- United States

- /

- Biotech

- /

- NasdaqGM:ALVO

Alvotech (ALVO) Is Down 38.6% After FDA Delays AVT05 Biosimilar Approval and Cuts Revenue Outlook

Reviewed by Sasha Jovanovic

- In November 2025, Alvotech announced that the U.S. FDA issued a complete response letter for the Biologics License Application of AVT05, a biosimilar to Simponi, highlighting deficiencies in the Reykjavik manufacturing facility that must be resolved before approval, though the site remains FDA-approved for current products.

- The delay in AVT05’s approval prompted Alvotech to lower its 2025 revenue outlook to between US$570 million and US$600 million, as additional investments are required to address the facility issues and temporarily slow production.

- We’ll explore how this regulatory setback and the revised financial outlook impact Alvotech’s investment narrative and longer-term market positioning.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Alvotech Investment Narrative Recap

Owning Alvotech depends on believing in consistent execution on a broad pipeline of biosimilars, securing timely regulatory approvals, and translating scientific and operational achievements into reliable cash flow. The recent FDA complete response letter regarding AVT05 delays a critical approval, meaning the biggest near-term catalyst, US market entry for this biosimilar, faces a direct short-term setback. At the same time, the most material risk, revenue "lumpiness" from regulatory-dependent milestones, comes to the forefront, as management has already trimmed its 2025 outlook following the news.

Among recent company announcements, the EMA's acceptance of the AVT23 application (biosimilar to Xolair) stands out, as it signals ongoing pipeline momentum even as the AVT05 delay unfolds in the US. This EMA milestone helps balance the narrative for investors focused on global regulatory progress as a key catalyst, though continued US regulatory headwinds could affect sentiment and near-term execution on guidance.

However, investors should know that, even with approvals in place elsewhere, the effect of regulatory delays on milestone-driven revenue can...

Read the full narrative on Alvotech (it's free!)

Alvotech's narrative projects $1.4 billion revenue and $538.9 million earnings by 2028. This requires 36.7% yearly revenue growth and a $475.5 million increase in earnings from $63.4 million today.

Uncover how Alvotech's forecasts yield a $16.10 fair value, a 233% upside to its current price.

Exploring Other Perspectives

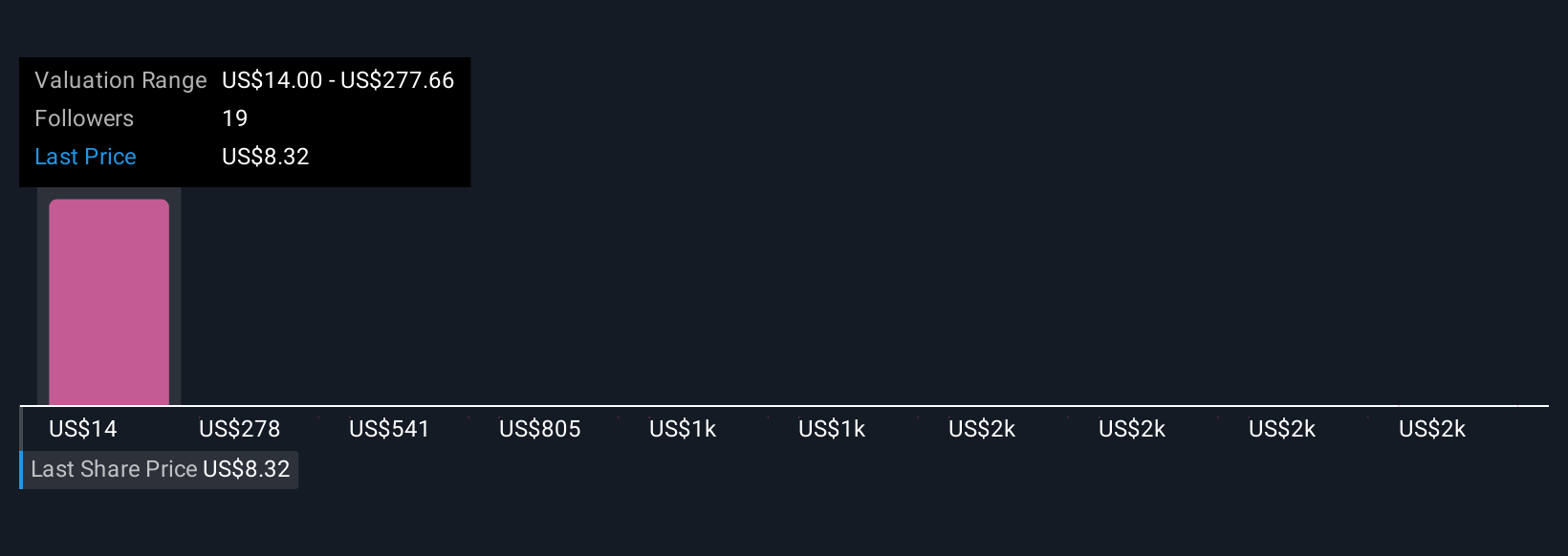

You have 7 fair value estimates from the Simply Wall St Community, stretching from US$14 to US$2,650.56 per share. With recent regulatory delays and revised revenue targets, your view on milestone risk could shape your own assessment just as strongly, consider alternative outlooks before making any decisions.

Explore 7 other fair value estimates on Alvotech - why the stock might be a potential multi-bagger!

Build Your Own Alvotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alvotech research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Alvotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alvotech's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ALVO

Alvotech

Through its subsidiaries, develops and manufactures biosimilar medicines for patients worldwide.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives