- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

Is ADMA Stock a Bargain After Recent Plasma Therapy Demand Headlines?

Reviewed by Bailey Pemberton

- Curious whether ADMA Biologics might be undervalued or primed for a turnaround? You are not alone, and diving into the numbers can really pay off.

- The stock has seen a modest lift of 2.0% over the last week and 2.9% for the month. Its year-to-date performance lags at -13.9%, with a 1-year return of -20.1%, despite boasting an impressive 502.3% return over the last three years.

- Recent headlines have highlighted ongoing demand for plasma-derived therapies, and ADMA’s product pipeline continues to draw attention from both analysts and industry watchers. These stories add key context to the recent share price moves and may hint at shifting sentiment around growth prospects.

- On our valuation scoreboard, ADMA Biologics earns a 4 out of 6, indicating the company looks undervalued on several fronts. We will break down how this score was reached using different valuation methods. Stick around, because there is an even more insightful approach to valuation ahead.

Find out why ADMA Biologics's -20.1% return over the last year is lagging behind its peers.

Approach 1: ADMA Biologics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting those amounts back to today's dollar value. This approach provides an objective look at what ADMA Biologics could be worth based on expected financial performance.

For ADMA Biologics, the most recent Free Cash Flow (FCF) reported is $63.9 million. Analysts forecast the company's FCF to grow steadily over the coming years, reaching an estimated $453.9 million by the end of 2029. After that point, additional FCF projections are extrapolated rather than provided directly by analysts, but the trend continues to move upward.

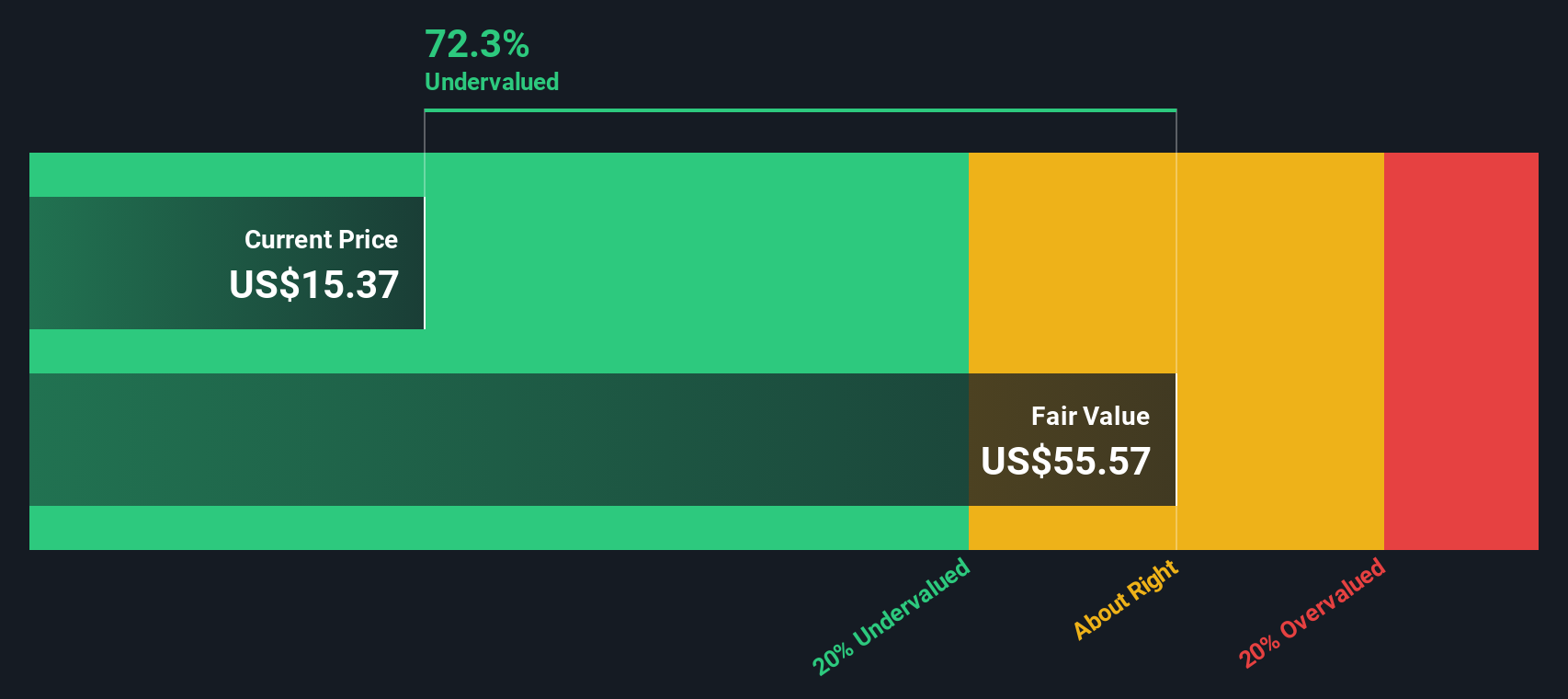

Using the 2 Stage Free Cash Flow to Equity method, these projected figures are discounted back to the present to estimate the company’s true worth. The resulting DCF valuation suggests an intrinsic value of $54.01 per share. This result indicates the stock is trading at a 71.3% discount to this calculated fair value, which implies the current price is significantly below what the future cash flows would justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ADMA Biologics is undervalued by 71.3%. Track this in your watchlist or portfolio, or discover 833 more undervalued stocks based on cash flows.

Approach 2: ADMA Biologics Price vs Earnings (PE)

For profitable companies like ADMA Biologics, the Price-to-Earnings (PE) ratio is a widely used valuation tool. This metric reflects how much investors are willing to pay for each dollar of current earnings, making it especially relevant when earnings are positive and growing.

The "normal" or "fair" PE ratio for a stock depends on several factors. Higher expected earnings growth, greater profitability, and lower business risk all justify a higher PE. Conversely, slower growth or more uncertainty usually means the stock should trade at a lower multiple. Comparing a company’s PE to those of its industry or peers can provide some context, but these benchmarks might not reflect the company’s specific situation.

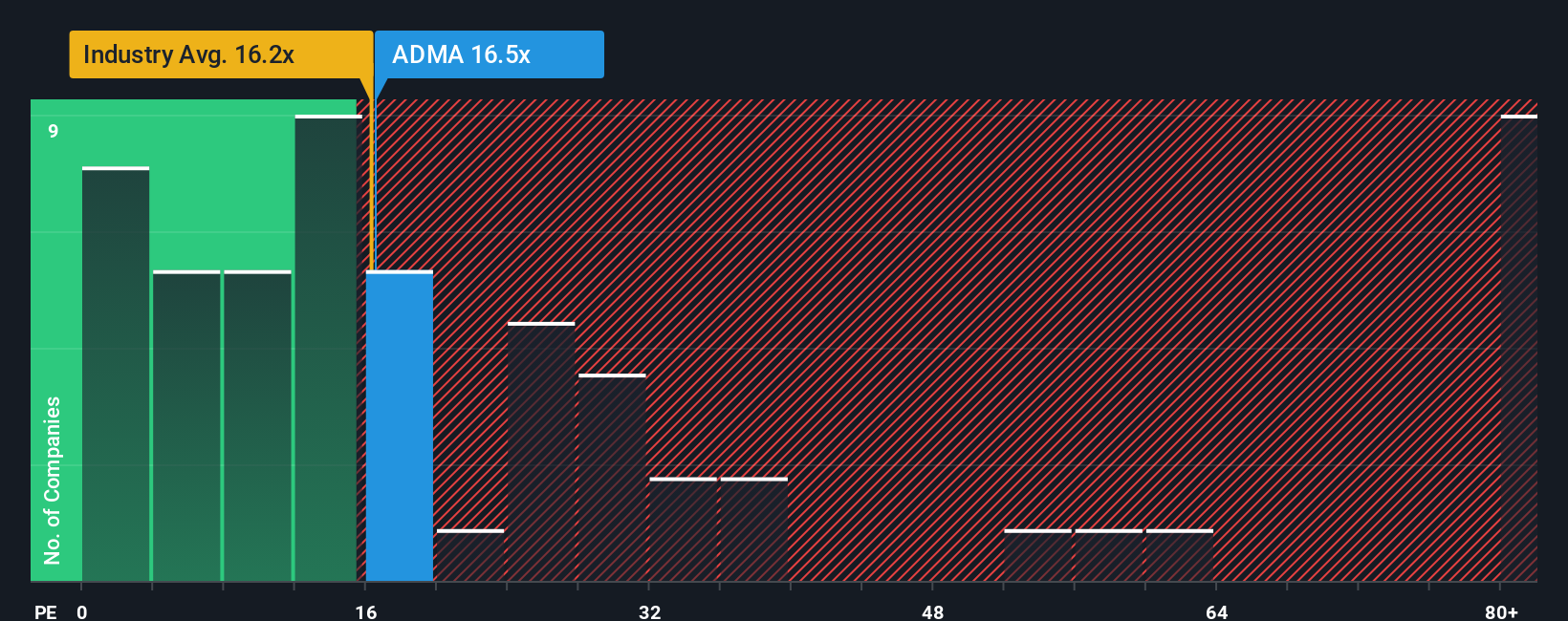

As of now, ADMA Biologics has a PE ratio of 17.7x. This is closely in line with the biotech industry average of 17.4x and sits comfortably below the average of its direct peers at 29.1x. While these comparisons are useful, they do not always account for the company's distinctive growth trajectory or risk profile.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio for ADMA Biologics is 22.8x. It is calculated based on its earnings growth, position in the industry, profit margins, size, and company-specific risks. Because it moves beyond broad industry averages, the Fair Ratio offers a more tailored benchmark for what ADMA’s PE should reasonably be today.

When we compare the Fair Ratio of 22.8x to ADMA’s current PE of 17.7x, the stock appears to be trading at a discount to its fair PE. This indicates that, considering its growth outlook and financial quality, the current share price may offer value for investors seeking future upside.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ADMA Biologics Narrative

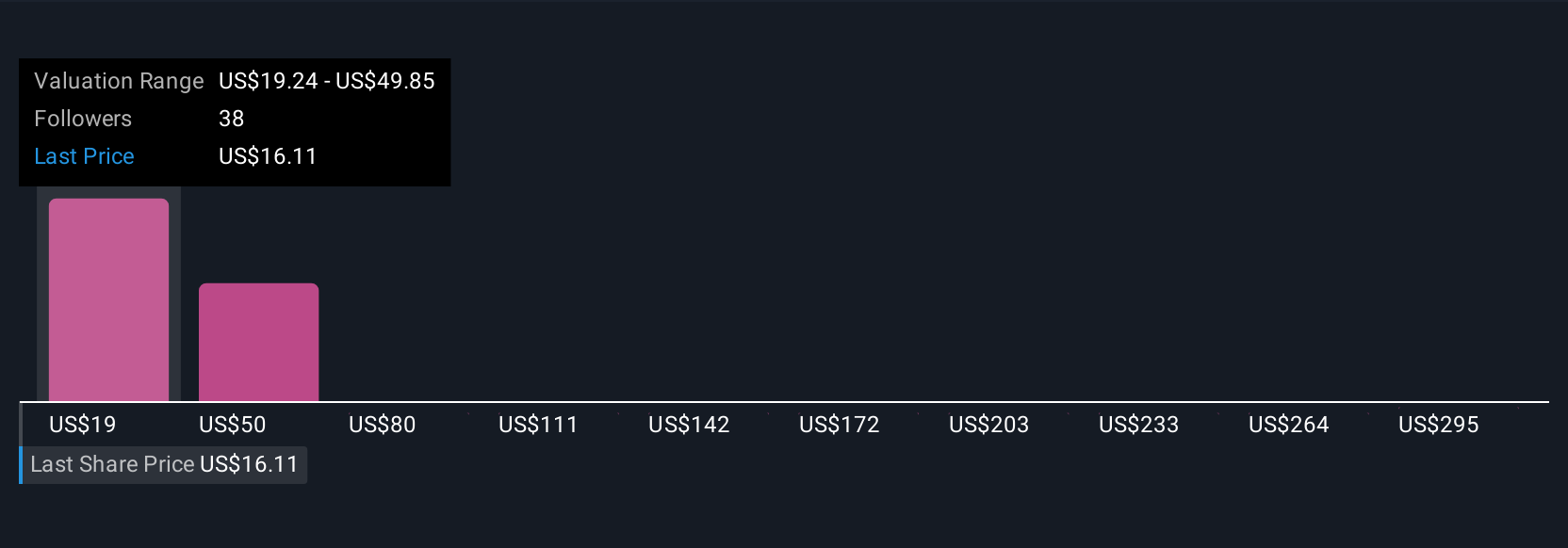

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a story that you, as an investor, can create around a company by linking real business developments and assumptions about its future, such as projected revenue growth and profit margins, to your own estimate of fair value.

Narratives bridge the gap between a company’s story and the financial numbers by connecting how you see ADMA Biologics evolving with forecasts and what those mean for the share price. This approach moves beyond static metrics and allows you to easily build and adjust your perspective right within Simply Wall St’s Community page, where millions of investors exchange their views.

With Narratives, you can quickly see whether, based on your view of future potential and fair value, the stock looks under- or over-priced today. As new events like earnings releases or major news emerge, Narratives are updated dynamically to help you stay in tune with how sentiment and outlooks shift over time.

For example, some investors are optimistic, with Narratives projecting a fair value as high as $27.25 per share based on faster growth and margin expansion. Others are more cautious and see fair value as low as $20.93, reflecting conservative assumptions about ADMA’s prospects and industry risks.

Do you think there's more to the story for ADMA Biologics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives