- United States

- /

- Biotech

- /

- NasdaqCM:AMRN

Amarin (AMRN) Unprofitable as Losses Worsen, Profit Growth Forecasts Test Bullish Turnaround Hopes

Reviewed by Simply Wall St

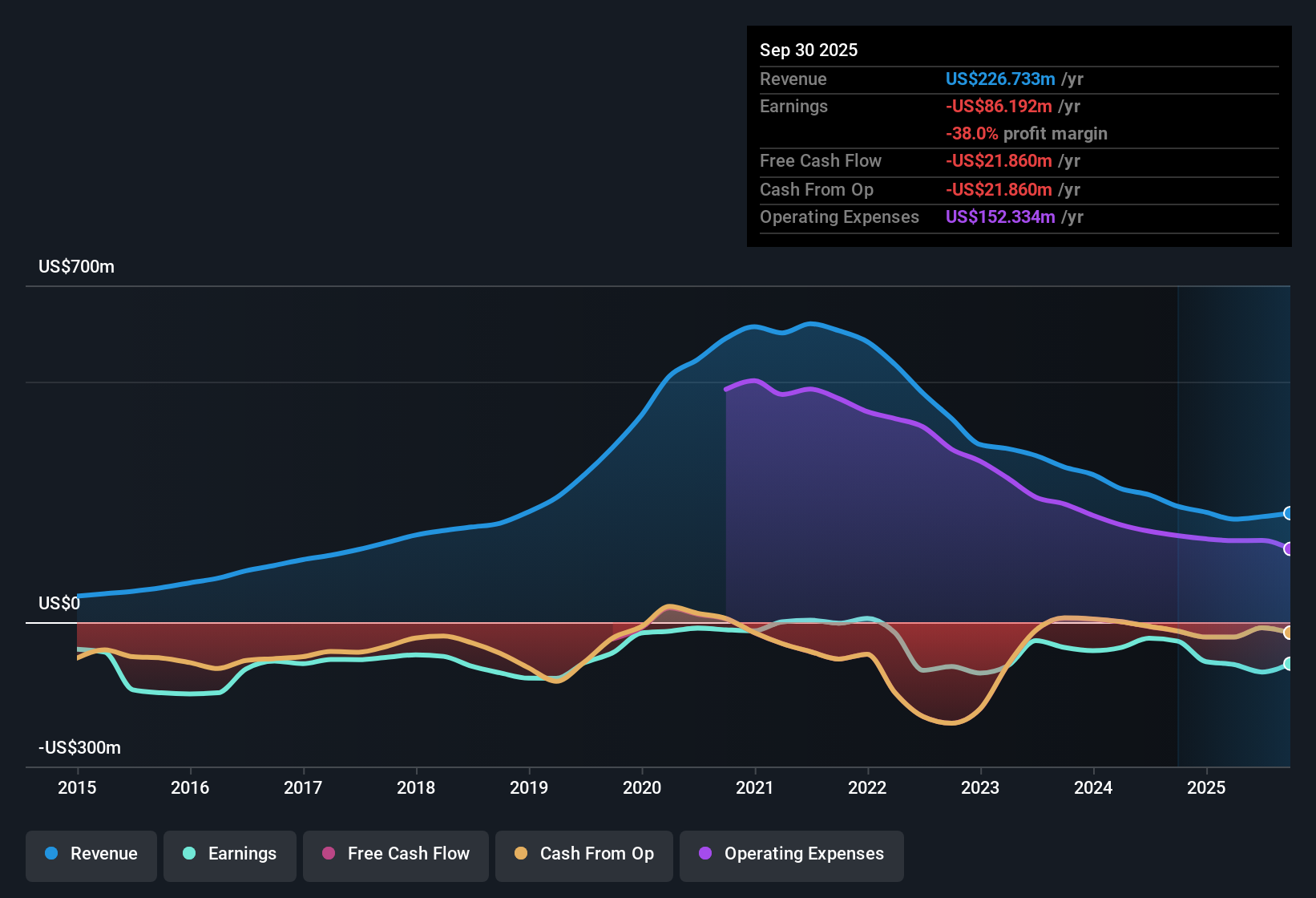

Amarin (AMRN) remains unprofitable with losses accelerating at 30.6% per year over the past five years, while its net profit margin has shown no signs of improvement for the latest reported period. Looking ahead, analysts forecast earnings to grow sharply at 98.63% per year, with the company expected to achieve profitability within three years. This is despite revenue being projected to fall by 15.7% per year over that timeframe. Investors are parsing these results for signs that Amarin’s strong earnings growth potential could outweigh near-term revenue headwinds and drive a turnaround story.

See our full analysis for Amarin.With the latest results on the table, it’s time to see how Amarin’s numbers compare with the hot topics and narratives debated in the market, and where the facts push back against the headlines.

See what the community is saying about Amarin

Margin Turnaround Hinges on International Execution

- Profit margins are projected to swing from -47.2% today to 3.1% in three years, as operating expenses are being scaled back by $70 million per year and international partnerships expand.

- Analysts' consensus view highlights mixed expectations for Amarin’s global strategy:

- Partnerships with major distributors like Recordati and rapid regulatory approvals in over fifty countries lay the groundwork for improved profitability. However, future earnings are increasingly tied to royalty and milestone payments that could be unpredictable if market access or partner execution stumbles.

- International sales are seeing double and triple-digit growth rates in several regions, such as 68% growth in China, offsetting U.S. revenue pressure cited by bears. The company remains exposed to global pricing and regulatory risks.

Single-Product Focus Magnifies Long-Term Volatility

- Amarin’s earnings durability is heavily exposed to Vascepa, with the shift towards royalty-driven revenues over direct sales amplifying the risk of large swings in year-over-year results as generic competition rises.

- Analysts' consensus view underscores both risk and opportunity:

- Critics highlight the dangers of relying on one commercial product without substantial pipeline diversification. Any clinical, regulatory, or market setback may sharply increase earnings variability faster than peers, especially as U.S. generics gain traction.

- Operational improvements and a nearly $300 million cash reserve with no debt provide a financial cushion to pursue global initiatives or weather setbacks that might temper volatility.

Valuation Remains a Bright Spot Versus Industry

- Amarin trades at a Price-to-Sales Ratio of 1.5x, which is a deep discount to the biotech sector’s 10.8x average, and its market price of $16.40 is well below the stated DCF fair value of $101.44.

- Analysts' consensus view notes the tension between low valuation and tough expectations:

- Bulls point out that the discounted valuation offers upside. Yet consensus analyst targets sit at $11.33, actually 31% below today’s share price, suggesting the market could still be overpricing near-term turnaround odds.

- Ahead of projected revenue declines, the analyst-implied PE ratio for 2028 rises to 65.0x, far above the industry’s 15.5x. Value investors should carefully scrutinize whether robust profit growth can truly materialize to justify multiples.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Amarin on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your perspective and shape your own story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Amarin.

See What Else Is Out There

Amarin faces declining revenues and remains vulnerable to unpredictable earnings swings, as its single-product focus and volatile margins increase long-term volatility.

For investors prioritizing smoother results, consider stable growth stocks screener (2112 results) to find companies with a solid record of stable revenue and earnings growth through every market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AMRN

Amarin

A pharmaceutical company, engages in the commercialization and development of therapeutics for the treatment of cardiovascular diseases in the United States, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives