- United States

- /

- Pharma

- /

- NasdaqGS:ARVN

Arvinas (ARVN): Valuation Discount Persists as Losses Widen, Challenging Hope for Profit Turnaround

Reviewed by Simply Wall St

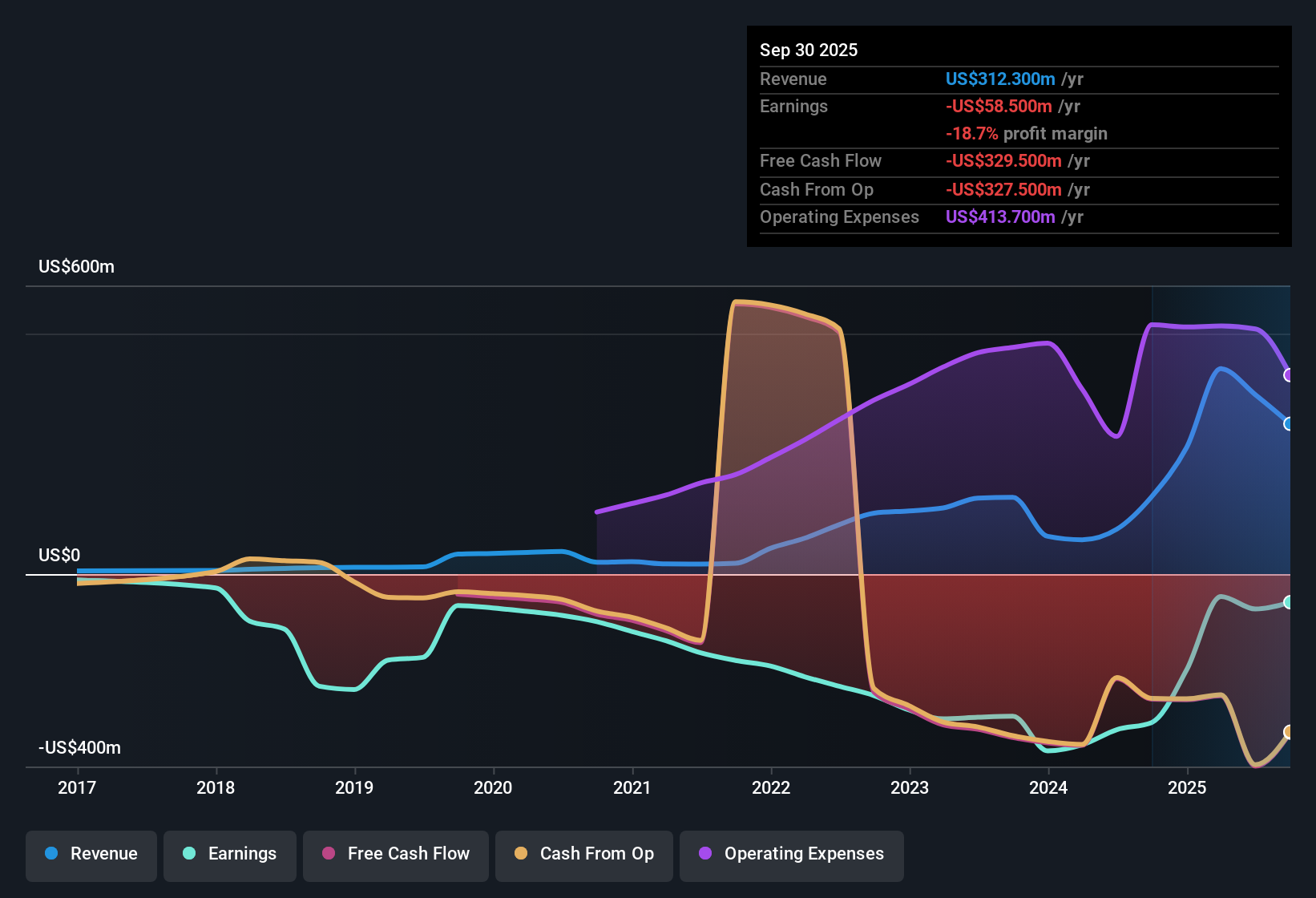

Arvinas (ARVN) continues to operate at a loss, with net losses increasing at an average rate of 7.7% per year over the past five years and no signs of profit growth acceleration. Revenue is forecast to grow slowly at just 1.1% per year, a pace that lags well behind the broader US market’s 10.5% growth rate. Despite these challenges, investors will weigh the potential reward of a low Price-To-Sales Ratio of 1.9x, which is much lower than peers, against the sustained losses and subpar revenue growth.

See our full analysis for Arvinas.Next up, we’ll see how these latest results stack up against the consensus narratives, highlighting where the numbers support the prevailing story and where they might spark debate.

See what the community is saying about Arvinas

Margin Pressures Persist as Losses Mount

- Net profit margin remains negative with no improvement reported, and losses have been increasing at an average pace of 7.7% per year, confirming analysts’ concerns around ongoing unprofitability.

- According to the analysts' consensus view, operational streamlining, including restructuring and workforce reduction, has extended Arvinas’ cash runway to 2028, but

- these efforts have yet to result in positive net margins. Consensus projects continued unprofitability for at least three more years, indicating that the company’s margin trajectory remains pressured and is not improving.

- recent cost-cutting may sustain R&D. However, pressures from industry competition and the need to prioritize pipeline candidates could restrict near-term earnings growth, supporting the view that margin improvement is not imminent.

- To see if analysts expect these numbers to reverse, check out the full consensus perspective for Arvinas. 📊 Read the full Arvinas Consensus Narrative.

Pipeline Bets Depend on PROTAC Validation

- Heavy reliance on the unproven PROTAC platform and early-stage pipeline means Arvinas’ ability to improve its bottom line rests on future clinical trial outcomes. No pivotal success or commercial inflection in key assets, like ARV-102, has been confirmed yet.

- Consensus narrative highlights that partnerships such as those with Novartis and Pfizer could spark milestone payments and diversify future earnings,

- but delayed or disappointing pivotal trials could elongate the path to profitability, and dependency on these partnerships raises the stakes if development rights or commercialization plans falter.

- analysts warn that, without clear PROTAC validation and progress in late-stage assets, Arvinas may face prolonged negative net margins and a continued cash burn, supporting caution on the current innovation risk profile.

Valuation Attractive, But Profit Gap Wide

- Arvinas trades at a Price-To-Sales Ratio of 1.9x, distinctly lower than the US Pharmaceuticals industry average of 4.2x and peer group average of 6.7x. This supports the consensus view that its current valuation appears compelling relative to comparable companies.

- However, the analysts' consensus narrative points out that despite this valuation discount, the current share price of $9.57 remains well below the single allowed analyst price target of $18.25,

- suggesting that for the market to close this gap, investors would need to believe Arvinas can eventually achieve industry-like profit margins of 23.2%. This is an optimistic outcome that is not supported by current loss trends and margin data.

- while industry momentum around targeted protein degradation and M&A activity may help sentiment, true upside depends on evidence of sustained earnings and margin improvements, which are not yet visible.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Arvinas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others might miss? Put your own spin on the story and shape the narrative in just a few minutes with Do it your way.

A great starting point for your Arvinas research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Arvinas continues to grapple with persistent losses and uncertain profit growth, raising concerns about the company’s ability to achieve stable and consistent earnings.

If reliable results matter to you, use stable growth stocks screener (2074 results) to zero in on companies that consistently deliver steady revenue and earnings, even when others struggle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARVN

Arvinas

A clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins.

Flawless balance sheet and fair value.

Market Insights

Community Narratives