- United States

- /

- Biotech

- /

- NasdaqGS:ALKS

Benign Growth For Alkermes plc (NASDAQ:ALKS) Underpins Its Share Price

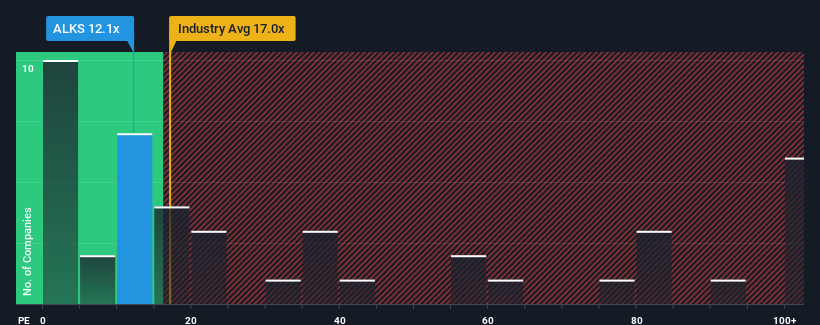

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider Alkermes plc (NASDAQ:ALKS) as an attractive investment with its 12.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Alkermes could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Alkermes

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Alkermes' is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 19% each year during the coming three years according to the analysts following the company. Meanwhile, the broader market is forecast to expand by 11% each year, which paints a poor picture.

With this information, we are not surprised that Alkermes is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Alkermes' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Alkermes that you should be aware of.

If these risks are making you reconsider your opinion on Alkermes, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALKS

Alkermes

A biopharmaceutical company, researches, develops, and commercializes pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives