- United States

- /

- Biotech

- /

- OTCPK:ACOR.Q

The Acorda Therapeutics (NASDAQ:ACOR) Share Price Is Down 91% So Some Shareholders Are Rather Upset

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Acorda Therapeutics, Inc. (NASDAQ:ACOR) for five whole years - as the share price tanked 91%. We also note that the stock has performed poorly over the last year, with the share price down 90%. Furthermore, it's down 63% in about a quarter. That's not much fun for holders.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Acorda Therapeutics

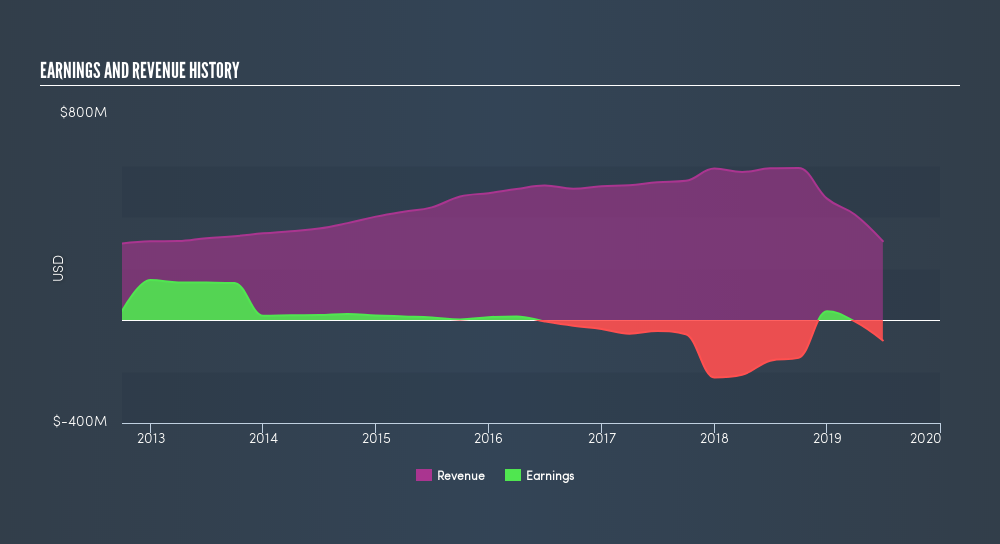

Because Acorda Therapeutics is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Acorda Therapeutics saw its revenue increase by 3.7% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 38% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Acorda Therapeutics had a tough year, with a total loss of 90%, against a market gain of about 0.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 38% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Acorda Therapeutics better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:ACOR.Q

Acorda Therapeutics

A biopharmaceutical company, develops and commercializes therapies for neurological disorders in the United States.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives