- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

Assessing AbCellera Biologics (NasdaqGS:ABCL) Valuation After New Facility Launch and Pipeline Progress

Reviewed by Simply Wall St

AbCellera Biologics (NasdaqGS:ABCL) recently reported year-over-year revenue growth along with important operational milestones, including activating a clinical manufacturing facility and moving lead drug candidates ABCL635 and ABCL575 into Phase 1 trials. These developments come even as the company reported a wider net loss, largely attributed to higher research and development spending.

See our latest analysis for AbCellera Biologics.

Following these recent clinical and operational milestones, AbCellera Biologics has seen meaningful volatility in its share price. While the 1-day share price return sits at 1.4% and the year-to-date gain is a solid 19.5%, investors have weathered a sharp 36% pullback over the past month. Longer term, the picture remains mixed, with a 27.9% total shareholder return over the past year and a still-substantial 72.9% drop in total returns across three years. The latest moves suggest market sentiment is recalibrating based on fresh data about pipeline progress and risk appetite around early-stage biotech plays.

If you’re tracking innovative biotechs with clinical catalysts, it’s worth discovering the latest companies featured in our See the full list for free.

With shares rebounding after long-term losses and the pipeline showing momentum, is the recent volatility a signal that AbCellera stock is undervalued, or has the market already priced in any future growth?

Most Popular Narrative: 64.5% Undervalued

With AbCellera Biologics’ fair value set at $10.20 according to the most popular narrative, the last close price of $3.62 is dramatically lower. This represents one of the largest valuation gaps seen in the sector right now. The narrative behind this number focuses on optimism around platform transition and upcoming clinical milestones.

The completion of AbCellera's integrated clinical manufacturing capabilities by the end of 2025 is likely to enhance operational efficiency and reduce COGS, potentially improving net margins as the company begins utilization of these capabilities. Financial backing with over $630 million in liquidity and additional funding commitments provides AbCellera with the necessary resources to support long-term pipeline development, enhancing potential future earnings through successful commercialization of their clinical candidates.

Want to know what's fueling this sky-high narrative price target? The key factors include projected margin improvements, rapidly accelerating revenue, and a significant valuation increase if profit trends continue. Discover what analysts expect for earnings and the specific financial drivers the narrative relies on.

Result: Fair Value of $10.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in clinical trials or continued widening losses could quickly dampen sentiment and potentially reverse the optimism driving recent upward valuations.

Find out about the key risks to this AbCellera Biologics narrative.

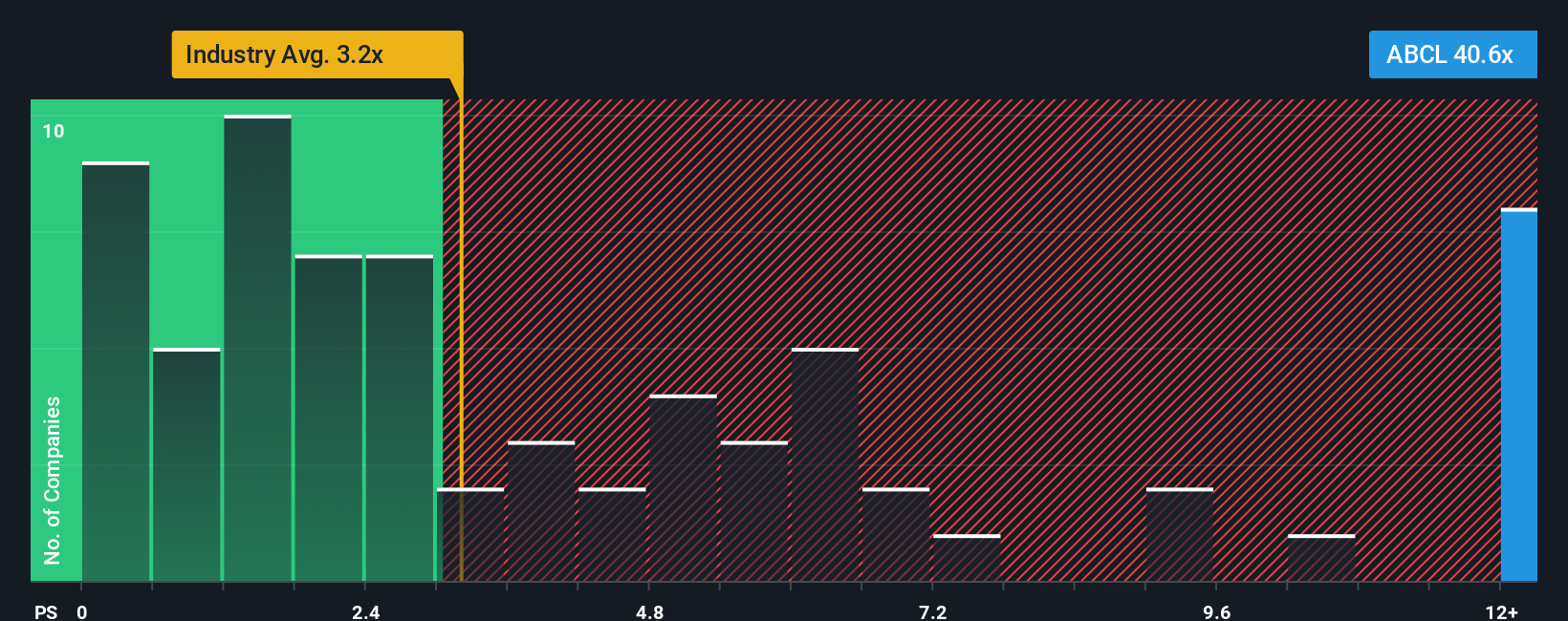

Another View: Market Multiples Raise Red Flags

Looking at valuation through a price-to-sales lens delivers a very different story. AbCellera trades at a hefty 30.7 times sales, which is far above both industry peers (3.8x) and the wider sector average (4.7x). The fair ratio, informed by market trends, sits much lower. This highlights the risk that the company’s valuation could face a sharp reset if investor optimism fades or revenue does not accelerate as expected. Does this gap reveal hidden potential or signal caution for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbCellera Biologics Narrative

For those who want to interpret the figures differently and follow their own line of reasoning, you can craft a personalized assessment in just a few minutes. Do it your way

A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Maximize your next move by uncovering stocks that fit your strategy. Don’t miss your chance to spot early momentum, unique innovation, or lasting value with these hand-picked opportunities:

- Tap into strong earning potential by evaluating these 927 undervalued stocks based on cash flows, which shows compelling financials and attractive pricing right now.

- Explore the future of medicine and technology with these 30 healthcare AI stocks, which is reshaping patient care and powering new breakthroughs in health data.

- Catch the latest trends in digital finance and decentralized systems by checking out these 81 cryptocurrency and blockchain stocks, moving fast in the blockchain universe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success