- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

Will AbCellera Biologics' (ABCL) New Board Addition Shape Its Scientific Edge and Innovation Strategy?

Reviewed by Sasha Jovanovic

- AbCellera Biologics recently announced the appointment of Dr. Stephen Quake, a renowned scientist and entrepreneur, to its Board of Directors, while Dr. Andrew W. Lo has resigned from the board.

- Dr. Quake’s experience leading major scientific initiatives and founding numerous biotech companies highlights the company’s emphasis on scientific leadership and business innovation at the board level.

- We’ll explore how Dr. Quake’s addition to the board, given his deep expertise in genomic innovation, could influence AbCellera’s investment outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

AbCellera Biologics Investment Narrative Recap

To be a shareholder in AbCellera Biologics, you need conviction in its ability to translate world-class scientific innovation into clinically and commercially successful antibody medicines. The recent appointment of Dr. Stephen Quake, with his reputation for scientific leadership and company-building, may strengthen confidence in AbCellera’s leadership, but is not expected to immediately alter the biggest short-term catalyst, progress in clinical trials for its lead programs, or ease ongoing risks related to persistent operating losses.

Among recent announcements, dosing began in the Phase 1 clinical trial of ABCL575, one of AbCellera’s next-generation therapies. This development is highly relevant to the company's near-term prospects, as early-stage clinical progress in pipeline assets like ABCL575 and ABCL635 represents a key determinant of future revenue growth and could validate ongoing investments in R&D.

In contrast, investors should be aware that even with leadership changes, the challenge of sustainable revenue in light of increasing net losses remains a material risk...

Read the full narrative on AbCellera Biologics (it's free!)

AbCellera Biologics' outlook anticipates $123.3 million in revenue and $17.5 million in earnings by 2028. Achieving this would require 55.4% annual revenue growth and an earnings increase of $183.2 million from current earnings of -$165.7 million.

Uncover how AbCellera Biologics' forecasts yield a $10.20 fair value, a 191% upside to its current price.

Exploring Other Perspectives

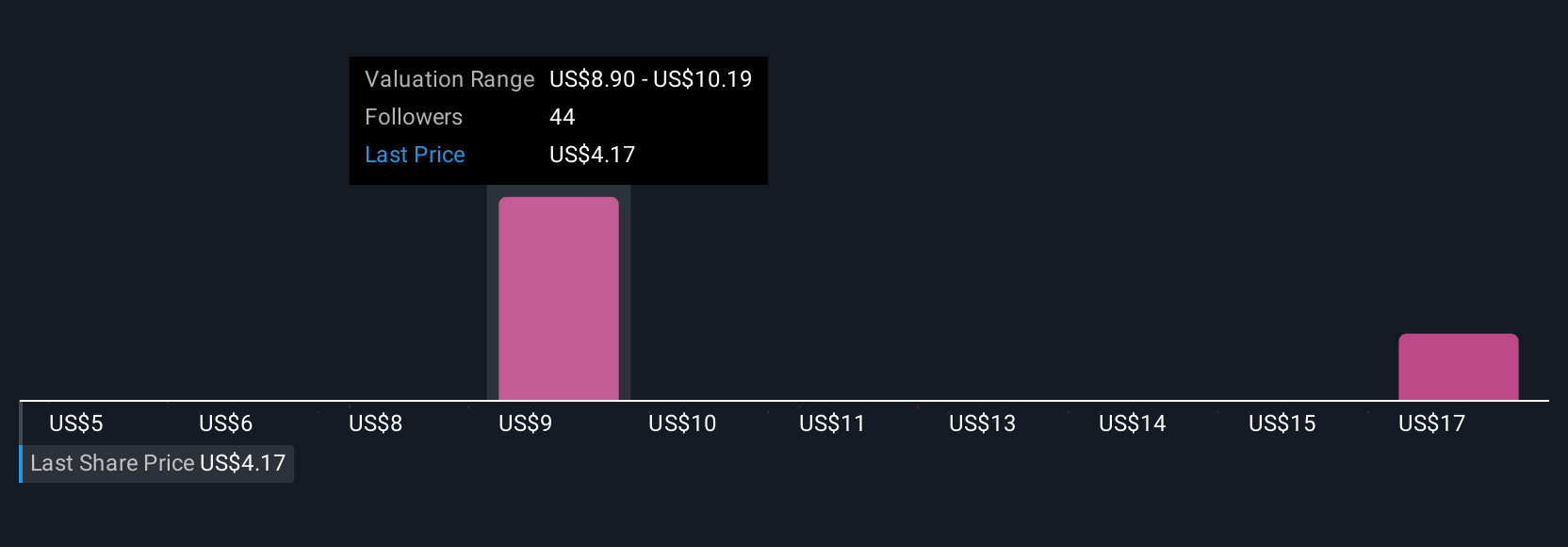

Nine fair value estimates from the Simply Wall St Community spread from US$5 to US$17 per share, illustrating starkly varied outlooks. With clinical trial outcomes for ABCL575 and ABCL635 pivotal to AbCellera’s commercial future, consider how differing opinions on pipeline potential might influence these broad perspectives.

Explore 9 other fair value estimates on AbCellera Biologics - why the stock might be worth over 4x more than the current price!

Build Your Own AbCellera Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AbCellera Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbCellera Biologics' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives