- United States

- /

- Entertainment

- /

- NYSE:TKO

Should TKO Group Holdings’ (TKO) UFC Partnership With Polymarket Impact Investors’ View on Fan Engagement Strategy?

Reviewed by Sasha Jovanovic

- In November 2025, Polymarket announced a comprehensive multi-year partnership with TKO Group Holdings’ UFC and Zuffa Boxing, becoming their Official and Exclusive Prediction Market Partner and integrating real-time fan prediction technology into live events and broadcasts.

- This collaboration marks the first time a major sports organization directly incorporates fan sentiment metrics as a central part of the viewing experience, potentially deepening audience involvement and reshaping how fights are presented to viewers.

- We'll explore how embedding fan prediction technology through features like the Fan Prediction Scoreboard may influence TKO Group Holdings' investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is TKO Group Holdings' Investment Narrative?

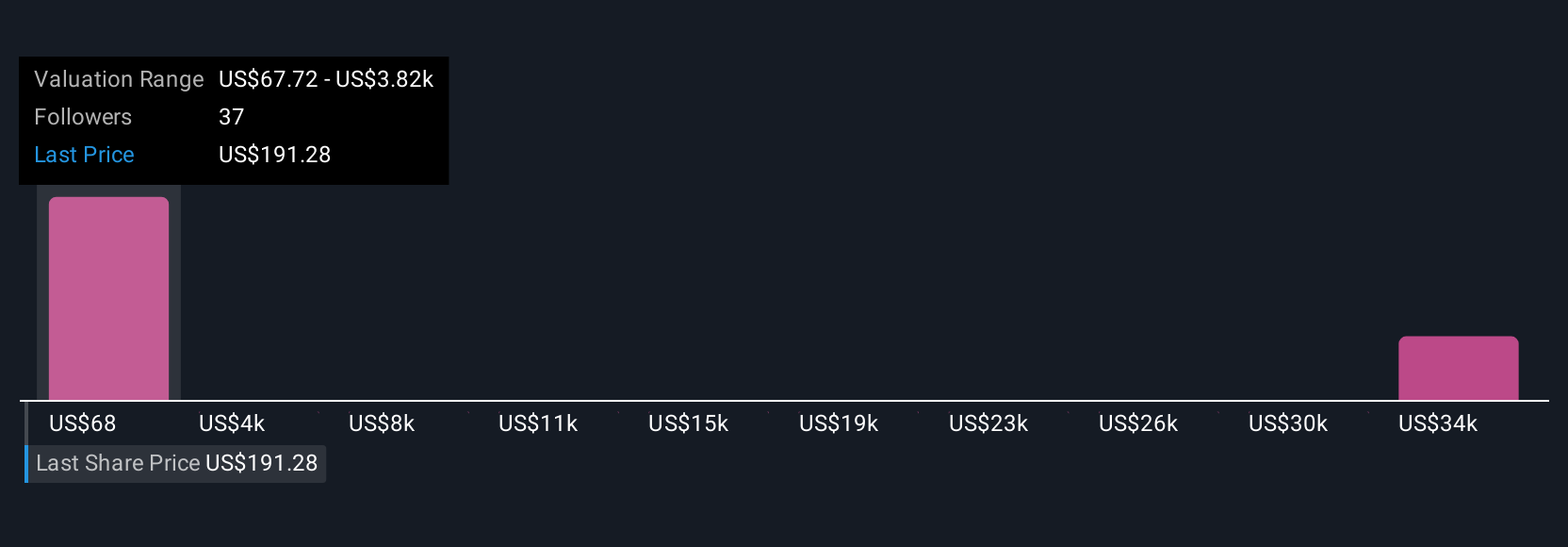

For TKO Group Holdings, the core belief underpinning the shareholder story centers on continued earnings growth, expanding global media rights, and successful delivery of engaging fan experiences. The new Polymarket partnership directly addresses that last catalyst, aiming to deepen real-time engagement across UFC and Zuffa Boxing without competing with regulated betting. By integrating prediction market tech and the Fan Prediction Scoreboard into broadcasts, TKO is leaning into data-driven interaction and new sponsorship avenues, which could complement its strong track record with content rights deals like the expanded Paramount agreements. While recent performance shows robust year-to-date returns and improved profitability, valuation concerns remain, with a high price-to-earnings ratio and a relatively new board that may pose execution risks. The Polymarket deal could enhance short-term engagement but may not materially change major risk factors without clear monetization impact.

However, questions around board experience could affect execution of these new initiatives.

Exploring Other Perspectives

Explore 10 other fair value estimates on TKO Group Holdings - why the stock might be a potential multi-bagger!

Build Your Own TKO Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TKO Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TKO Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TKO Group Holdings' overall financial health at a glance.

No Opportunity In TKO Group Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success