Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:ADAP

Investors Who Bought Adaptimmune Therapeutics (NASDAQ:ADAP) Shares A Year Ago Are Now Up 101%

It might be of some concern to shareholders to see the Adaptimmune Therapeutics plc (NASDAQ:ADAP) share price down 16% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. During that period, the share price soared a full 101%. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

View our latest analysis for Adaptimmune Therapeutics

Given that Adaptimmune Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Adaptimmune Therapeutics' revenue grew by 250%. That's stonking growth even when compared to other loss-making stocks. And the share price has responded, gaining 101% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

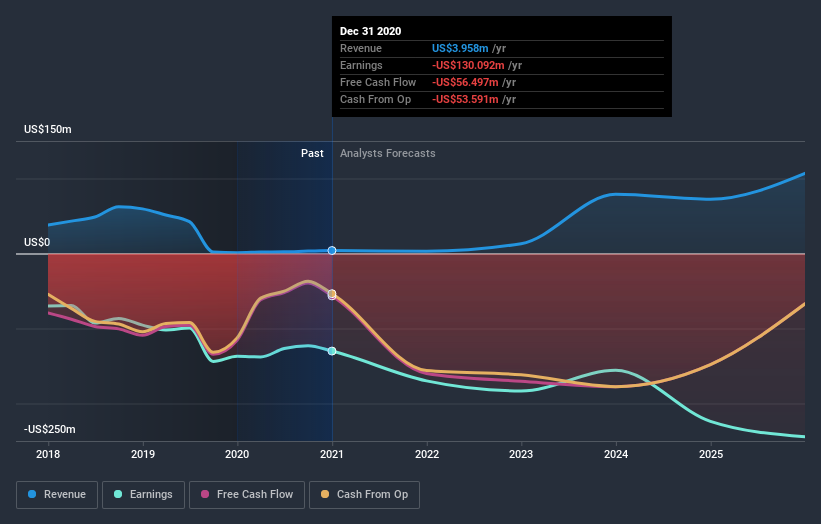

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Adaptimmune Therapeutics has rewarded shareholders with a total shareholder return of 101% in the last twelve months. Notably the five-year annualised TSR loss of 5% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Adaptimmune Therapeutics is showing 6 warning signs in our investment analysis , and 1 of those is potentially serious...

Of course Adaptimmune Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Adaptimmune Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Adaptimmune Therapeutics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ADAP

Adaptimmune Therapeutics

A clinical-stage biopharmaceutical company, provides novel cell therapies primarily to cancer patients in the United States and the United Kingdom.

Flawless balance sheet and slightly overvalued.