- United States

- /

- Biotech

- /

- NasdaqGS:AGIO

Agios Pharmaceuticals (AGIO) Posts $1.1 Billion One-Off Gain, Challenges Earnings Quality Narratives

Reviewed by Simply Wall St

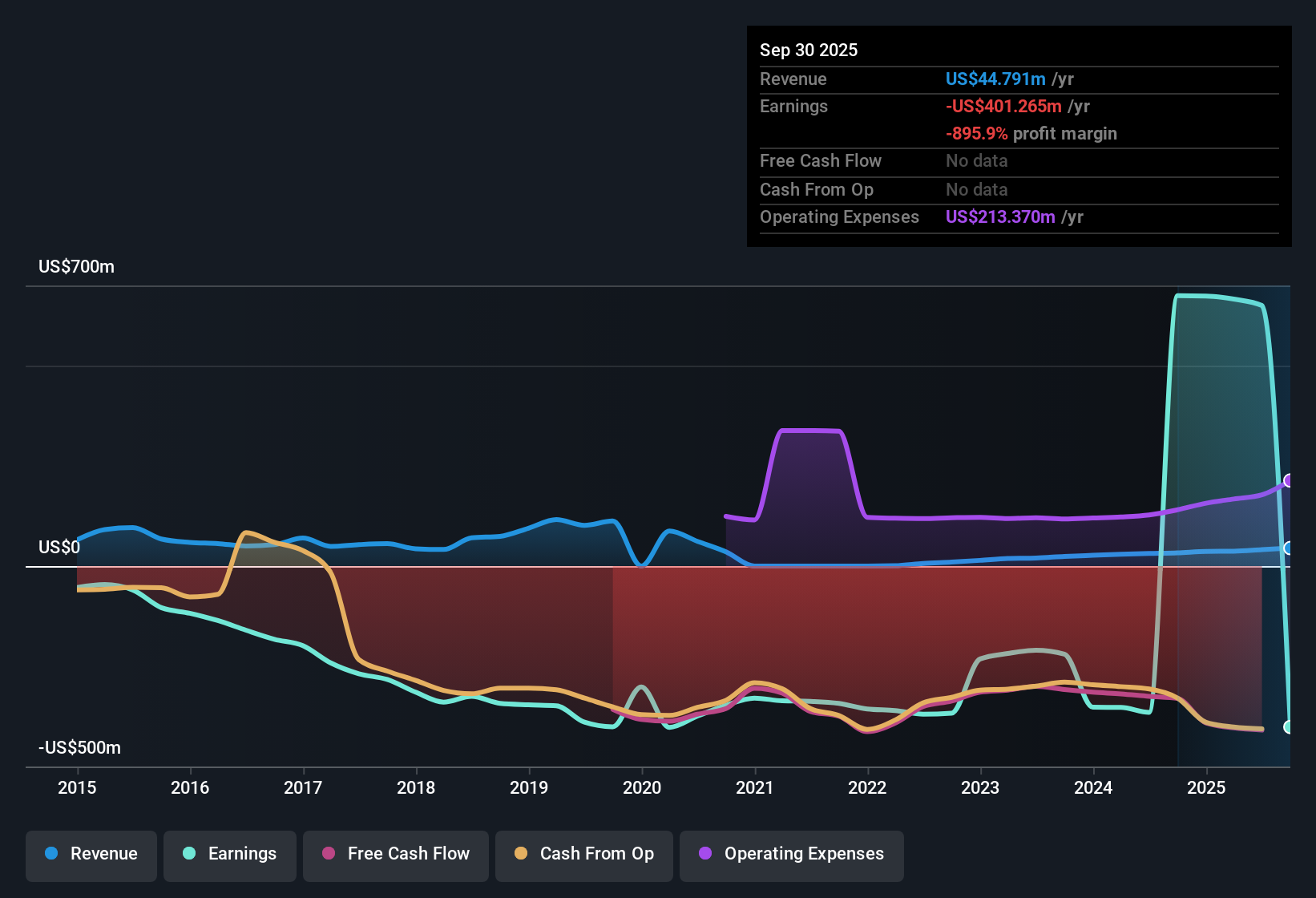

Agios Pharmaceuticals (AGIO) posted a one-off gain of $1.1 billion, which drove its net profit margins into positive territory for the twelve months through September 30, 2025. Over the last five years, the company averaged 50.6% annual earnings growth, with revenue now forecast to climb 57.2% per year and EPS projected to rise 43.6% annually. Both of these rates are well in excess of the broader US market’s respective rates. Investors will be weighing the strong growth outlook and low valuation multiples against the temporary boost from the non-recurring gain as they interpret Agios’s current results.

See our full analysis for Agios Pharmaceuticals.Next up, we will see how these headline results stand up to the prevailing narratives. Some expectations may be confirmed, while others could face fresh challenges.

See what the community is saying about Agios Pharmaceuticals

DCF Fair Value Stands Far Above Market Price

- Agios’s DCF fair value is $565.34, putting the current share price of $43.18 at a deep discount relative to modeled cash flows and well below analyst consensus price targets of $46.83.

- Analysts' consensus view points to significant upside if growth initiatives play out, but highlights risk factors such as heavy dependence on the success of PYRUKYND and persistent high R&D spending.

- The $1.1 billion one-off gain recently boosted profitability, yet analysts forecast profit margins will eventually move closer to the 16.1% industry norm, implying that today’s low valuation reflects some skepticism on the sustainability of recent results.

- It is notable that, even after factoring in modest growth projections and long-term margin normalization, consensus price targets remain higher than today’s market price, reflecting enduring confidence in Agios’s future growth trajectory.

Curious why analysts think Agios could leap far beyond today’s price? Bulls and bears both weigh in on the long-term story. Get the full consensus breakdown here. 📊 Read the full Agios Pharmaceuticals Consensus Narrative.

Profit Margin Turns Positive After $1.1 Billion Gain

- Net profit margins became positive for the most recent twelve months due to the reported $1.1 billion one-off gain, marking a clear departure from past loss-making periods.

- The consensus narrative emphasizes the catalyst effect of this gain, while also noting that analysts expect profit margins to settle much lower going forward.

- While bulls might point to sustained revenue growth (57.2% forecast annually) as evidence of lasting improvement, consensus recognizes that future earnings will depend heavily on continued drug launches and global expansion beyond this extraordinary gain.

- With profit estimates expected to normalize to $67 million in three years, markets will be watching how quickly core revenues and margins catch up to the company’s headline numbers.

Price-To-Earnings Ratio Much Lower Than Peers

- Agios trades at a price-to-earnings ratio of 3.9x, far lower than both the US biotech industry average of 17.4x and a peer average of 46.8x, making its valuation highly compelling compared to sector norms.

- Analysts' consensus view suggests that while this low multiple supports the bullish story of a value opportunity, it also implies that the market is pricing in risks around earnings durability and future drug launches.

- Despite analyst price targets of $46.83, investors remain cautious, possibly reflecting concerns about the narrow product focus and elevated operating costs noted by consensus analysts.

- If Agios can convert its pipeline into broader revenue streams, the present valuation gap versus industry may prove attractive. However, delivery on these fronts remains crucial for unlocking upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Agios Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Take just a few minutes to make your own mark and share your perspective: Do it your way

A great starting point for your Agios Pharmaceuticals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Agios’s rapid growth and attractive valuation, investors face uncertainty because of reliance on one-off gains and questions about sustaining core earnings and profit margins.

If you prefer gauging businesses with more steady momentum and consistent results, check out stable growth stocks screener (2112 results) to focus on companies delivering reliable growth through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGIO

Agios Pharmaceuticals

A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives