- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Is Alnylam Pharmaceuticals Fairly Priced After FDA Approval Drives 81.3% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Alnylam Pharmaceuticals is actually good value right now? You are not alone, especially with all the hype and debate around biotech stocks lately.

- The stock has leapt an impressive 81.3% year-to-date, despite dipping 11.0% in the last week and falling 7.2% over the past month. This demonstrates both breakout growth and some recent volatility.

- Big moves like this have been driven by the company announcing FDA approvals for new RNAi therapies, as well as strategic partnerships with major pharmaceutical players. These developments have kept investors attentive and likely contributed to the dramatic shifts in share price.

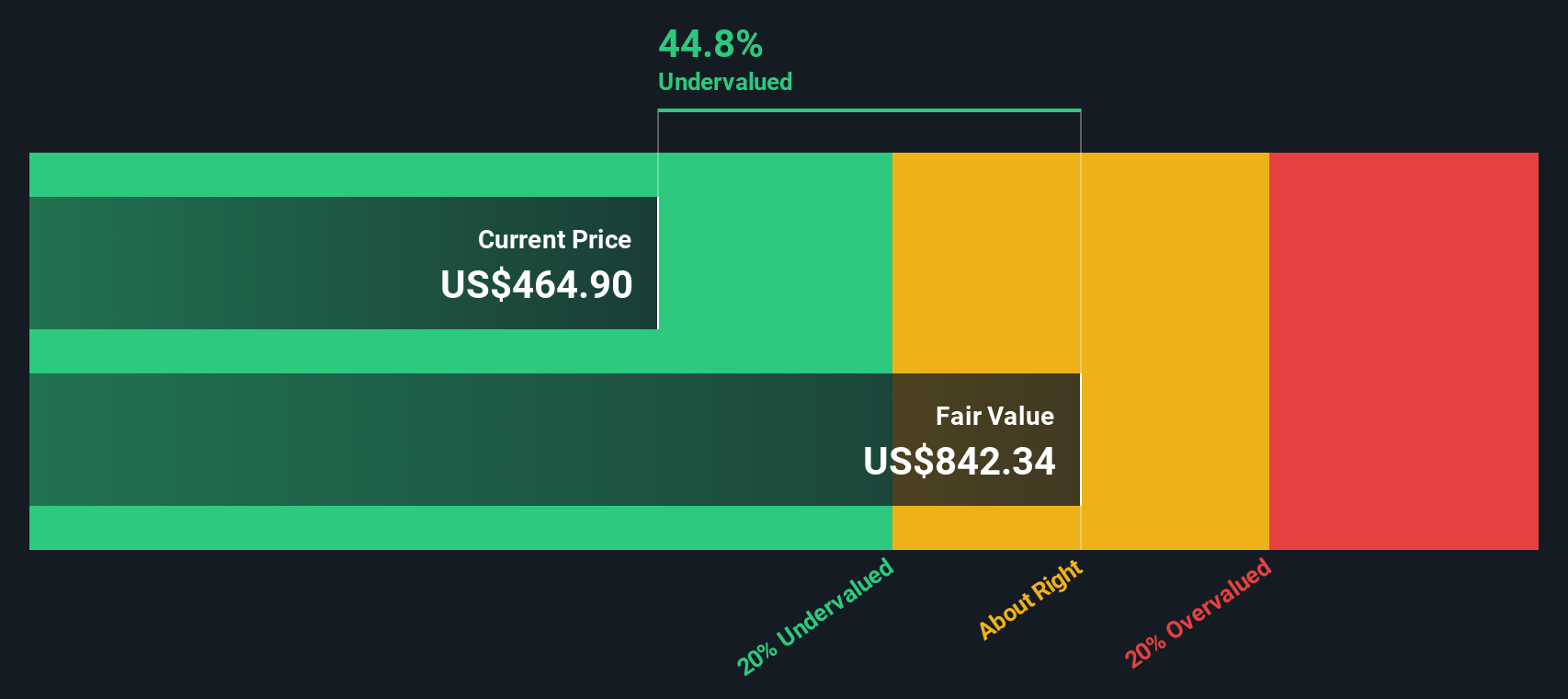

- On the Simply Wall St valuation checks, Alnylam scores 2 out of 6 for being undervalued here. This is a decent sign but far from a slam dunk. Let us break down how the stock stacks up on key valuation fronts, and offer a perspective that goes beyond the usual analyst playbook.

Alnylam Pharmaceuticals scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alnylam Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by estimating the future cash flows a business will generate and then discounting those back to today’s value. This approach aims to determine what the business is worth based on its ability to produce cash in the years ahead, using current and projected financials.

Alnylam Pharmaceuticals started the latest year with $195.74 million in Free Cash Flow. Analyst consensus forecasts that this figure will accelerate rapidly, crossing $1.2 billion by 2026 and rising to a projected $3.0 billion by 2029. Beyond those five years, the model continues to extrapolate future cash flows, adjusting for market expectations and growth slowdowns. All these values reflect US dollars.

Applying the 2 Stage Free Cash Flow to Equity model, the resulting estimated intrinsic value for Alnylam is $607.39 per share. This is 30.3% above the current trading price and suggests the stock may be meaningfully undervalued by the DCF approach. While DCF relies on many assumptions and is subject to change if forecasts shift, the current numbers indicate significant upside potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alnylam Pharmaceuticals is undervalued by 30.3%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Alnylam Pharmaceuticals Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred valuation metric for biopharmaceutical companies like Alnylam Pharmaceuticals, especially when profitability is still ramping up or earnings are volatile. Sales provide a useful benchmark for comparing companies that are in high-growth or early commercial stages, offering insight into how much investors are paying per dollar of revenue. This is a crucial factor for innovative biotech firms.

Growth expectations and company risk play significant roles in determining what qualifies as a "normal" or "fair" P/S ratio. High-growth, low-risk companies tend to command higher multiples, while companies facing slower growth or elevated risks generally trade at lower ones. For Alnylam, the current P/S ratio stands at 17.43x, which is notably higher than both the Biotechs industry average of 10.30x and the peer average of 8.71x. This may reflect investor optimism about Alnylam's pipeline and recent progress.

Simply Wall St’s proprietary Fair Ratio provides a more nuanced benchmark. Unlike traditional comparisons, the Fair Ratio (15.83x for Alnylam) is tailored to the company’s unique growth prospects, risk profile, profit margins, industry dynamics, and market capitalization. This approach gives a more balanced context and smooths out distortions that come from only looking at raw industry or peer multiples.

With Alnylam trading at a 17.43x P/S compared to a Fair Ratio of 15.83x, its current valuation appears slightly elevated. However, the difference is modest and implies that while the stock trades at a premium, it is not drastically out of line with what would be justified by its fundamentals.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

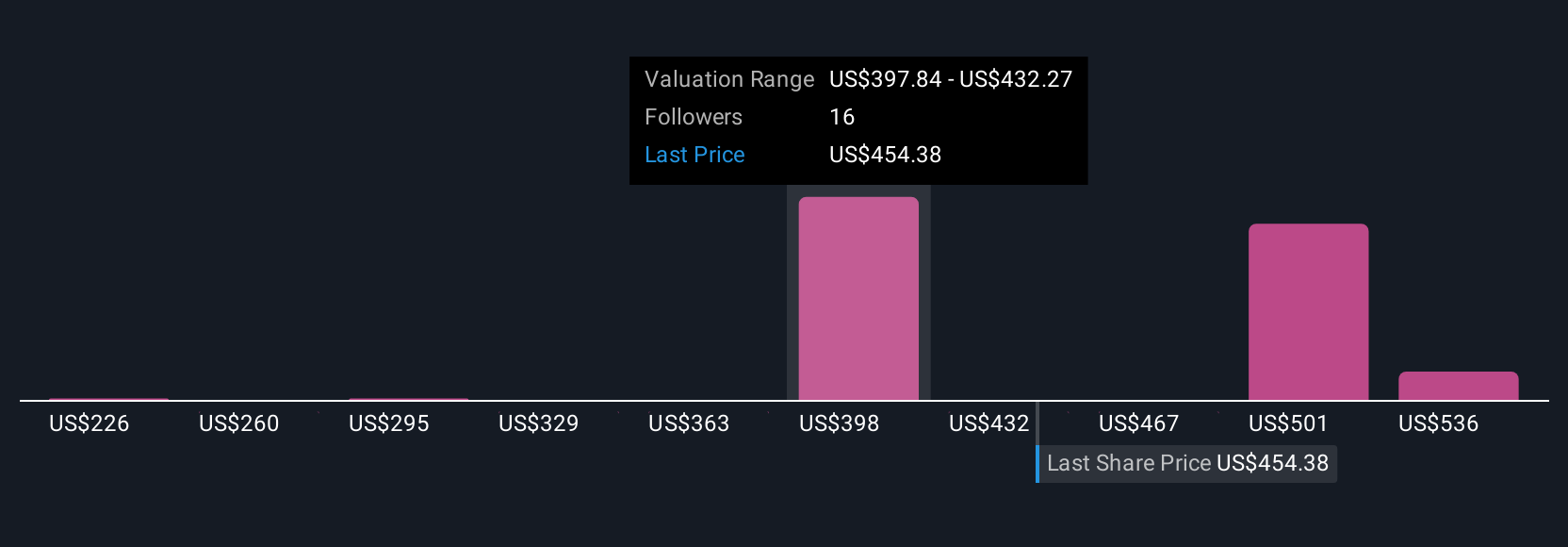

Upgrade Your Decision Making: Choose your Alnylam Pharmaceuticals Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful tool that lets investors connect their view of a company's story and outlook with key financial forecasts, such as future revenue, profits and margins, to estimate what the business is genuinely worth today.

Narratives bring the numbers to life by making it easy to explain how your conclusions are shaped by the company’s real-world progress, product launches, risks, and current market trends. On Simply Wall St’s Community page, millions of investors can create or follow Narratives, instantly seeing how fair value compares to the latest price and deciding whether it is time to buy, hold, or sell.

What makes Narratives especially dynamic is how they update automatically as new news and earnings come in, ensuring your view stays relevant in changing markets. For example, one Alnylam Narrative expects robust revenue and margin expansion from global RNAi therapy adoption and arrives at a fair value of $583, while a more cautious Narrative focuses on franchise concentration and margin risks, estimating fair value as low as $236. Narratives empower every investor to see where their expectations fit on the market’s spectrum and drive smarter, story-driven decisions.

Do you think there's more to the story for Alnylam Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives