- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

How Investors Are Reacting To AbCellera Biologics (ABCL) Advancing ABCL575 Into Phase 1 Trials for Atopic Dermatitis

Reviewed by Simply Wall St

- AbCellera Biologics recently announced it has dosed the first participants in its Phase 1 clinical trial for ABCL575, a next-generation antibody therapy designed for moderate-to-severe atopic dermatitis that targets OX40 ligand and offers a once-every-six-month dosing interval.

- This approach could address a major unmet need in atopic dermatitis by potentially reducing the treatment burden for patients and expanding applications to other inflammatory and autoimmune conditions.

- We'll examine how the advancement of ABCL575 into Phase 1 trials could shift AbCellera’s investment narrative toward long-term pipeline strengths.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AbCellera Biologics Investment Narrative Recap

To invest in AbCellera Biologics, you need to believe in the company’s ability to move its internal pipeline, such as ABCL575 and ABCL635, into late-stage clinical trials and eventual market approvals, overcoming the considerable risks of clinical translation and ongoing financial losses. The recent commencement of the ABCL575 Phase 1 trial marks progress on this front, but the trial’s outcome will not be a short-term catalyst and does not materially change the key financial risk of persistent net losses and high research expenses.

Among the recent company updates, the Health Canada No Objection Letter for ABCL575, received in May, paved the way for this current Phase 1 trial in atopic dermatitis. This regulatory milestone is ideally timed to reinforce the investment case around AbCellera's pipeline, but with the company still running significant quarterly losses, the eventual clinical success of programs like ABCL575 and ABCL635 remains central to investor sentiment.

By contrast, there are still meaningful risks investors should be aware of, such as the ongoing trend of widening net losses and the need for revenue growth to offset rising R&D expenses...

Read the full narrative on AbCellera Biologics (it's free!)

AbCellera Biologics' outlook forecasts $123.3 million in revenue and $17.5 million in earnings by 2028. This scenario assumes a 55.4% annual revenue growth rate and a turnaround in earnings of $183.2 million, up from current earnings of -$165.7 million.

Uncover how AbCellera Biologics' forecasts yield a $9.33 fair value, a 121% upside to its current price.

Exploring Other Perspectives

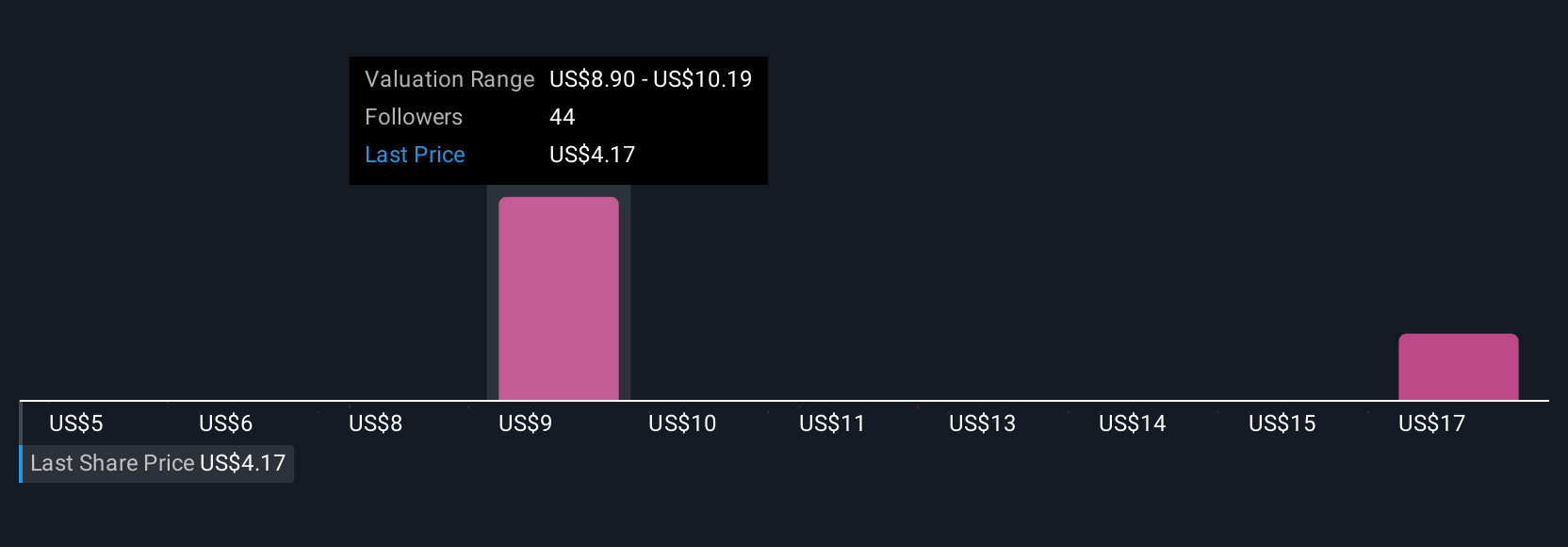

Eight fair value estimates from the Simply Wall St Community for AbCellera Biologics range from US$5 to US$17.99 per share. With such a spread of views, keep in mind that persistent net losses remain a big concern for future performance, and you can always weigh different perspectives before making your next move.

Explore 8 other fair value estimates on AbCellera Biologics - why the stock might be worth just $5.00!

Build Your Own AbCellera Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AbCellera Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbCellera Biologics' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives