- United States

- /

- Pharma

- /

- NasdaqGS:AMLX

Could Legal Scrutiny of AMLX’s Disclosures Reshape Management Credibility at Amylyx Pharmaceuticals?

Reviewed by Sasha Jovanovic

- In recent days, Kuehn Law, PLLC announced an investigation into Amylyx Pharmaceuticals, Inc. after a federal securities lawsuit alleged company insiders misrepresented or failed to disclose negative trends around RELYVRIO’s commercial performance.

- This situation highlights how legal scrutiny over disclosure practices can raise important questions regarding management accountability and investor confidence.

- We'll explore how the investigation into Amylyx's disclosure of RELYVRIO's commercial prospects impacts the company's current investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Amylyx Pharmaceuticals' Investment Narrative?

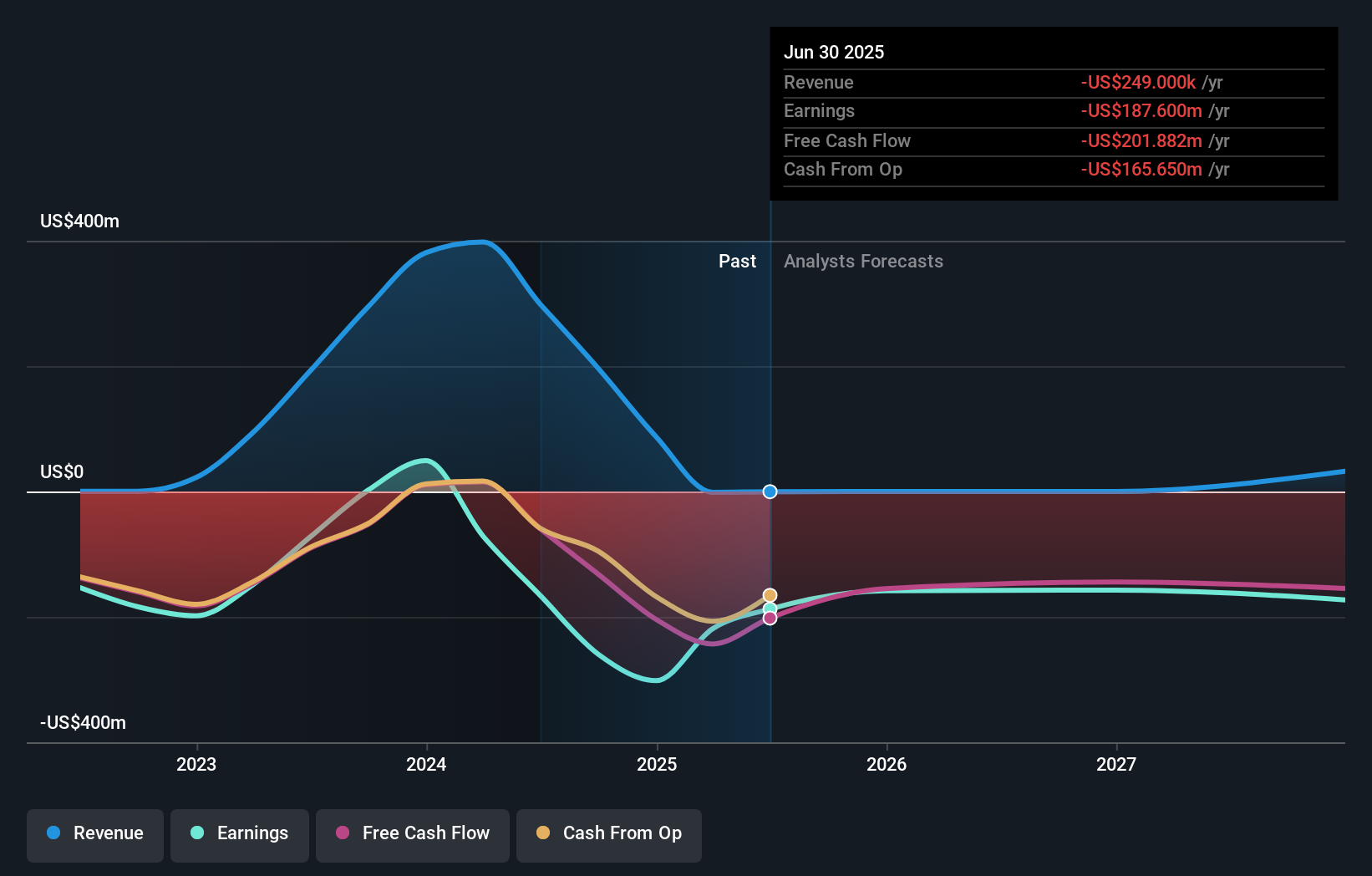

To be a shareholder in Amylyx Pharmaceuticals, you have to believe in the potential for its pipeline drugs to drive future revenue growth and the eventual shift towards profitability, despite current financial losses and substantial dilution in recent years. Investors have seen rapid share price appreciation in 2025 and revenue growth forecasts remain strong, even as profitability isn’t expected in the near term. The primary short term catalysts have been tied to clinical progress, regulatory advancements, and evidence of commercial traction for RELYVRIO. However, the new legal investigation into the company’s disclosures related to RELYVRIO’s commercial results could become a significant risk if it undermines management credibility or leads to financial consequences. This adds an additional layer of uncertainty to the existing risk profile, particularly around trust in leadership and timing of key product launches, meaning short term sentiment may be more vulnerable than previously assumed. The overall catalyst and risk calculus for Amylyx has shifted: legal and reputational headwinds may now sit alongside clinical and market-related milestones in the minds of current and potential shareholders. On the other hand, issues around management trust may now weigh heavier than before.

According our valuation report, there's an indication that Amylyx Pharmaceuticals' share price might be on the expensive side.Exploring Other Perspectives

Build Your Own Amylyx Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amylyx Pharmaceuticals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Amylyx Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amylyx Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMLX

Amylyx Pharmaceuticals

A clinical-stage pharmaceutical company, engages in the discovery and development of treatment options for neurodegenerative diseases and endocrine conditions in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives