- United States

- /

- Biotech

- /

- NasdaqGM:ACIU

Need To Know: Analysts Are Much More Bullish On AC Immune SA (NASDAQ:ACIU) Revenues

Celebrations may be in order for AC Immune SA (NASDAQ:ACIU) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

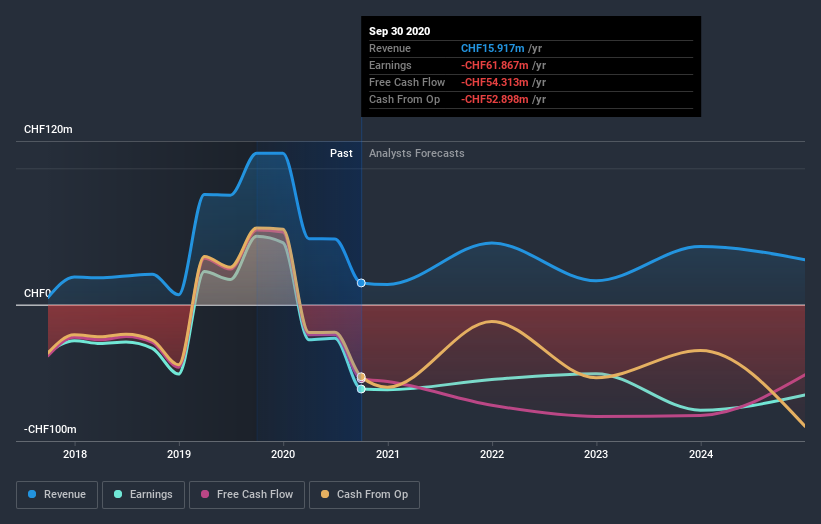

Following the upgrade, the current consensus from AC Immune's three analysts is for revenues of CHF68m in 2021 which - if met - would reflect a huge 326% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 22% to CHF0.67. However, before this estimates update, the consensus had been expecting revenues of CHF45m and CHF0.71 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

View our latest analysis for AC Immune

There was no major change to the consensus price target of CHF11.12, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic AC Immune analyst has a price target of CHF16.13 per share, while the most pessimistic values it at CHF8.63. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that AC Immune's rate of growth is expected to accelerate meaningfully, with the forecast 3x revenue growth noticeably faster than its historical growth of 15% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 21% next year. Factoring in the forecast acceleration in revenue, it's pretty clear that AC Immune is expected to grow much faster than its industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses next year, perhaps suggesting AC Immune is moving incrementally towards profitability. They also upgraded their revenue estimates for next year, and sales are expected to grow faster than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at AC Immune.

Analysts are clearly in love with AC Immune at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as dilutive stock issuance over the past year. You can learn more, and discover the 3 other flags we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading AC Immune or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:ACIU

AC Immune

A clinical stage biopharmaceutical company, discovers, designs, and develops medicines, and therapeutic and diagnostic products for the prevention and treatment of neurodegenerative diseases associated with protein misfolding.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success