- United States

- /

- Pharma

- /

- NasdaqGS:AMRX

Amneal Pharmaceuticals (AMRX): One-Off $55.9M Loss Tests Bull Case Built on High Earnings Growth Forecasts

Reviewed by Simply Wall St

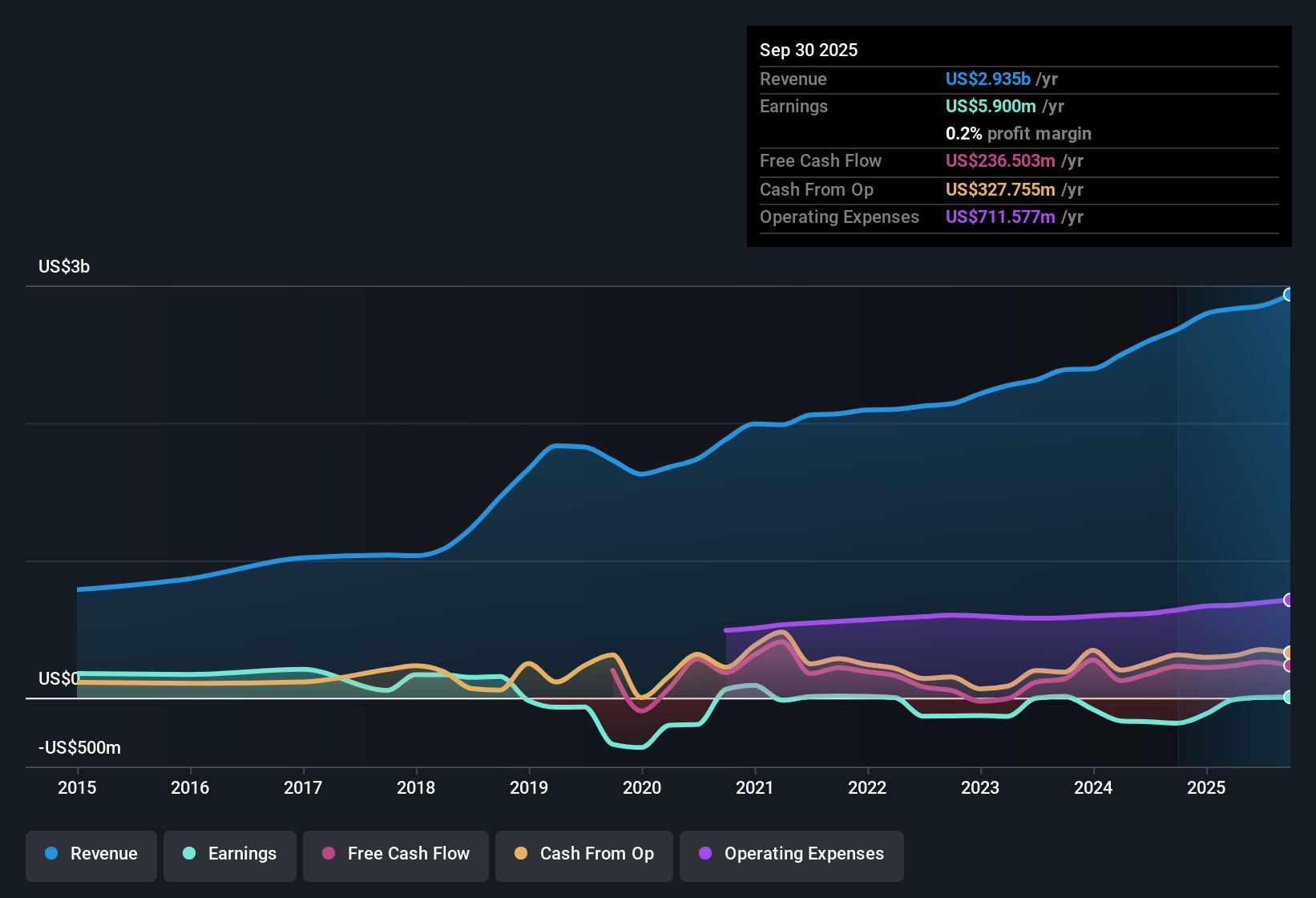

Amneal Pharmaceuticals (AMRX) has posted a standout earnings outlook, with net income projected to grow at a rapid 80.1% per year for the next three years, far surpassing the US market average of 15.9%. While the company’s revenue is expected to grow at a slower pace of 7.7% per year, recent filings confirm its return to profitability and an improvement in net profit margins compared to the previous year. Amid these results, Amneal’s shares currently trade at $10.82, notably below the discounted cash flow estimated fair value of $73.77, and its valuation ratios stand well below industry averages. This combination has caught the attention of value-focused investors. However, a one-off loss of $55.9 million in the last twelve months and volatile multi-year profit trends serve as reminders to approach future growth forecasts with some caution.

See our full analysis for Amneal Pharmaceuticals.The next section will put these fresh results in context, comparing the headline numbers against the dominant narratives about AMRX. This is where we see which market stories hold up under the numbers and which ones do not.

See what the community is saying about Amneal Pharmaceuticals

Margins Climb from 0.1% to 5.9% Target

- Analysts expect Amneal's profit margins to rise sharply, from the current 0.1% to 5.9% over the next three years. This is anticipated to drive profit expansion beyond simple revenue growth.

- According to the analysts' consensus view, this dramatic margin improvement is seen as a key reason the company could achieve $207.9 million in forecast annual earnings by 2028.

- The projected rise in margins is tied to ongoing investments in U.S.-based manufacturing and supply chain optimization. These initiatives are intended to boost operational efficiency and insulate cash flow against shifting industry dynamics.

- Consensus warns that achieving these targets depends on the company's ability to continuously launch new products and manage debt, given its heavy exposure to the U.S. generics market and industry-wide cost pressures.

- For investors tracking durable margin expansion as a growth lever, these numbers put operational execution under the spotlight.

- Analysts agree that if margins do not meet expectations, the longer-term earnings potential could fall well short of guidance and erode the upside even as revenues grow.

Share Count to Rise Amid Growth

- Amneal’s share count is expected to grow 1.37% annually for the next three years, as projected by analysts.

- Consensus narrative notes this gradual increase is fueled by equity-based reinvestment and aligns with management’s intent to reinvest in high-growth pipeline launches.

- This approach could dilute existing shareholder ownership somewhat but may be necessary to support expanded supply capabilities as the company diversifies into branded and biosimilar products.

- The payoff, according to consensus, depends on whether investments effectively convert to accelerated revenue and margin growth without eroding per-share value.

DCF Fair Value Far Above Market

- Current shares trade at $10.82, well below the latest DCF fair value estimate of $73.77 and meaningfully beneath the sector average price-to-sales multiple (1.2x vs 4.3x).

- Analysts' consensus view argues this deep discount supports the case for substantial rerating potential.

- For valuation-sensitive investors, the upside case hinges on both the company's ability to execute its margin expansion and the market's willingness to re-rate AMRX nearer to peer multiples.

- Consensus also highlights that a one-off $55.9 million loss and inconsistent multi-year earnings trends explain some of the market’s skepticism, requiring improved reporting consistency to unlock a higher valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Amneal Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the numbers? You can shape your perspective into a concise narrative in just a few minutes. Do it your way

A great starting point for your Amneal Pharmaceuticals research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite ambitious profit margin targets, Amneal’s inconsistent earnings history and recent one-off loss highlight the risk of unpredictable growth ahead.

If stable performance is what you seek, use stable growth stocks screener (2103 results) to find companies that consistently deliver steady revenue and earnings regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMRX

Amneal Pharmaceuticals

A global biopharmaceutical company, develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives