- United States

- /

- Pharma

- /

- NasdaqGS:AMLX

Should Amylyx Pharmaceuticals' Sharply Reduced Net Losses Prompt a Rethink by AMLX Investors?

Reviewed by Sasha Jovanovic

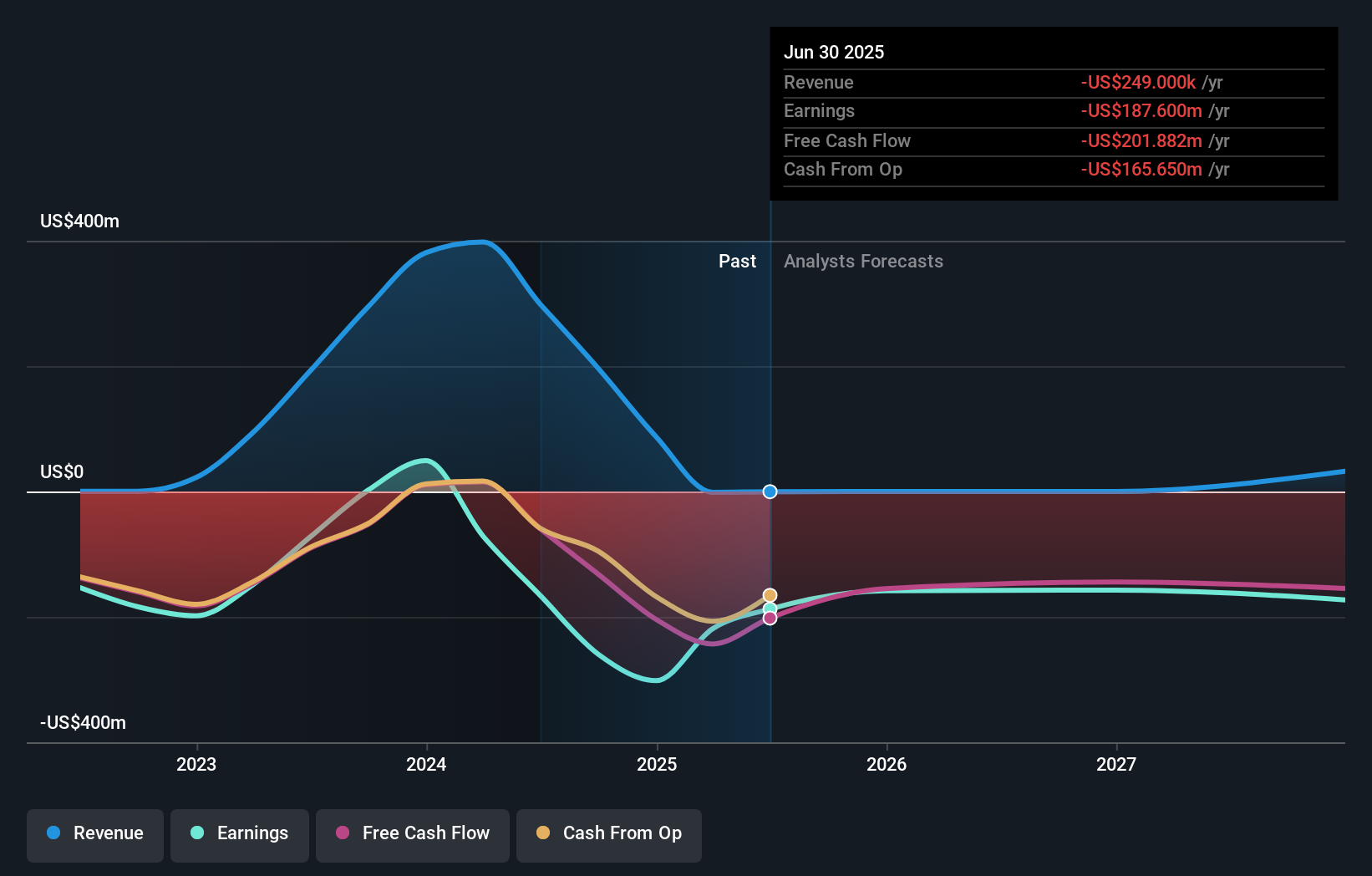

- Amylyx Pharmaceuticals announced third quarter 2025 results, reporting a net loss of US$34.39 million and a loss per share of US$0.37, both improved from the previous year's figures for the same period.

- The company's reduced losses over the last nine months highlight substantial changes in its cost structure or operational efficiency.

- We'll look at how the marked decrease in net loss shapes Amylyx Pharmaceuticals' investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

What Is Amylyx Pharmaceuticals' Investment Narrative?

If you’re considering Amylyx Pharmaceuticals as an investment, the crux is whether you believe in the company’s ability to translate promising clinical programs and a growing pipeline into commercial success. The latest results showing a sharp reduction in quarterly and year-to-date net losses signal pivot points in cost control, potentially strengthening Amylyx’s position heading into milestone trial readouts for avexitide and AMX0035. In the short term, these improving financials could support more positive sentiment around upcoming clinical and regulatory catalysts, especially after the recent equity raise. However, the company remains unprofitable and faces significant competition, dilution risks, and the challenge of demonstrating meaningful revenue growth from a largely pre-commercial pipeline. The recent improvement in losses slightly shifts focus from short-term financial stability to the outcomes and timelines of ongoing late-stage trials, which remain the main drivers and risks for shareholders.

But, without clear commercial revenue, uncertainty around funding and future dilution is something investors should be aware of. Insights from our recent valuation report point to the potential overvaluation of Amylyx Pharmaceuticals shares in the market.Exploring Other Perspectives

Build Your Own Amylyx Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amylyx Pharmaceuticals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Amylyx Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amylyx Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMLX

Amylyx Pharmaceuticals

A clinical-stage pharmaceutical company, engages in the discovery and development of treatment options for neurodegenerative diseases and endocrine conditions in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives