- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

ADMA Biologics (ADMA): Assessing Valuation After Raised Earnings Guidance and Strong Q3 Results

Reviewed by Simply Wall St

ADMA Biologics (ADMA) just released its third quarter results, reporting higher revenue and net income compared to a year ago. The company also raised its revenue outlook for both 2025 and 2026, signaling ongoing confidence.

See our latest analysis for ADMA Biologics.

ADMA Biologics has been on investors’ radars thanks to upbeat earnings, raised guidance, and a recently completed share buyback, but its share price is still working to regain earlier highs. The stock posted a solid 9% one-month share price return after its latest update, even as year-to-date performance remains in the red and the past 12 months delivered a -24% total shareholder return. That said, ADMA’s three- and five-year total shareholder returns—nearly 386% and 748%, respectively—underscore the company’s dramatic turnaround and the kind of long-term momentum that keeps growth-watchers optimistic.

If ADMA’s renewed momentum has you interested in what else is on the move, now is a great time to broaden your investing scope and discover See the full list for free.

With analysts projecting further upside for ADMA while shares remain below historical highs, the debate now centers on whether the recent pullback represents a chance to buy into future growth or if the market has already priced it all in.

Most Popular Narrative: 42% Undervalued

Compared to ADMA Biologics' latest closing price of $15.69, the leading narrative estimates a fair value as high as $27.25. That sets the stage for some seriously ambitious projections behind this price target.

Commercial-scale implementation of the FDA-approved yield enhancement process is producing a 20%+ increase in bulk immunoglobulin output. This is expected to drive sustained gross margin expansion and higher net income starting in early 2026 and beyond.

Rapidly increasing adoption and utilization of ASCENIV, with a growing number of physicians and patient starts, is supported by aging populations and rising prevalence of immunodeficiency and infectious diseases. These secular trends are likely to drive ADMA's top-line revenue growth for years to come.

Want to know what’s powering this massive valuation gap? Think margin expansion at scale and aggressive revenue targets factored into analyst growth models. Discover the financial strategies that make this narrative stand out from the pack. Numbers alone won’t tell the full story; see what assumptions really set the stage for this bold bullish stance.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain challenges or setbacks with expanding ADMA’s product portfolio could disrupt growth and change the bullish outlook described above.

Find out about the key risks to this ADMA Biologics narrative.

Another View: Market Multiples Tell a Different Story

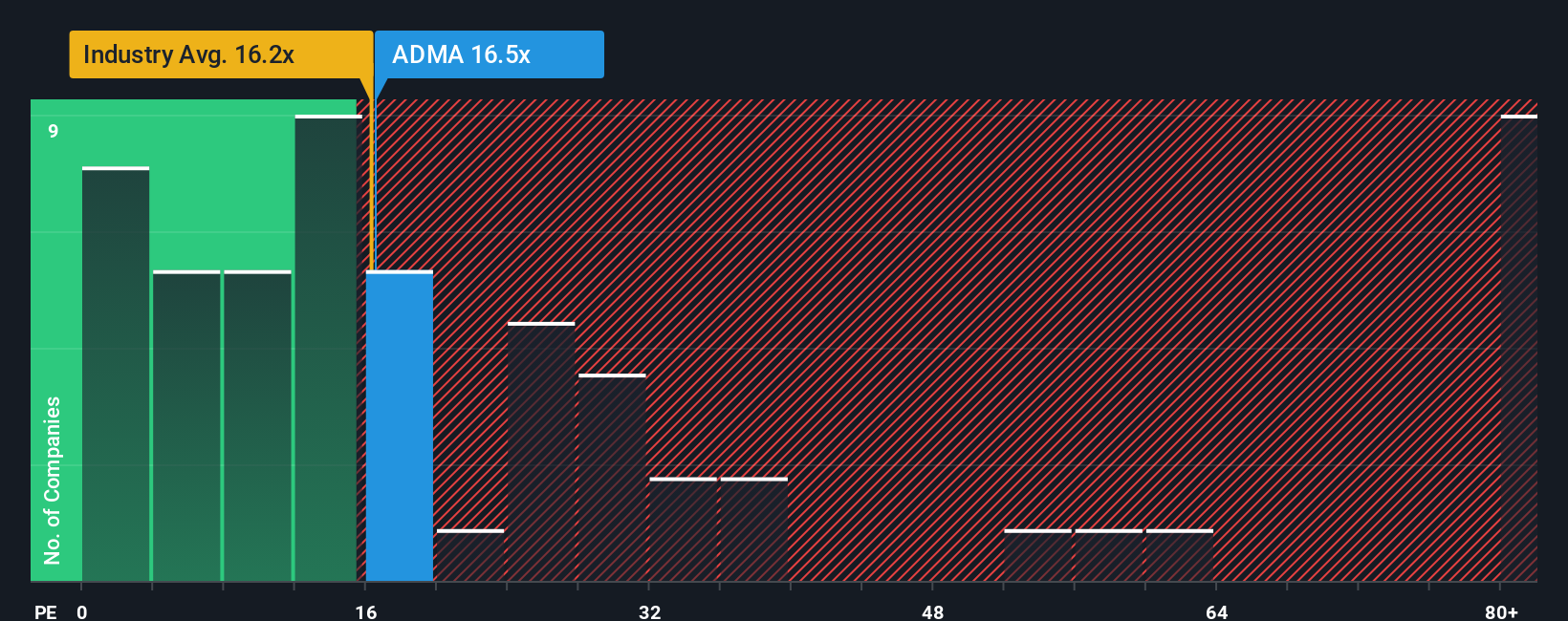

While growth forecasts spotlight ADMA's upside, its current price-to-earnings ratio of 17.8x sits just above the US Biotechs industry average of 17.5x. Against peers, however, it looks attractive when compared to a much higher peer average of 30.9x. The fair ratio sits at 24.5x. This suggests the market could re-rate ADMA higher over time, but also warns that its valuation is not a cut-and-dried bargain. Does this risk-reward balance change your outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ADMA Biologics Narrative

If you’d rather reach your own conclusions or want to dig into the numbers firsthand, you can easily craft your personal outlook in just a few minutes. Do it your way

A great starting point for your ADMA Biologics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Expand your strategy and capture potential before others do. Use these smart ideas from the Simply Wall Street Screener to power up your next move:

- Supercharge your portfolio by spotting income potential through these 18 dividend stocks with yields > 3% that consistently deliver robust yields above 3%.

- Stay ahead of the market disruption and ride the next innovation wave with these 27 AI penny stocks reshaping entire industries.

- Sharpen your edge by targeting value opportunities with these 908 undervalued stocks based on cash flows set for strong growth based on healthy cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives