- United States

- /

- Pharma

- /

- NasdaqGM:AQST

What Aquestive Therapeutics, Inc.'s (NASDAQ:AQST) 30% Share Price Gain Is Not Telling You

Aquestive Therapeutics, Inc. (NASDAQ:AQST) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. The annual gain comes to 108% following the latest surge, making investors sit up and take notice.

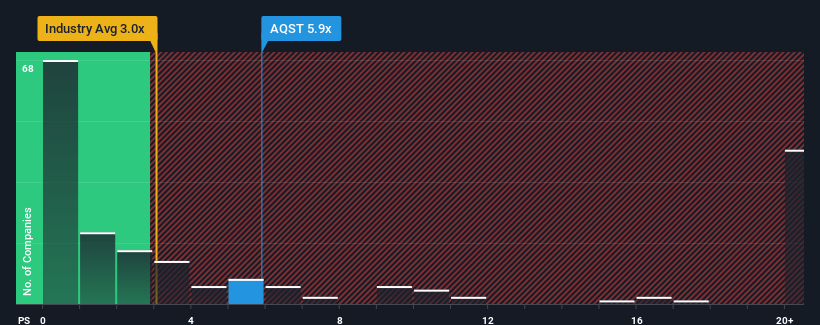

Following the firm bounce in price, Aquestive Therapeutics may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 5.9x, when you consider almost half of the companies in the Pharmaceuticals industry in the United States have P/S ratios under 3x and even P/S lower than 0.8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Aquestive Therapeutics

How Has Aquestive Therapeutics Performed Recently?

There hasn't been much to differentiate Aquestive Therapeutics' and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aquestive Therapeutics.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Aquestive Therapeutics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Revenue has also lifted 6.8% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 20% per annum during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 20% per annum, which is not materially different.

In light of this, it's curious that Aquestive Therapeutics' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

The strong share price surge has lead to Aquestive Therapeutics' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Aquestive Therapeutics' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 4 warning signs for Aquestive Therapeutics (2 shouldn't be ignored!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AQST

Aquestive Therapeutics

Operates as a pharmaceutical company in the United States and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives