- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

ADMA Biologics (ADMA): Assessing Valuation as Short Interest Declines and Market Sentiment Improves

Reviewed by Simply Wall St

ADMA Biologics (ADMA) has seen its short interest drop by nearly 5% since the last report, now sitting at just under 9%. This is noticeably below the biotech's average peer short interest, which hovers above 14%.

See our latest analysis for ADMA Biologics.

ADMA Biologics has demonstrated impressive momentum lately, with its share price jumping 22.4% in the past week and 26.6% over the past month. While the total shareholder return over the past year is still in negative territory, the five-year figure of 855.7% shows just how far the company has come. Recent share price gains hint at renewed optimism around its growth story.

If the shifting sentiment in biotech catches your interest, you might want to discover more opportunities through our curated healthcare stock screener: See the full list for free.

With shares up sharply and short interest dropping, investors now have to ask if ADMA Biologics is still undervalued at current levels or if the market has already priced in all the company’s future growth.

Most Popular Narrative: 29.5% Undervalued

With ADMA Biologics closing at $19.21 and the most popular narrative indicating a fair value of $27.25, sentiment among analysts suggests a significant gap between the company’s current valuation and its potential. This difference is linked to expected transformation in ADMA’s revenue streams and operational efficiencies.

Commercial-scale implementation of the FDA-approved yield enhancement process is producing a 20%+ increase in bulk immunoglobulin output, expected to drive sustained gross margin expansion and higher net income starting in early 2026 and beyond. Rapidly increasing adoption and utilization of ASCENIV, with a growing number of physicians and patient starts, is supported by aging populations and rising prevalence of immunodeficiency and infectious diseases. These secular trends are likely to drive ADMA's top-line revenue growth for years to come.

What’s fueling this bullish view? The numbers behind the fair value are built on aggressive projections of rapid earnings and revenue expansion, with a future profit multiple that turns heads in the biotech sector. Want to uncover the bold assumptions that power this outlook? Dive into the full narrative to see which financial leaps analysts believe ADMA will achieve.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as dependence on a limited product portfolio and uncertainties in scaling up new manufacturing processes could impact ADMA Biologics’ future growth assumptions.

Find out about the key risks to this ADMA Biologics narrative.

Another View: What Do Earnings Ratios Say?

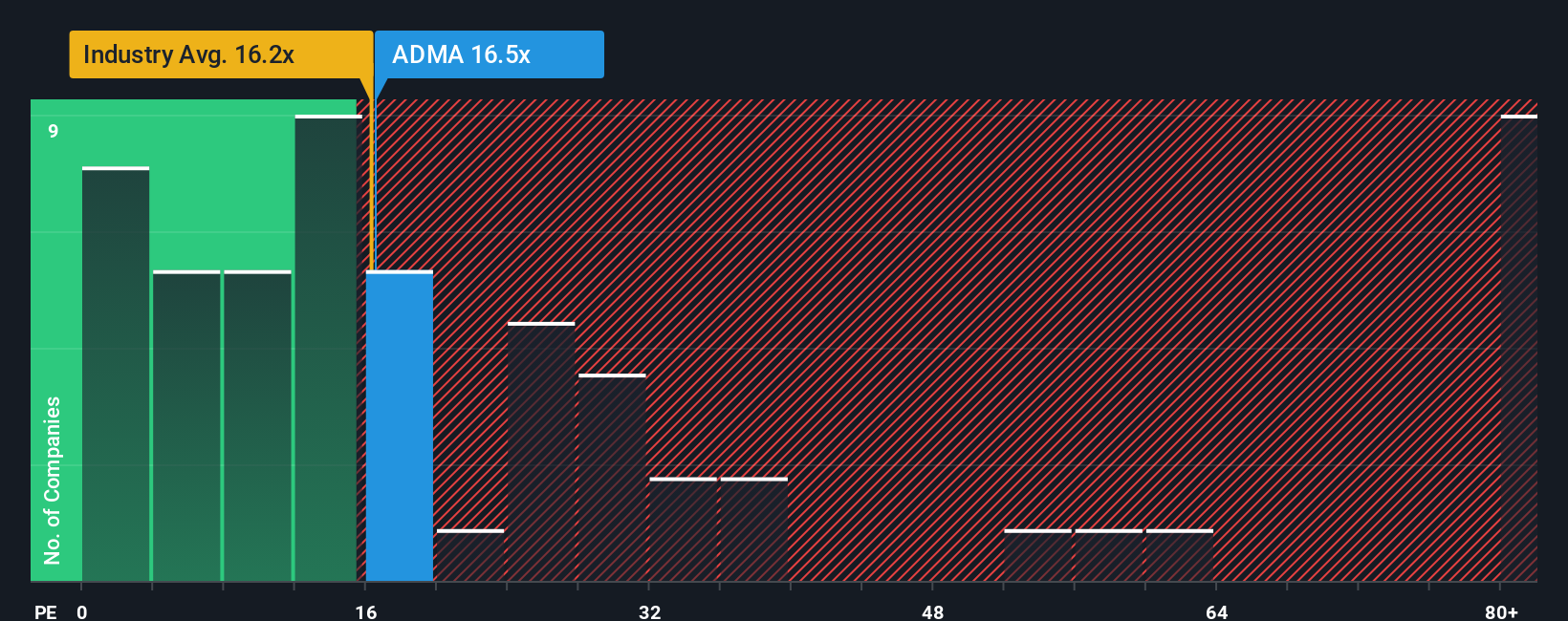

Switching perspective, ADMA Biologics’ current earnings ratio stands at 21.8x, which is higher than both the US Biotechs industry average of 18.8x and the peer average of 32x. However, the fair ratio for ADMA is estimated at 25.3x, suggesting that the stock could see its valuation shift if market sentiment aligns with that benchmark. This gap creates both uncertainty and potential. Will the price move upward or stay put?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ADMA Biologics Narrative

If you have your own perspective or want to dig deeper into the numbers, you can put together your own story about ADMA Biologics in just a few minutes, and Do it your way.

A great starting point for your ADMA Biologics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You owe it to yourself to check out other smart opportunities that fit your strategy. The best investors never limit themselves to a single story.

- Boost your portfolio’s stability with stocks paying strong yields. See the full list in these 14 dividend stocks with yields > 3%.

- Tap into rapid tech evolution by researching the most promising innovations with these 26 quantum computing stocks, which are redefining possibilities.

- Ride the momentum of digital innovation and uncover fast-moving trends by investigating these 81 cryptocurrency and blockchain stocks right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success