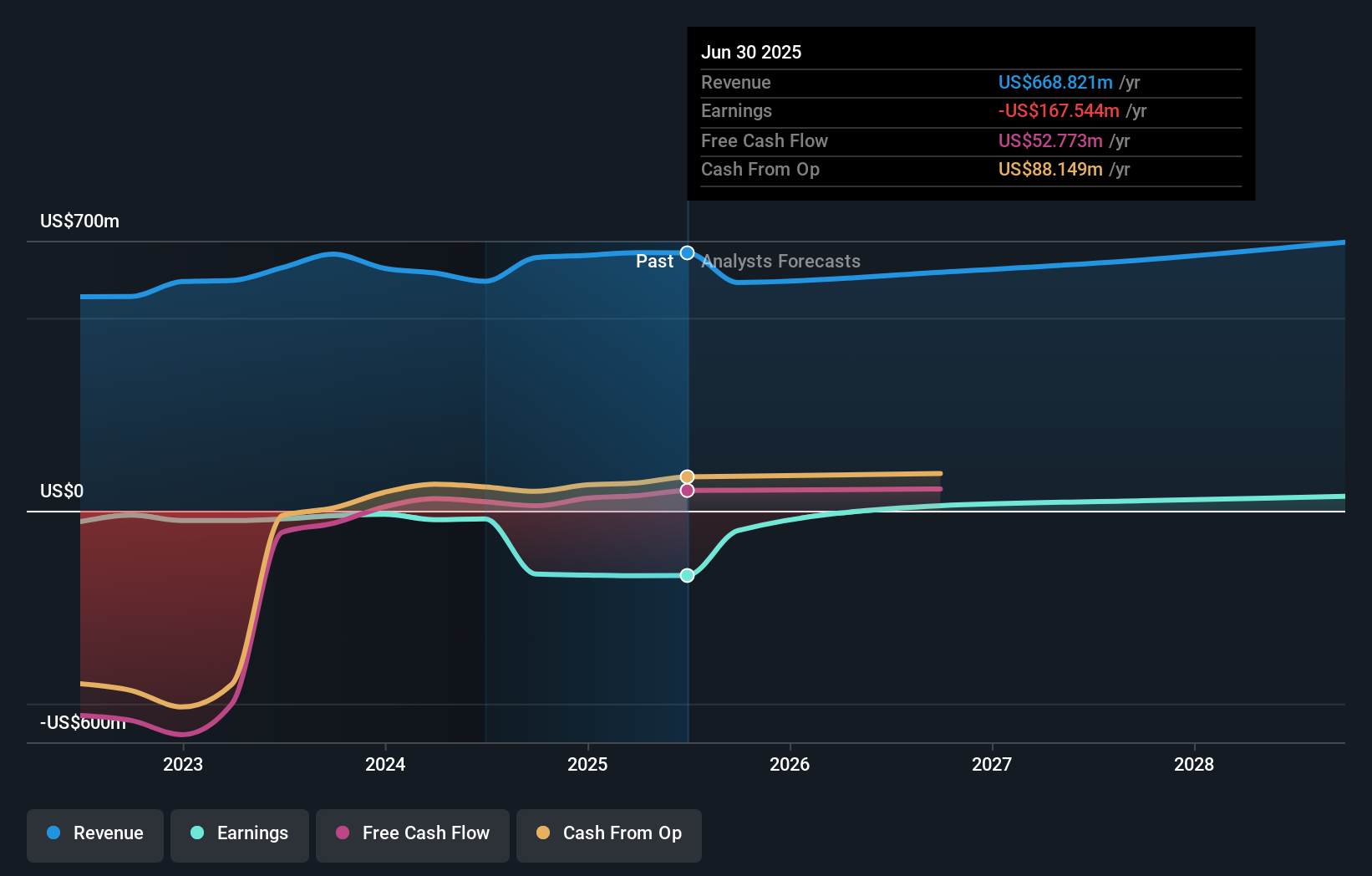

- Azenta, Inc. released its fourth quarter 2025 financial results on November 21, following a period of increased insider and institutional investor activity ahead of the announcement.

- Analyst expectations centered on signs of a turnaround in revenue growth and operational performance, given Azenta’s historical difficulty in consistently meeting Wall Street forecasts.

- We'll explore how ongoing insider trading activity sets the stage for potential shifts in Azenta's investment story following its latest earnings release.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Azenta Investment Narrative Recap

To be an Azenta shareholder, you need to believe that the company can return to sustainable revenue growth and improve operational performance, leveraging trends in life sciences automation and personalized medicine. The latest insider and institutional activity ahead of fourth-quarter results, while noteworthy, is not a material short-term catalyst and does not directly offset the biggest risk facing the business: continued revenue pressure from biotech sector headwinds and product mix volatility.

Among Azenta’s recent announcements, its strategic partnership with the PRECEDE Foundation stands out, as it aligns with the company’s push toward recurring biorepository services and industry collaboration. This partnership supports a core catalyst: expanding the addressable market and recurring revenue in life sciences services, even as broader industry softness poses an ongoing challenge.

By contrast, investors should be aware of the potential impact if delays in orders for Azenta’s higher-margin capital equipment persist due to...

Read the full narrative on Azenta (it's free!)

Azenta's outlook anticipates $684.6 million in revenue and $34.5 million in earnings by 2028. This scenario requires a 0.8% annual revenue decline and a $202 million increase in earnings from the current -$167.5 million.

Uncover how Azenta's forecasts yield a $35.17 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Azenta, ranging from US$32.96 to US$35.17. While some see upside, ongoing pressure on core revenue segments remains a key uncertainty affecting Azenta’s near-term trajectory, explore the range of views to better understand this evolving story.

Explore 2 other fair value estimates on Azenta - why the stock might be worth as much as 17% more than the current price!

Build Your Own Azenta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Azenta research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Azenta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Azenta's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences market in the United States, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives