- United States

- /

- Interactive Media and Services

- /

- NYSE:YELP

Yelp (NYSE:YELP) shareholders have endured a 21% loss from investing in the stock a year ago

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Yelp Inc. (NYSE:YELP) share price is down 21% in the last year. That's disappointing when you consider the market returned 27%. However, the longer term returns haven't been so bad, with the stock down 7.9% in the last three years.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for Yelp

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Yelp share price fell, it actually saw its earnings per share (EPS) improve by 228%. It could be that the share price was previously over-hyped.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

Yelp's revenue is actually up 8.7% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

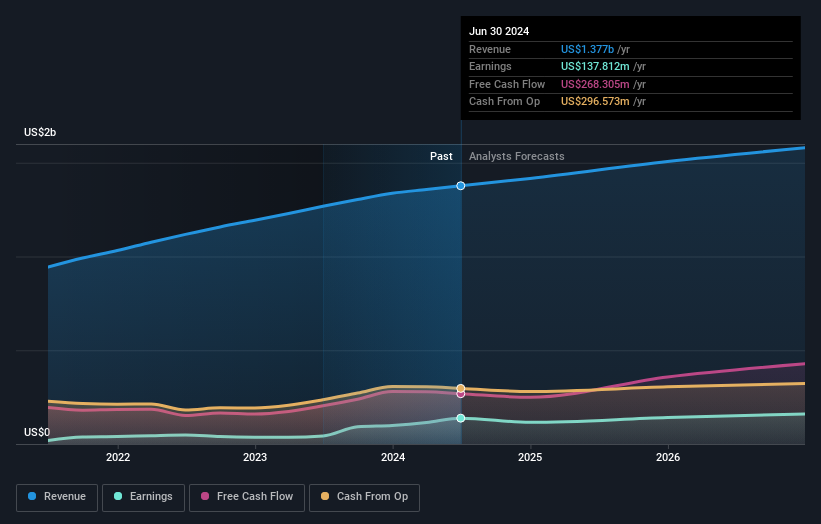

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Yelp is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Yelp in this interactive graph of future profit estimates.

A Different Perspective

Yelp shareholders are down 21% for the year, but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Yelp in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Yelp may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:YELP

Yelp

Operates a platform that connects consumers with local businesses in the United States and internationally.

Flawless balance sheet and undervalued.