- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Should Axsome Therapeutics' (AXSM) Revenue Surge and Shelf Filing Spark a New Investor Outlook?

Reviewed by Sasha Jovanovic

- Axsome Therapeutics reported third-quarter 2025 earnings, posting revenues of US$170.99 million, up from US$104.76 million in the prior year, as well as a reduced net loss of US$47.23 million compared to US$64.6 million a year ago.

- The company also filed a shelf registration to offer a range of securities, positioning itself for future fundraising opportunities and increased financial flexibility as its product portfolio and pipeline progress.

- We'll explore how Axsome's robust revenue growth and continued investment in new therapies influence the company's broader investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Axsome Therapeutics Investment Narrative Recap

To be a shareholder in Axsome Therapeutics, you need to believe in the company’s ability to expand its central nervous system (CNS) drug portfolio and deliver blockbuster-scale growth from both existing and pipeline assets. While the latest quarterly results confirmed strong sales momentum and narrowing losses, they do not materially change the biggest near-term catalyst: further clinical and regulatory progress for late-stage candidates such as AXS-05 and AXS-12. However, persistent net losses and high R&D spending continue to reinforce liquidity and dilution as central risks.

Among recent announcements, Axsome’s filing of a universal shelf registration is highly relevant, as it gives the company flexibility to raise additional capital through various types of securities. This move aligns with the need for ongoing investment to accelerate key product launches and clinical programs, directly connected to the growth catalysts and liquidity risks discussed above.

In contrast, investors should be aware that ongoing cash burn and shareholder dilution risks remain front and center if commercial scaling or pipeline milestones disappoint...

Read the full narrative on Axsome Therapeutics (it's free!)

Axsome Therapeutics' narrative projects $1.7 billion in revenue and $553.3 million in earnings by 2028. This requires 51.9% yearly revenue growth and a $800.2 million increase in earnings from the current -$246.9 million.

Uncover how Axsome Therapeutics' forecasts yield a $176.84 fair value, a 30% upside to its current price.

Exploring Other Perspectives

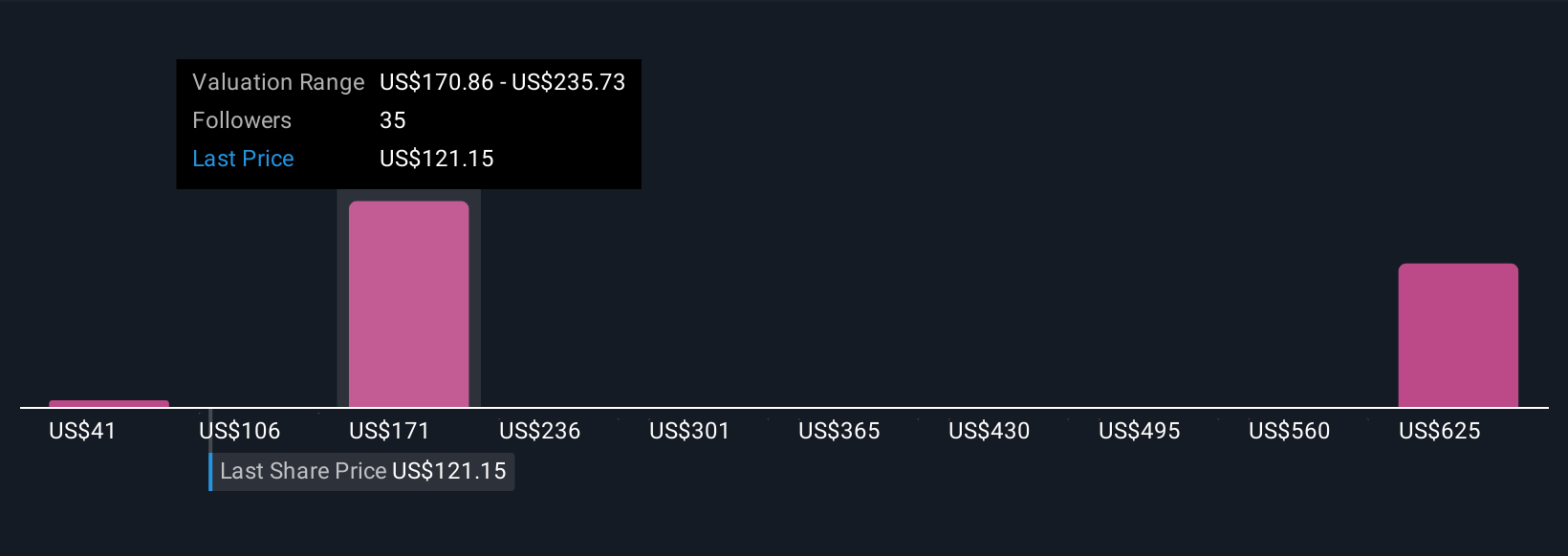

Eight members of the Simply Wall St Community provided fair value estimates for Axsome Therapeutics, ranging from as low as US$41.12 to US$700.78 per share. These differing outlooks reflect both the company’s ambitious revenue growth targets and the persistent risk of heavy reliance on a narrow product portfolio, so you may want to compare several viewpoints.

Explore 8 other fair value estimates on Axsome Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Axsome Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axsome Therapeutics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Axsome Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axsome Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives