- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Is Amgen’s Pipeline Progress Signaling More Upside After a 14.4% Year-to-Date Gain?

Reviewed by Bailey Pemberton

- Thinking about buying Amgen and wondering if it's a smart value play right now? You're not alone. Many investors are sizing up whether the company's long-term prospects are already baked into the price, or if there's still room for upside.

- Amgen's stock price has climbed 1.6% over the last week and is up an impressive 14.4% year-to-date, although it's off by 4.0% compared to this time last year. This reflects both renewed growth optimism and shifts in risk perception among investors.

- Recent headlines have focused on Amgen's advancements in its biosimilar pipeline and regulatory progress for new therapies, both of which have put the company in the spotlight. Industry watchers are also paying attention to ongoing partnerships and acquisitions, fueling speculation about Amgen's future earnings power and competitive edge.

- Based on our valuation scorecard, Amgen earns a 4 out of 6 for being undervalued across several key checks. It's worth digging into different approaches to valuation to reveal where the opportunities might be, and keep an eye out for a smarter way to assess value at the end of this article.

Find out why Amgen's -4.0% return over the last year is lagging behind its peers.

Approach 1: Amgen Discounted Cash Flow (DCF) Analysis

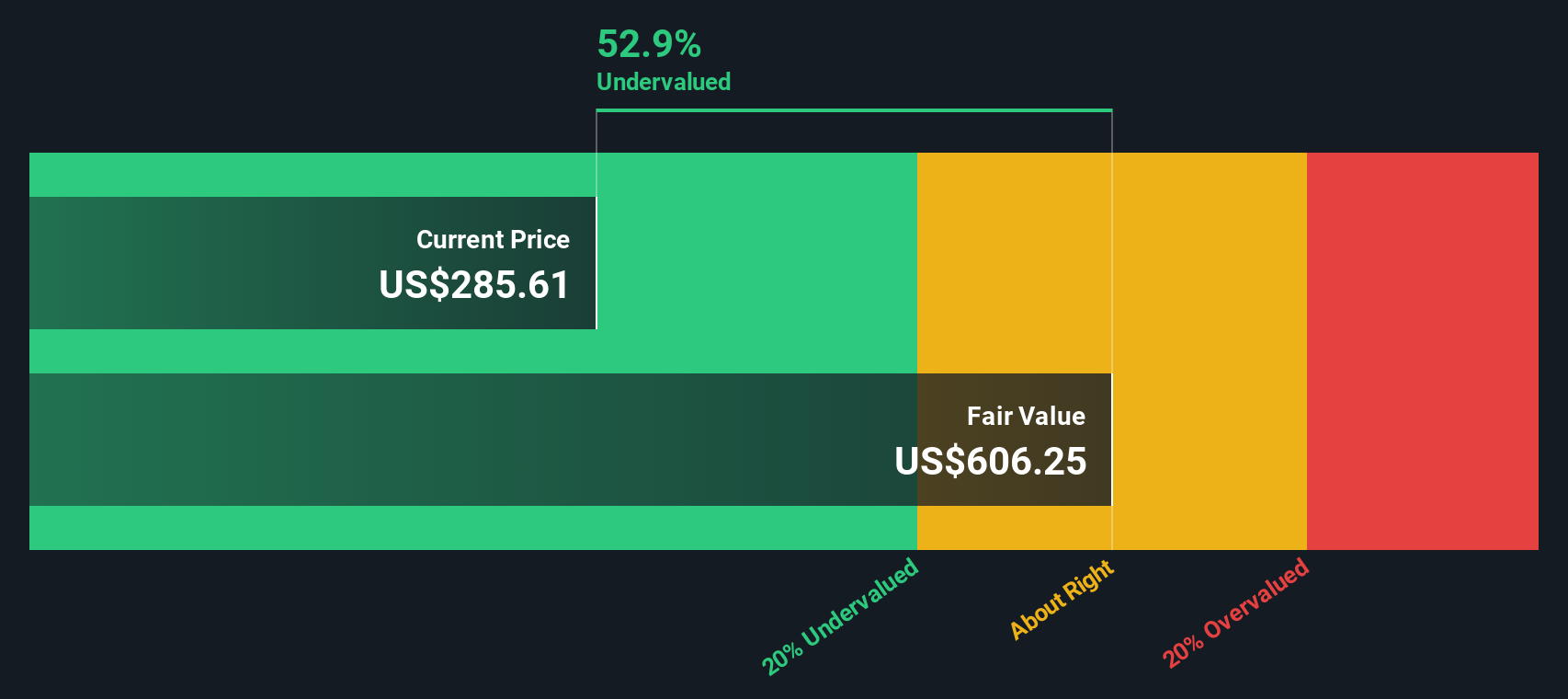

A Discounted Cash Flow (DCF) model works by projecting a company's future cash flows and then discounting them back to reflect what they are worth today. This helps estimate the intrinsic value of the business based on its expected ability to generate cash in the future.

For Amgen, the current Free Cash Flow stands at $10.7 Billion. Analyst forecasts extend out five years, reaching an estimated $15.8 Billion in annual Free Cash Flow by 2029. After that, cash flow projections are extrapolated based on reasonable long-term growth assumptions. All values are presented in US dollars for consistency.

The DCF model estimates Amgen’s intrinsic value at $622.68 per share. With the current share price trading at a 52.4% discount to this calculated value, the stock appears notably undervalued according to DCF methods. This suggests long-term investors may be overlooking the company’s full earnings potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amgen is undervalued by 52.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

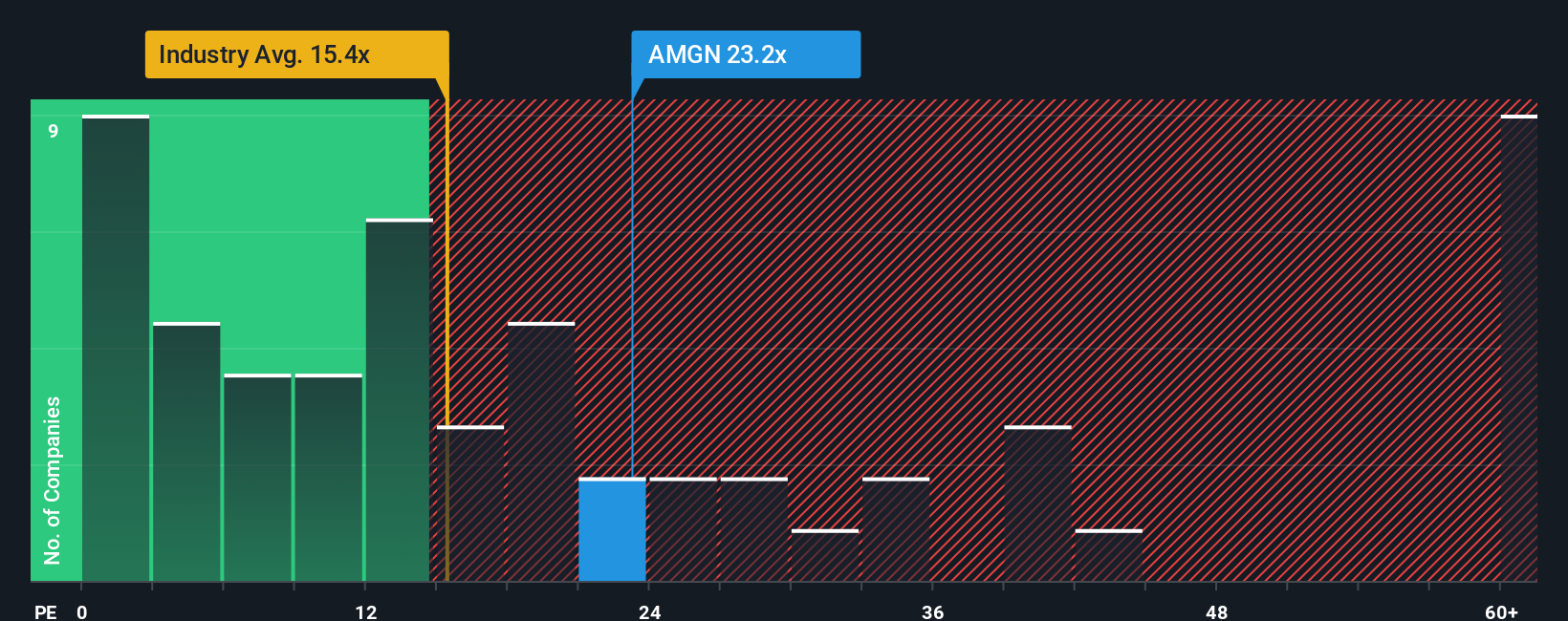

Approach 2: Amgen Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Amgen, since it connects a company's share price to its underlying earnings. It is especially relevant for established firms in the biotech sector that generate steady profits. This gives investors a straightforward way to compare valuation across different businesses.

A "normal" or "fair" PE ratio depends on investor expectations for a company’s growth and the level of perceived risk. Higher growth prospects or lower risks usually justify a higher PE, while sluggish growth or increased risk puts downward pressure on the multiple investors are willing to pay for each dollar of earnings.

Currently, Amgen trades at a PE ratio of 24.1x. This is meaningfully higher than the average biotech industry PE of 16.9x. However, it sits below the average among its peer group, which stands at 56.1x. On the surface, this positions Amgen’s valuation somewhere in the middle of industry benchmarks.

Simply Wall St’s “Fair Ratio” for Amgen is 27.5x. This is a proprietary metric designed to estimate what PE multiple the company should command considering its growth, risk, profitability, size, and industry dynamics. Unlike simple peer or industry comparisons, the Fair Ratio takes a more nuanced view, factoring in Amgen’s specific circumstances and future outlook.

With Amgen’s actual PE ratio close to but slightly below the Fair Ratio, the evidence suggests the stock is valued about right by this method, with no major discount or premium relative to its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

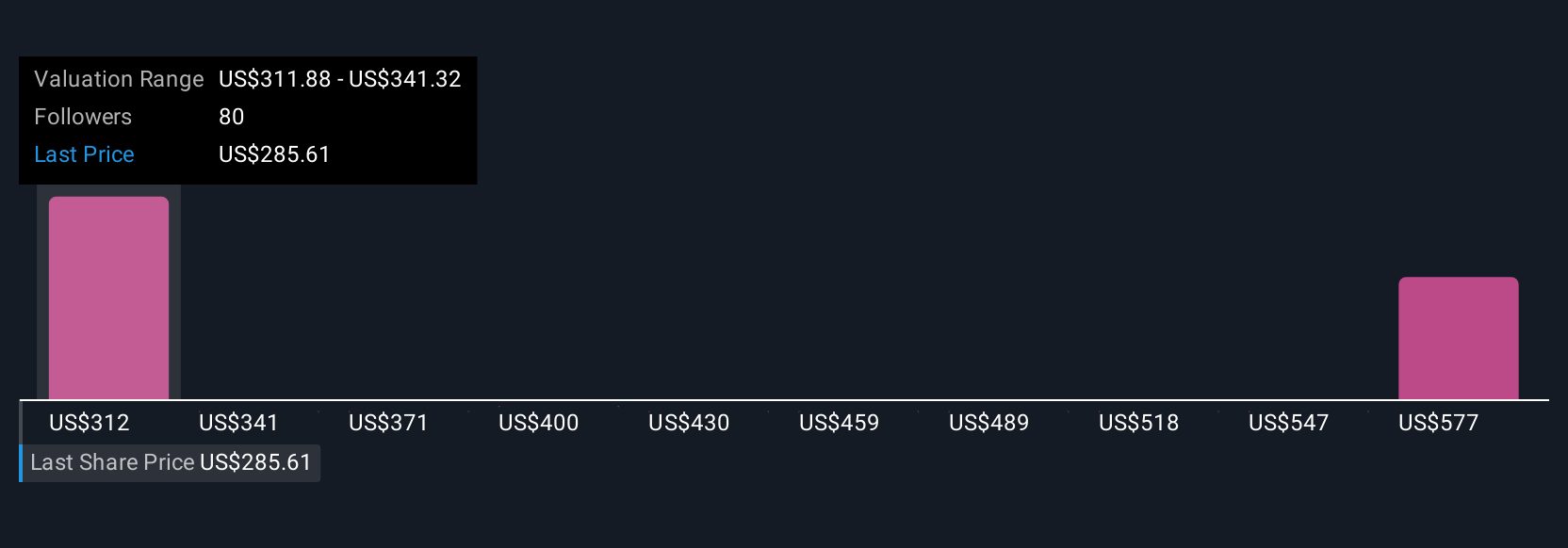

Upgrade Your Decision Making: Choose your Amgen Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, connecting the numbers to your perspective on future revenues, margins and fair value, then matching it to a financial forecast. With Narratives, you do more than look at past data; you outline your view of where Amgen is headed and see how your expectations compare to the current price and to other investors.

This approach is simple and accessible on the Simply Wall St Community page, used by millions of investors. Narratives help you decide when to buy or sell by letting you compare your Fair Value directly against the market price, and are updated in real time when major news or earnings reports are released, so your view stays relevant.

For example, some investors believe Amgen's future is worth $405 per share thanks to strong global expansion and high-margin therapies. Others, more cautious about pricing pressures and competition, set their fair value closer to $219. Narratives make these differences easy to see and test against your own research, empowering you to invest with a clearer, more adaptable strategy.

For Amgen, however, we'll make it really easy for you with previews of two leading Amgen Narratives:

Fair Value: $404.87

Currently trading at a 26.7% discount to this estimate

Revenue growth forecast: 7.1%

- Rapid product expansion and AI-driven R&D are expected to boost revenue and margins through frequent new drug launches in key therapeutic areas.

- Global expansion, resilience to pricing pressure, and a strong M&A position give Amgen the ability to unlock long-term growth and broaden its market.

- Potential risks include policy shifts on drug pricing, patent expirations, rising R&D costs, and the challenges of integrating large acquisitions and competing in the biosimilar market.

Fair Value: $218.89

Currently trading at a 35.6% premium to this estimate

Revenue growth forecast: -0.5%

- Heavy reliance on aging brand-name products and patent expirations are expected to result in revenue declines and margin pressure as biosimilar competition intensifies.

- Greater regulatory and pricing pressures, alongside integration and cost risks from large acquisitions, may restrict profitability and long-term growth.

- Potential upside could come if pipeline launches succeed and broad healthcare trends drive higher demand, but execution and market forces remain key challenges.

Do you think there's more to the story for Amgen? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives