- United States

- /

- Pharma

- /

- NasdaqGM:ANIP

ANI Pharmaceuticals (ANIP): Assessing Valuation After Rare Disease Revenue Surges on Cortrophin Gel Demand

Reviewed by Simply Wall St

ANI Pharmaceuticals (ANIP) is drawing attention after its rare disease franchise delivered a major revenue surge over the past year. This growth has been powered by booming demand for Cortrophin Gel and expanded outreach to prescribers and patients.

See our latest analysis for ANI Pharmaceuticals.

Following the breakout performance in rare disease treatments, ANI Pharmaceuticals’ shares have caught investors’ attention. After a stellar 50% year-to-date share price return and a one-year total return of nearly 44%, momentum has cooled in recent weeks. However, long-term shareholders are still sitting on gains of over 100% in three years as the market factors in future potential from pipeline expansion and recent launches.

If ANI’s surge in rare disease demand has you curious about similar opportunities, take the next step and see the full roster of innovators in our See the full list for free..

With shares sitting well below analyst targets and recent growth outpacing expectations, investors have to wonder: is ANI Pharmaceuticals still undervalued, or has the market already priced in the company’s next wave of expansion?

Most Popular Narrative: 24.3% Undervalued

ANI Pharmaceuticals’ most popular narrative points to a fair value that is meaningfully higher than its recent closing price of $83.22. This suggests plenty of upside from here if the company delivers on projected growth.

There is significant, untapped growth potential for Cortrophin Gel across core and emerging indications (neurology, nephrology, rheumatology, pulmonology, ophthalmology, and gout), with patient populations far below prior peaks. Epidemiological data suggests the addressable market could be several times larger due to an aging population and the rising prevalence of chronic diseases, supporting multiyear revenue expansion.

Where do they get that bold upside? This narrative pivots on ambitious revenue and margin upgrades, plus a strong profit trajectory. If you want to see the full forecast, especially the standout assumptions driving this premium valuation, you need to dig deeper.

Result: Fair Value of $109.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in generics or stricter payer controls on Cortrophin Gel could present challenges to ANI Pharmaceuticals’ projected profit growth and future valuation.

Find out about the key risks to this ANI Pharmaceuticals narrative.

Another View: A Look Through Multiples

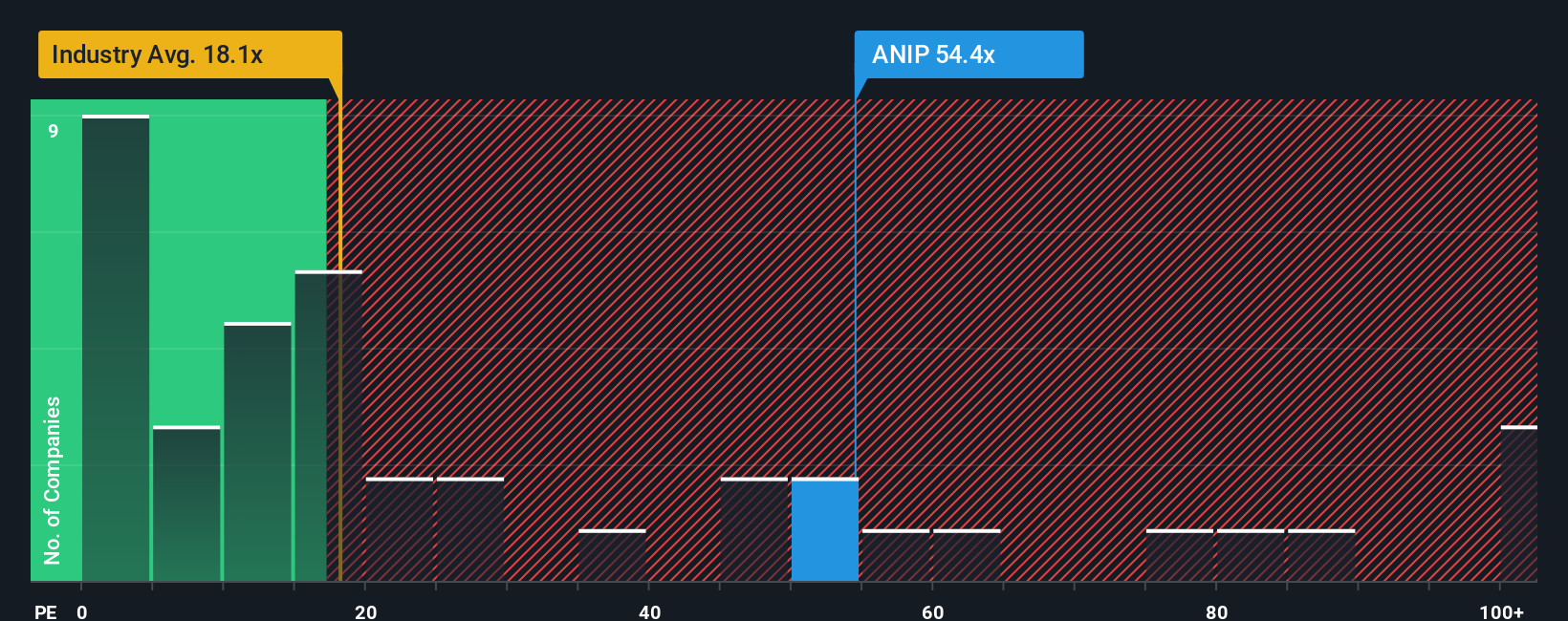

While fair value models point to ANI Pharmaceuticals being deeply undervalued, its price-to-earnings ratio tells a different story. At 50.9x, the company's ratio is over double the US Pharmaceuticals industry average of 20.1x, and well above its own fair ratio of 20.1x. This gap suggests investors are paying a premium for future growth and presents more risk if those expectations are not met. Is the optimism justified, or could sentiment eventually swing the other way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ANI Pharmaceuticals Narrative

If you want to reach your own conclusions or see where the data leads you, putting together your personal view takes just a couple of minutes. Do it your way.

A great starting point for your ANI Pharmaceuticals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead. Smart investors are already using Simply Wall Street’s tools to uncover standout stocks across unstoppable trends and hidden value.

- Boost your income potential by starting with these 14 dividend stocks with yields > 3% for shares offering strong yields above 3% and a consistent payout record.

- Tap into tomorrow’s breakthroughs by checking out these 26 quantum computing stocks, featuring innovative businesses transforming tech with quantum computing advancements.

- Seize overlooked growth opportunities by focusing on these 924 undervalued stocks based on cash flows to find quality companies trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ANIP

ANI Pharmaceuticals

A biopharmaceutical company, develops, manufactures, and markets branded and generic pharmaceutical products in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success