- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Axsome Therapeutics, Inc.'s (NASDAQ:AXSM) Price In Tune With Revenues

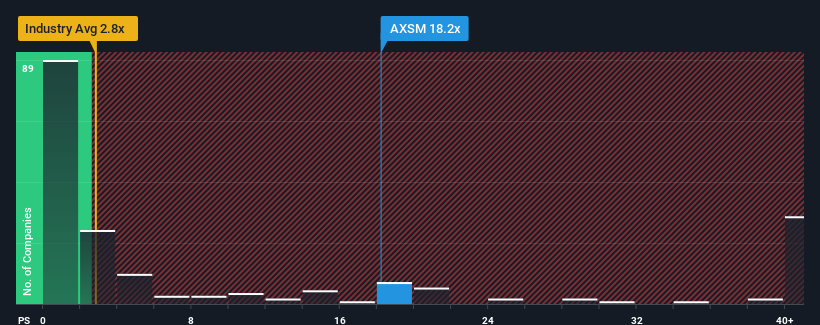

When close to half the companies in the Pharmaceuticals industry in the United States have price-to-sales ratios (or "P/S") below 2.8x, you may consider Axsome Therapeutics, Inc. (NASDAQ:AXSM) as a stock to avoid entirely with its 18.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Axsome Therapeutics

What Does Axsome Therapeutics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Axsome Therapeutics has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Axsome Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Axsome Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Axsome Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 71% per year during the coming three years according to the twelve analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 58% per annum, which is noticeably less attractive.

In light of this, it's understandable that Axsome Therapeutics' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Axsome Therapeutics' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Axsome Therapeutics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Axsome Therapeutics that you should be aware of.

If you're unsure about the strength of Axsome Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives