- United States

- /

- Biotech

- /

- NasdaqCM:WHWK

Analysts Have Lowered Expectations For Aadi Bioscience, Inc. (NASDAQ:AADI) After Its Latest Results

Aadi Bioscience, Inc. (NASDAQ:AADI) shareholders are probably feeling a little disappointed, since its shares fell 2.2% to US$4.50 in the week after its latest quarterly results. The results weren't stellar - revenue fell 8.4% short of analyst estimates at US$6.0m, although statutory losses were a relative bright spot. The per-share loss was US$0.60, 15% smaller than the analysts were expecting prior to the result. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Aadi Bioscience

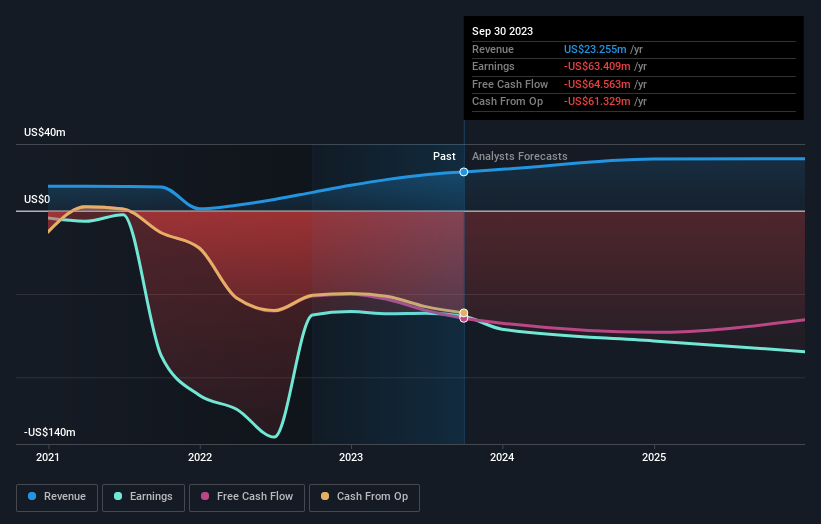

Following the latest results, Aadi Bioscience's five analysts are now forecasting revenues of US$31.0m in 2024. This would be a major 33% improvement in revenue compared to the last 12 months. Losses are expected to increase substantially, hitting US$2.85 per share. Before this latest report, the consensus had been expecting revenues of US$33.4m and US$2.93 per share in losses. It looks like there's been a modest increase in sentiment in the recent updates, with the analysts becoming a bit more optimistic in their predictions for losses per share, even though the revenue numbers fell somewhat.

The consensus price target fell 11% to US$35.25, with the dip in revenue estimates clearly souring sentiment, despite the forecast reduction in losses. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Aadi Bioscience analyst has a price target of US$45.00 per share, while the most pessimistic values it at US$30.00. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 26% growth on an annualised basis. That is in line with its 24% annual growth over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 15% per year. So it's pretty clear that Aadi Bioscience is forecast to grow substantially faster than its industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Even so, long term profitability is more important for the value creation process. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Aadi Bioscience. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Aadi Bioscience going out to 2025, and you can see them free on our platform here..

You still need to take note of risks, for example - Aadi Bioscience has 2 warning signs we think you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Whitehawk Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:WHWK

Whitehawk Therapeutics

An oncology therapeutics company that develops technologies to establish tumor biology for cancer treatments.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives