- United States

- /

- Entertainment

- /

- NYSE:TKO

Will Paramount’s Expanded UFC Streaming Deal Reshape TKO Group Holdings' (TKO) Global Growth Narrative?

Reviewed by Sasha Jovanovic

- Paramount, a Skydance Corporation, and UFC recently announced a seven-year, multi-territory expansion of their partnership, securing exclusive UFC media rights for Paramount+ across Latin America and Australia starting in 2026, in addition to their earlier U.S. agreement.

- This move brings every UFC event to Paramount+ subscribers in these regions, strengthening UFC's global presence and broadening TKO Group Holdings' international exposure through increased access and content distribution.

- We'll examine how this expanded global partnership with Paramount+ could influence TKO's investment narrative, especially in terms of new licensing revenue streams.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is TKO Group Holdings' Investment Narrative?

Investors looking at TKO Group Holdings are effectively betting on the company's ability to build on its premium live sports and entertainment assets, while rapidly expanding its international appeal. The expanded Paramount partnership, announced in late October, stands out as a potential shift in the company’s near-term narrative, it opens a pathway to fresh, recurring licensing revenues across fast-growing streaming regions just as TKO pivots its core UFC product toward a global direct-to-consumer model. In the short run, this broader distribution focus could be a meaningful catalyst, potentially offsetting concerns about the move away from legacy Pay-Per-View and possibly recalibrating forecasts for earnings volatility. However, investors still have to keep an eye on the persistent risks: a relatively inexperienced board, hefty one-off items in recent earnings, lofty valuation multiples and ongoing legal proceedings. Whether these new content deals outweigh such challenges remains to be seen, but the landscape is shifting quickly. Yet, how the transition from Pay-Per-View might alter UFC’s profitability is something investors should not overlook.

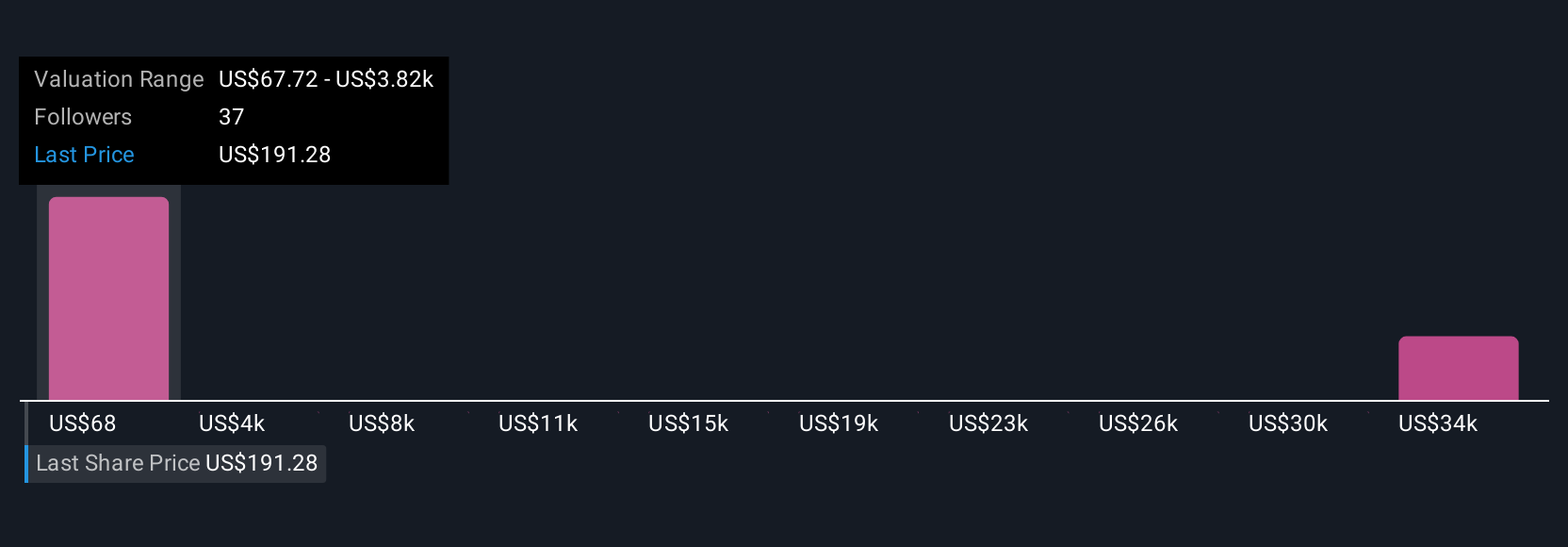

TKO Group Holdings' shares are on the way up, but they could be overextended by 20%. Uncover the fair value now.Exploring Other Perspectives

Explore 10 other fair value estimates on TKO Group Holdings - why the stock might be a potential multi-bagger!

Build Your Own TKO Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TKO Group Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TKO Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TKO Group Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives