- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Amgen (AMGN): Reviewing Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Amgen.

After a strong recent run, Amgen now trades at $343.99 per share. The stock’s momentum has been building, reflected in a 15.1% share price return over the past month and a confident 32.7% gain so far this year. Long-term holders have also seen a 25.98% total shareholder return over the past year. This indicates that both near-term optimism and multi-year resilience are fueling renewed interest.

If Amgen’s gains have you thinking about other opportunities in healthcare, it’s the perfect time to discover See the full list for free.

But with shares climbing so rapidly, investors may wonder whether Amgen is now undervalued by the market or if its recent surge means that all future growth is already reflected in the price.

Most Popular Narrative: 8% Overvalued

According to the most widely followed narrative, Amgen’s fair value target stands at $318.51, about 8% below the last closing price of $343.99. This suggests that the current stock price may reflect elevated expectations.

Operational efficiencies and large-scale digital transformation, including AI-driven innovation and digitized workflows, are expected to enhance productivity across R&D and commercial operations. These changes are anticipated to support higher net margins and improved long-term earnings power.

Want to know what is fueling this high valuation? There is a bold call on profit margins, top-line growth, and a future earnings multiple indicating market leadership. But which financial projections are driving this price? Find out what benchmarks and assumptions underpin the narrative’s calculations—some of them could surprise you.

Result: Fair Value of $318.51 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as intensifying drug pricing pressures or increased competition from biosimilars could quickly challenge these optimistic assumptions and alter market sentiment.

Find out about the key risks to this Amgen narrative.

Another View: Our DCF Model Paints a Different Picture

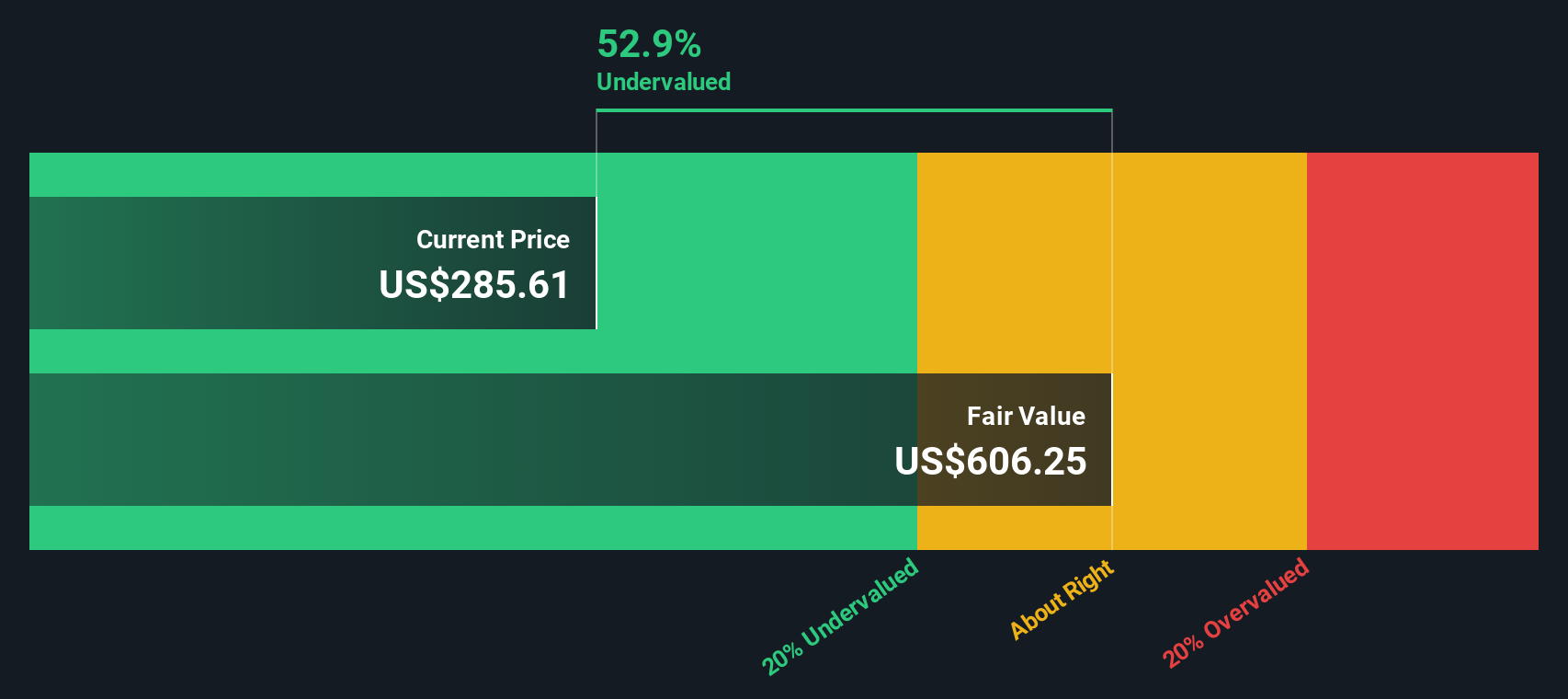

While multiples suggest Amgen might look pricey compared to its biotech peers, our SWS DCF model tells a different story. Based on cash flow projections, Amgen appears undervalued by a significant margin and is trading below what we calculate as its fair value. Could the market be underestimating its cash-generating power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amgen Narrative

Of course, if you want to dig deeper or chart your own conclusions, you can build a personal Amgen outlook in just a few minutes: Do it your way

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass you by. You could uncover your next big winner with just a few clicks using the Simply Wall Street Screener.

- Unlock the potential of stable passive income by reviewing these 18 dividend stocks with yields > 3% offering yields above 3% and strong fundamentals for consistent payout seekers.

- Tap into the future of healthcare innovation by scanning these 31 healthcare AI stocks making waves with AI-driven diagnostics, treatments, and research breakthroughs.

- Stay ahead of market trends by selecting these 907 undervalued stocks based on cash flows that may be overlooked and present compelling value based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives