- United States

- /

- Biotech

- /

- NasdaqGS:ARWR

Arrowhead Pharmaceuticals (ARWR): Exploring Valuation After a 7% Climb and Strong Year-to-Date Gains

Reviewed by Simply Wall St

See our latest analysis for Arrowhead Pharmaceuticals.

Arrowhead Pharmaceuticals has been a standout among biotech names lately, with its latest 30-day share price return of 7.5% adding to a remarkable year-to-date surge of 105%. While excitement in the sector plays a role, much of the momentum is tied to optimism around Arrowhead’s advancing drug pipeline. Looking at a broader perspective, the one-year total shareholder return sits at an impressive 88.9%, reinforcing that recent gains are part of a larger trend rather than a temporary bounce.

Looking for more opportunities in the biotech and healthcare space? You can discover promising companies with See the full list for free..

With recent returns outpacing the broader market, investors are left to wonder whether Arrowhead Pharmaceuticals is still trading at a value, or if the market has already priced in expectations for the pipeline’s future growth.

Most Popular Narrative: 15% Undervalued

With Arrowhead Pharmaceuticals trading at $40.31, the latest popular narrative sets a fair value target at $47.50 per share. This gap has drawn fresh investor attention. This sets up a debate: are cost advantages and partnerships strong enough to keep the company's momentum going?

Advancing RNAi therapy pipeline and global partnerships boost Arrowhead's growth prospects, competitive position, and access to emerging healthcare markets. Strategic collaborations and favorable regulatory trends support revenue stability, strong margins, and opportunities for long-term earnings and expansion.

Ready to see why this stock’s valuation got such a bump? Analysts are betting on powerful trial catalysts, game-changing partnerships, and a profit trajectory not seen in ordinary biotechs. What is the quantitative backbone behind that bold price target? Dive in and uncover the make-or-break assumptions that support this fair value.

Result: Fair Value of $47.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on milestone payments and potential delays from key partners highlight uncertainties that could quickly reshape Arrowhead’s current growth story.

Find out about the key risks to this Arrowhead Pharmaceuticals narrative.

Another View: What About the Multiples?

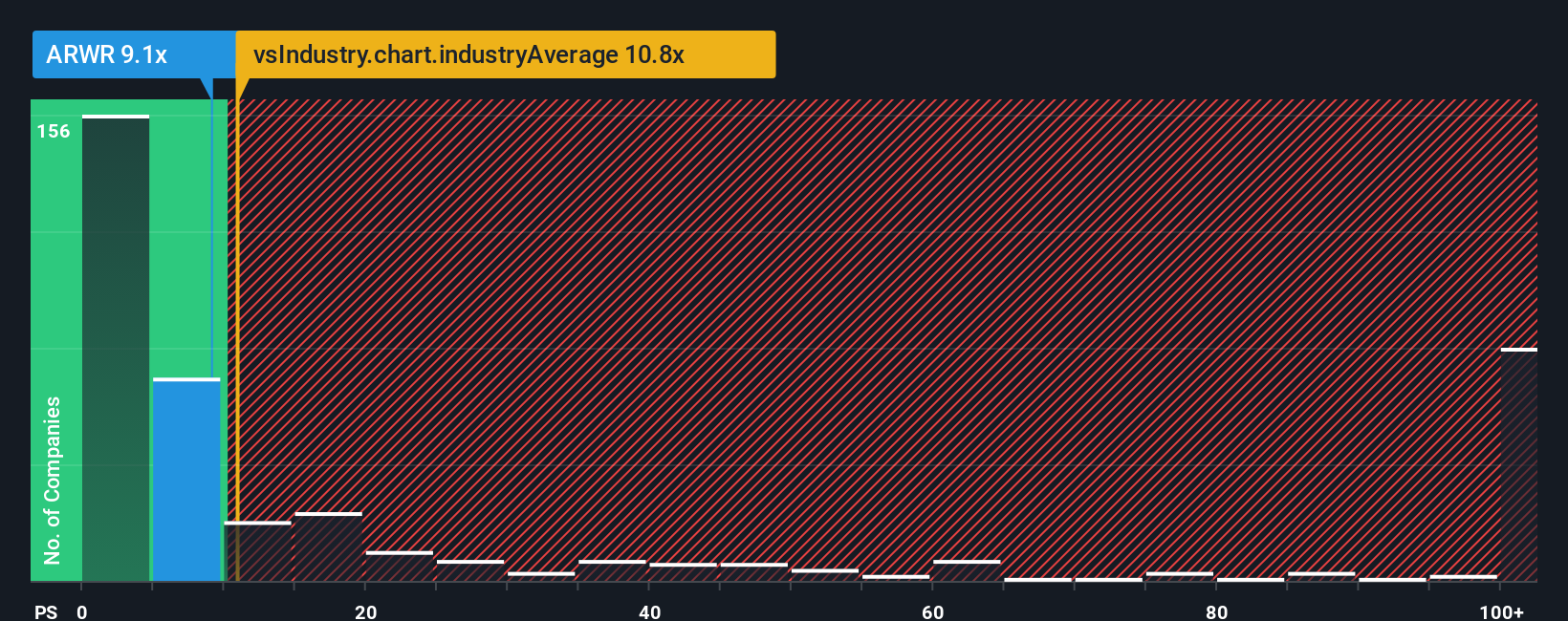

While our main valuation points to Arrowhead Pharmaceuticals as undervalued, a look at its price-to-sales ratio shows a split verdict. The company trades at 9.7x sales, more expensive than the peer average of 7.1x, but just below the US Biotechs industry average of 10.3x and near the fair ratio of 10x. This narrow gap highlights how market sentiment can quickly tip risk or opportunity for investors hunting for an edge. Is the market being too cautious, or not cautious enough?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arrowhead Pharmaceuticals Narrative

If our analysis does not line up with your view, or you enjoy taking a hands-on approach with the numbers, consider building your own Arrowhead Pharmaceuticals thesis in just minutes with Do it your way.

A great starting point for your Arrowhead Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Don't Miss Out: More Smart Investment Opportunities Await

Why limit your strategy to just one stock? Stay ahead of the crowd by targeting powerful trends in today’s market. These curated investment ideas put you in control.

- Capitalize on rapid breakthroughs in artificial intelligence by tracking industry leaders through these 26 AI penny stocks.

- Unlock affordable gems with strong potential for growth using these 850 undervalued stocks based on cash flows based on robust cash flow analysis.

- Tap into the revolution in healthcare and artificial intelligence by checking out these 33 healthcare AI stocks that are transforming patient outcomes and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARWR

Arrowhead Pharmaceuticals

Develops medicines for the treatment of intractable diseases in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives