- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Axsome Therapeutics (AXSM): Exploring Valuation as Shares Climb 54% Year-to-Date

Reviewed by Simply Wall St

Axsome Therapeutics (AXSM) shares have delivered a steady run lately, climbing 12% over the past month and up more than 50% this year. Investors are considering how current momentum relates to company performance and future prospects.

See our latest analysis for Axsome Therapeutics.

Momentum has clearly been building for Axsome Therapeutics, with the share price up over 54% year-to-date and the 1-year total shareholder return exceeding 51%. This sustained outperformance suggests growing optimism about the firm’s growth trajectory and pipeline potential, even as investors remain alert to changing risk perceptions.

If you’re excited by what’s happening in biotech lately, it is a great moment to explore more possibilities with our See the full list for free.

With Axsome’s shares rising strongly and still trading more than 30% below the average analyst price target, the key question is whether the market is overlooking further upside or if the recent surge already reflects future growth prospects.

Most Popular Narrative: 23.7% Undervalued

Axsome Therapeutics closed at $134.93, but the most widely followed narrative estimates fair value at $176.84. This presents a notably different outlook than today's market pricing. Here's what is driving attention to this bullish scenario.

The company is advancing multiple late-stage clinical programs (AXS-05, AXS-12, AXS-14, and several solriamfetol indications). This positions Axsome to benefit from the aging population and rising prevalence of CNS disorders, potentially resulting in a diversified revenue base, higher earnings, and reduced risk of overreliance on a single product.

Curious about why this price target leaps so far ahead? The smartest projections here hinge on several bold leaps in sales, profit margins, and market reach. Want to see which ambitious forecasts could reshape Axsome’s valuation story? Unlock the revealing assumptions behind this fair value and decide if the optimism is justified.

Result: Fair Value of $176.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as unexpected setbacks in product launches or slower revenue growth could quickly challenge the current optimism regarding Axsome’s outlook.

Find out about the key risks to this Axsome Therapeutics narrative.

Another View: Sizing Up Axsome’s Valuation by Sales Ratios

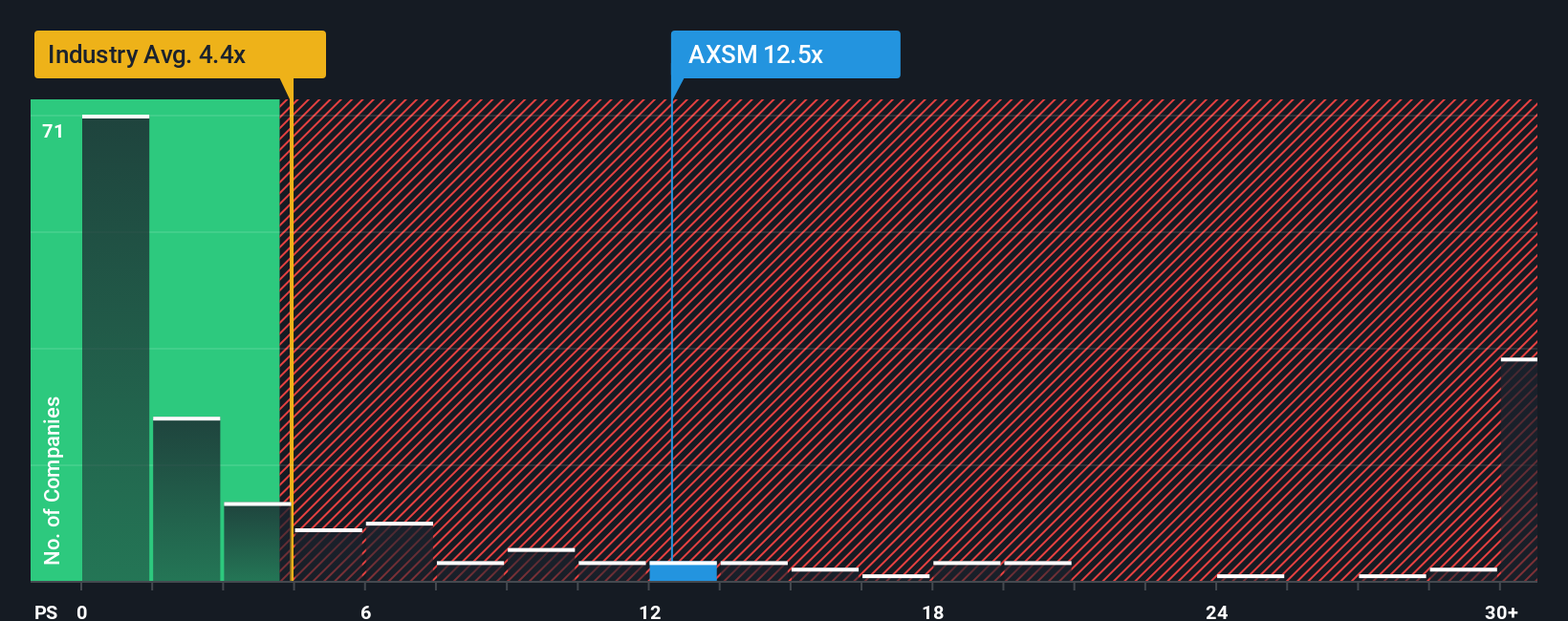

While bullish narratives point to Axsome being undervalued, a look at its price-to-sales ratio tells a different story. At 12.1x, Axsome trades well above the peer average of 9.1x and nearly triple the 4.3x industry average. The market's optimism is built in. But will the fair ratio of 15.6x that our analysis projects ever materialize, or is there downside risk if growth stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axsome Therapeutics Narrative

If you see the story differently, or want to dig through the numbers yourself, you can craft your own take on Axsome’s outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Axsome Therapeutics.

Looking for More Smart Investment Angles?

Never limit your options to a single stock. Some of the most exciting opportunities are hiding in plain sight. Use the Simply Wall Street Screener to seize these market advantages and avoid missing the next big thing in investing.

- Find potential bargains by targeting companies that look undervalued based on their future cash flows using these 844 undervalued stocks based on cash flows.

- Unleash your portfolio’s growth potential with these 27 AI penny stocks that are shaping tomorrow’s artificial intelligence breakthroughs.

- Secure reliable returns by zeroing in on these 20 dividend stocks with yields > 3% offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives