- United States

- /

- Biotech

- /

- NasdaqGS:ASND

Assessing Ascendis Pharma After Pipeline Updates and a 59.8% One-Year Surge

Reviewed by Bailey Pemberton

- Ever wondered if Ascendis Pharma is a hidden gem or if the recent buzz is justified? Let’s break down what might really be driving the current price.

- The stock has seen some ups and downs lately, dipping by 1.1% over the past week and 1.5% in the last month. It still boasts a strong 45.6% gain year-to-date and an impressive 59.8% return over the past year.

- Much of this momentum has been shaped by recent news highlighting pipeline updates and regulatory milestones, which have kept investors on their toes. Developments around key product approvals and expanded indications have sparked renewed optimism in the market.

- When we look at valuation checks, Ascendis Pharma scores 4 out of 6 for being undervalued. This suggests there is more than one sign pointing to value. Now, let’s dig into what goes into those numbers, with a better way to judge whether the stock is really undervalued coming up at the end.

Approach 1: Ascendis Pharma Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to their present value. This approach offers a perspective on what Ascendis Pharma could be worth if its future unfolds in line with these expectations.

For Ascendis Pharma, the most recent Free Cash Flow (FCF) stands at €-173.4 Million, with analysts forecasting steady improvements each year. While analyst estimates extend for five years, projections for the following years are extrapolated to complete a ten-year outlook. By 2029, annual FCF is thought to reach €1.24 Billion. This resulting growth path is reflected in the 2 Stage Free Cash Flow to Equity model utilized here.

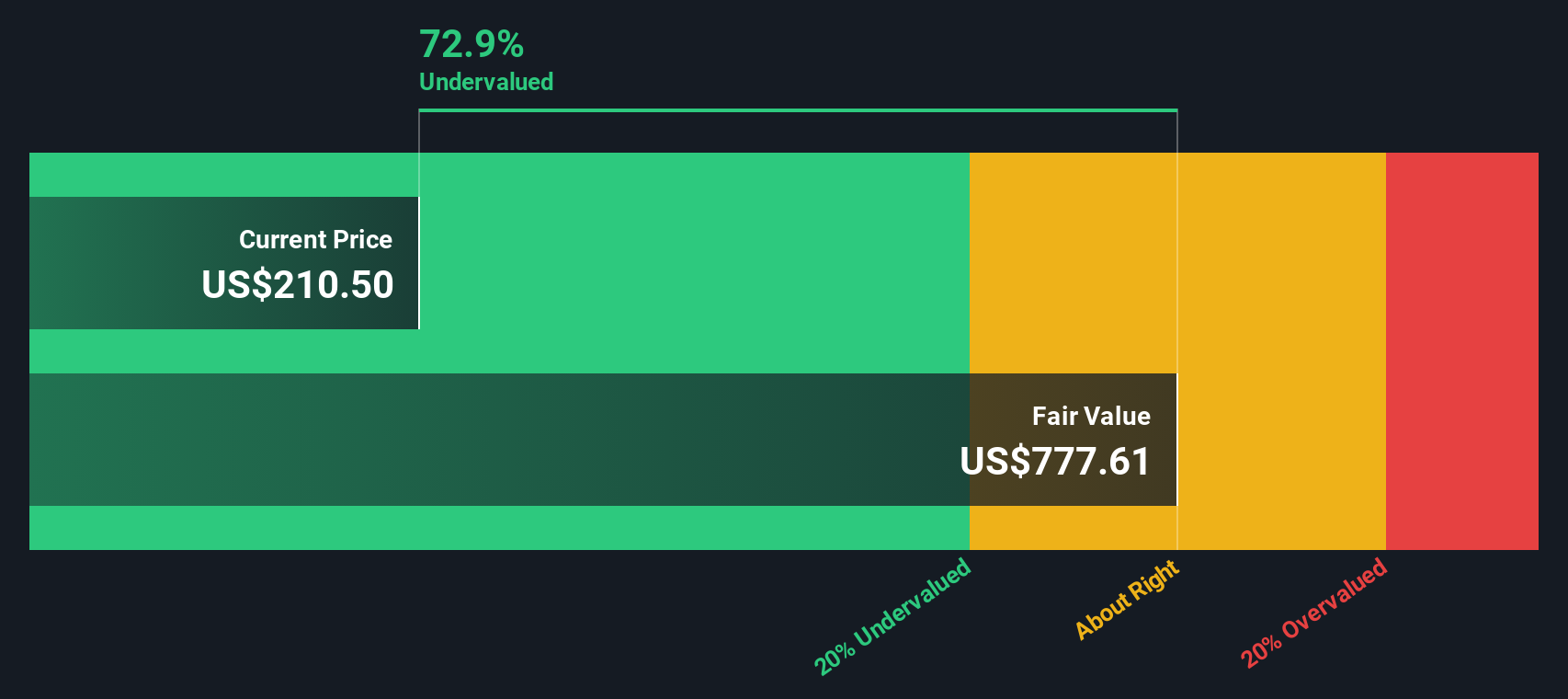

Based on this method, the estimated intrinsic value is €748.83 per share. When we compare this figure to the current share price, the DCF model implies that Ascendis Pharma is trading at a substantial 73.2% discount to its fair value, which may indicate significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ascendis Pharma is undervalued by 73.2%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Ascendis Pharma Price vs Sales (P/S)

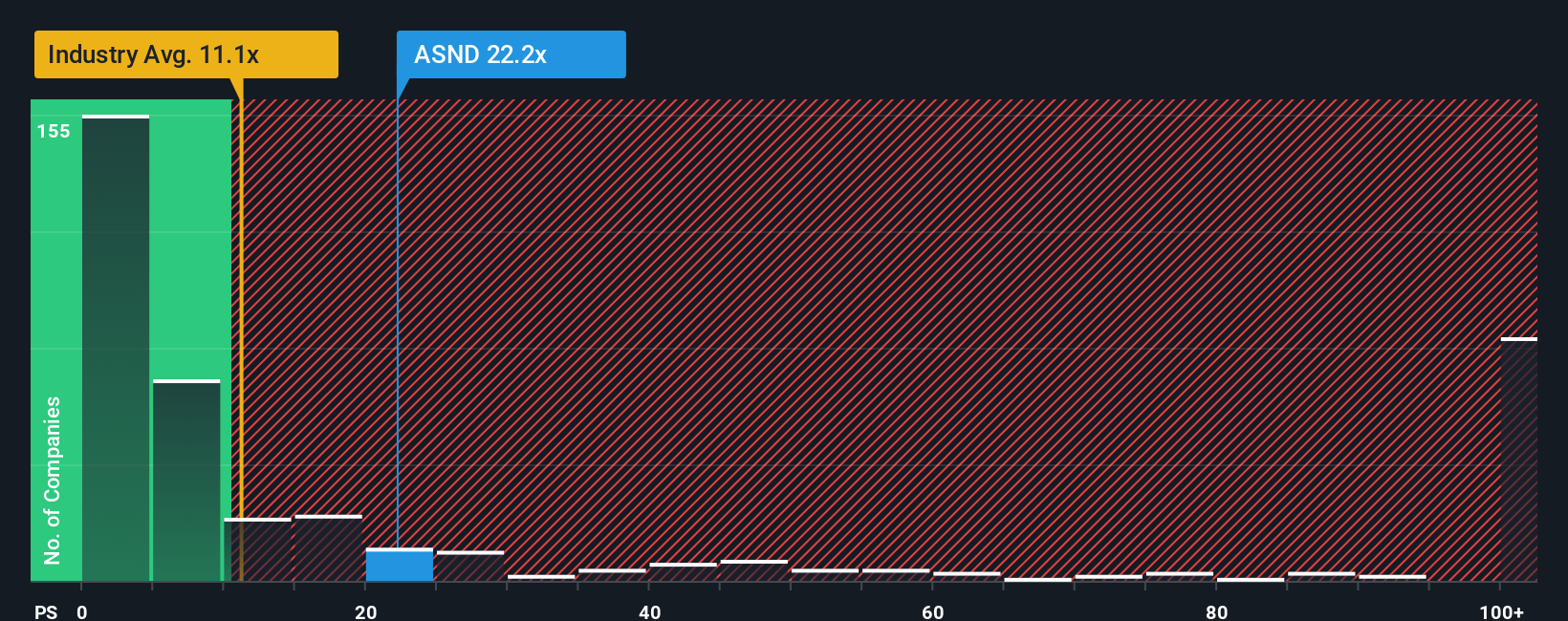

The Price-to-Sales (P/S) ratio is a popular valuation tool for companies like Ascendis Pharma, particularly in the biotech sector where earnings may not yet be positive due to ongoing research and significant investments in growth. This metric allows investors to gauge how much they are paying for each dollar of the company’s sales, which can be especially meaningful when profit is not yet robust.

Growth expectations and company-specific risks have a significant impact on what counts as a "normal" P/S ratio. Companies with higher growth prospects often warrant a higher multiple, while those in riskier or more volatile markets may trade at a discount.

Currently, Ascendis Pharma trades at a P/S ratio of 21.7x. For context, the average P/S across its biotech peers is 28.2x, while the broader industry average sits at 10.8x. These benchmarks help frame where the company stands but do not account for its unique growth profile and risk factors.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is a proprietary measure that considers not only sales growth but also profit margins, the company’s industry, market cap, and specific risks. This provides a more tailored valuation anchor compared to generic peer or industry averages.

For Ascendis Pharma, the Fair Ratio is calculated at 15.6x. Since the current P/S of 21.7x is notably higher than this fair value benchmark, the data suggests that the stock may currently be overvalued on this basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ascendis Pharma Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story, based on your personal outlook and assumptions about a company like Ascendis Pharma, that connects what’s happening in the real world with what the numbers might look like in the future. This approach links your perspective on growth, margins, and risks directly to a forecast and fair value.

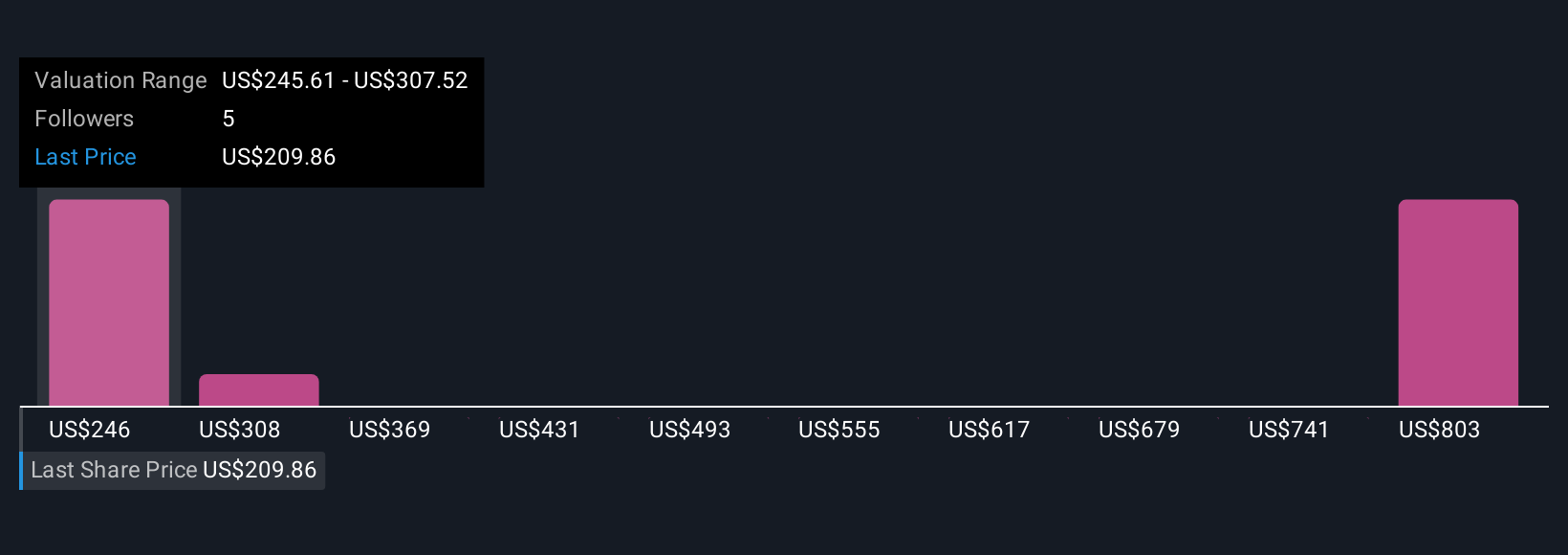

Narratives make it easy to turn your own research, or reactions to the latest news, into a dynamic investment viewpoint. Each Narrative is posted and updated in real-time on Simply Wall St’s Community page, where millions of investors share, compare, and refine their beliefs. Comparing your Narrative’s fair value with the live share price helps you decide whether it’s time to buy, sell, or hold, and your view will stay up to date as new financial results or regulatory news are announced.

For example, one Narrative on Ascendis Pharma might forecast rapid revenue growth and future drug approvals, resulting in a fair value as high as $307. Another Narrative might emphasize competitive threats and cost risks, producing a fair value closer to $203. Narratives allow you to choose the forecast and story that best fit your understanding, giving you a smarter, more personal way to invest.

Do you think there's more to the story for Ascendis Pharma? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASND

Ascendis Pharma

Operates as a biopharmaceutical company that focuses on developing TransCon-based therapies for unmet medical needs in Denmark, rest of Europe, North America, and internationally.

Exceptional growth potential and good value.

Market Insights

Community Narratives