- United States

- /

- Entertainment

- /

- NYSE:TME

Tencent Music Entertainment Group's (NYSE:TME) Shares Climb 38% But Its Business Is Yet to Catch Up

Tencent Music Entertainment Group (NYSE:TME) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

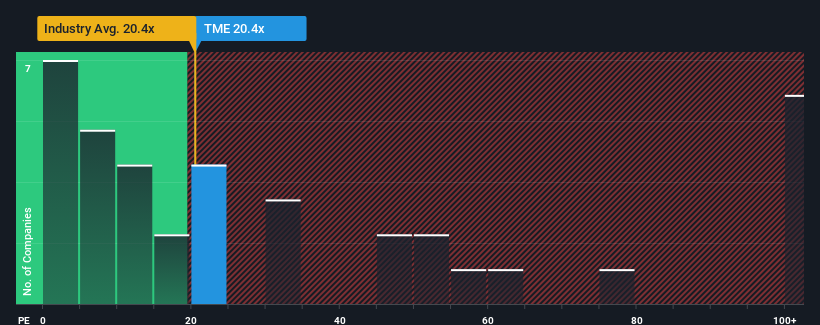

Following the firm bounce in price, Tencent Music Entertainment Group may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.4x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

We check all companies for important risks. See what we found for Tencent Music Entertainment Group in our free report.Recent times have been advantageous for Tencent Music Entertainment Group as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Tencent Music Entertainment Group

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Tencent Music Entertainment Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 85% gain to the company's bottom line. Pleasingly, EPS has also lifted 266% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.4% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 10% per annum, which is noticeably more attractive.

In light of this, it's alarming that Tencent Music Entertainment Group's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Tencent Music Entertainment Group's shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Tencent Music Entertainment Group currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Tencent Music Entertainment Group with six simple checks on some of these key factors.

You might be able to find a better investment than Tencent Music Entertainment Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success