- United States

- /

- Life Sciences

- /

- NasdaqGS:ADPT

Should Growing Analyst Optimism on Upcoming Earnings Drive New Moves for Adaptive Biotechnologies (ADPT) Investors?

Reviewed by Sasha Jovanovic

- In late October 2025, analysts became increasingly optimistic about Adaptive Biotechnologies' earnings prospects for the September quarter, highlighted by a positive Earnings ESP of 29.03% and a strong track record of earnings outperformance over the past year.

- This sustained bullish sentiment among analysts, fueled by consistent earnings beats, has heightened market attention on the company's upcoming results and outlook.

- Next, we'll explore how this surge in analyst optimism ahead of earnings could impact Adaptive Biotechnologies' longer-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Adaptive Biotechnologies Investment Narrative Recap

To own a stake in Adaptive Biotechnologies, an investor needs confidence in the company's ability to translate its molecular diagnostics and immune sequencing innovations, particularly clonoSEQ, into sustained revenue growth and a pathway to profitability. While a surge in short-term analyst optimism driven by another likely earnings beat has sharpened focus on the upcoming results, this does not fundamentally shift the biggest near-term catalyst, expanding clinical adoption and reimbursement for clonoSEQ, or the ongoing risk of persistent company-wide unprofitability and potential dilution from additional capital needs. Among recent developments, the July announcement of clonoSEQ’s integration with Flatiron Health's OncoEMR stands out as directly relevant. This move expands access for over 4,500 clinicians, which supports the core catalyst of increasing clinical test volumes and recurring revenue, setting the stage for further progress in the company’s quest to reach operating scale and margin improvement. On the other hand, investors should be aware that should cash burn persist or worsen, even upbeat earnings results might not fully offset the risk that...

Read the full narrative on Adaptive Biotechnologies (it's free!)

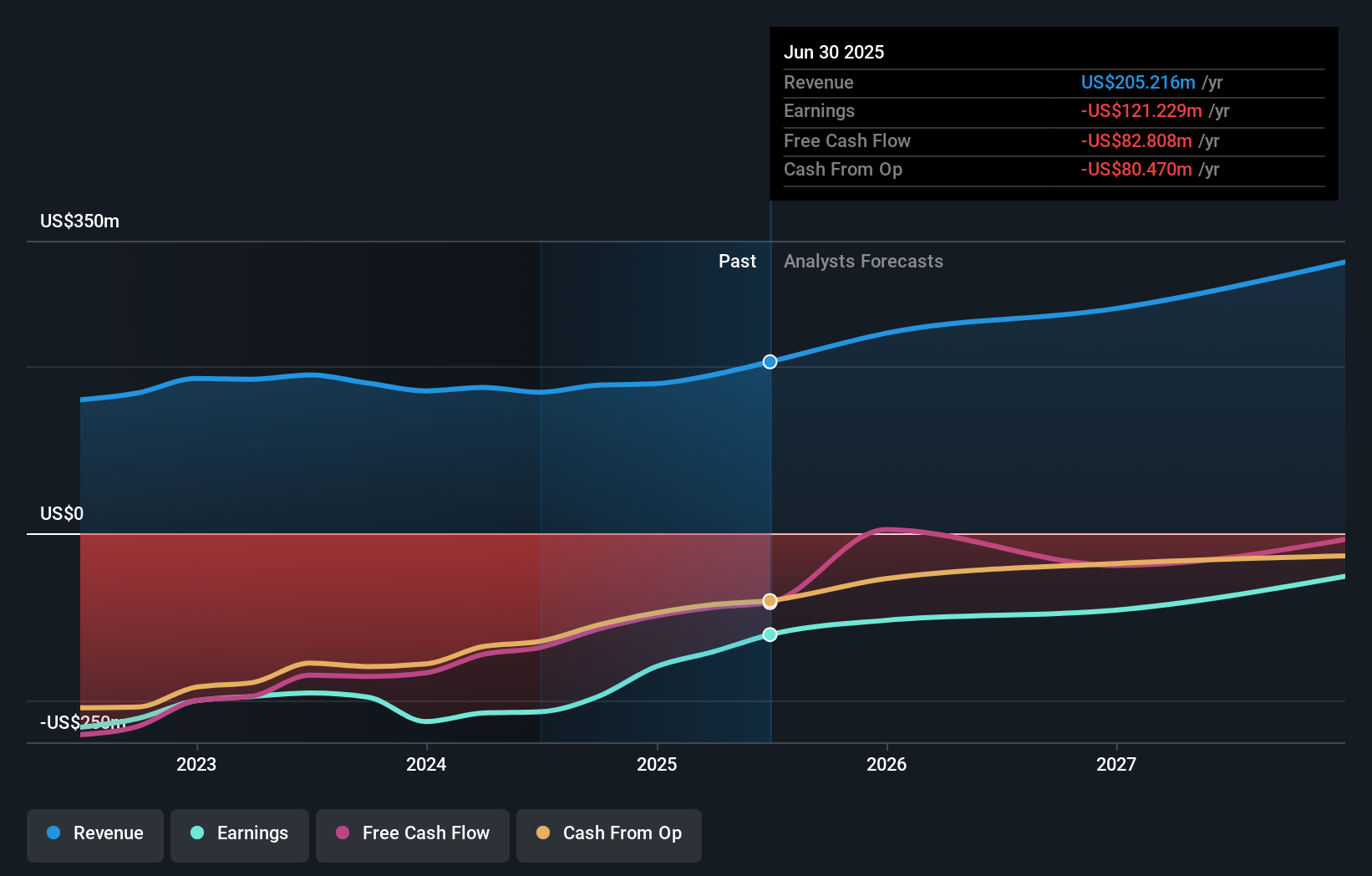

Adaptive Biotechnologies' outlook projects $350.6 million in revenue and $49.8 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 19.5% and a $171 million increase in earnings from the current -$121.2 million.

Uncover how Adaptive Biotechnologies' forecasts yield a $17.14 fair value, in line with its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community value Adaptive Biotechnologies between US$7.88 and US$17.14 per share, reflecting a broad spectrum of expectations. With analyst focus keenly set on reducing cash burn and achieving profitability, it's clear market participants weigh these risks differently and you are encouraged to explore several alternative viewpoints.

Explore 2 other fair value estimates on Adaptive Biotechnologies - why the stock might be worth as much as $17.14!

Build Your Own Adaptive Biotechnologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Adaptive Biotechnologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adaptive Biotechnologies' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADPT

Adaptive Biotechnologies

A commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases.

Adequate balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives