- United States

- /

- Media

- /

- NYSE:TGNA

TEGNA's (TGNA) Falling Earnings and Dividend Raise Questions About Its Capital Allocation Strategy

Reviewed by Sasha Jovanovic

- TEGNA Inc. recently announced that its Board of Directors declared a regular quarterly dividend of US$0.125 per share, payable on January 2, 2026, and reported third-quarter earnings showing a significant year-over-year decline in both sales and net income.

- An important detail for shareholders is that TEGNA did not repurchase any shares in the most recent quarter, having already completed buybacks totaling over 18.58 million shares for US$274.87 million under its current program.

- We’ll examine how the pronounced drop in quarterly revenue and earnings reported by TEGNA impacts its investment outlook and future prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

TEGNA Investment Narrative Recap

To be a TEGNA shareholder right now, you need to believe the company can adapt to declining broadcast ad revenues by accelerating digital growth and capitalizing on demand for local news, despite earnings and sales softness. The recent quarterly results, with a sharp drop in both revenue and net income, directly impact perceptions of near-term earnings power, reinforcing the risk that the company’s digital transformation may not offset structural declines quickly enough. However, the biggest short-term catalyst remains the pending Nexstar merger, which currently overshadows the latest quarterly numbers; the disappointing Q3 outcome does not materially change this focus.

Of the latest corporate announcements, TEGNA’s consistent quarterly dividend declaration stands out as a key point of stability. It signals management’s intent to maintain shareholder returns during uncertain periods, which may help balance investor sentiment as the company prioritizes its merger transaction. But contrasting that stability with the bigger challenge ahead, investors should be mindful of...

Read the full narrative on TEGNA (it's free!)

TEGNA's narrative projects $3.0 billion revenue and $400.8 million earnings by 2028. This requires a 0.1% annual revenue decline and a $51.9 million decrease in earnings from $452.7 million currently.

Uncover how TEGNA's forecasts yield a $21.33 fair value, a 7% upside to its current price.

Exploring Other Perspectives

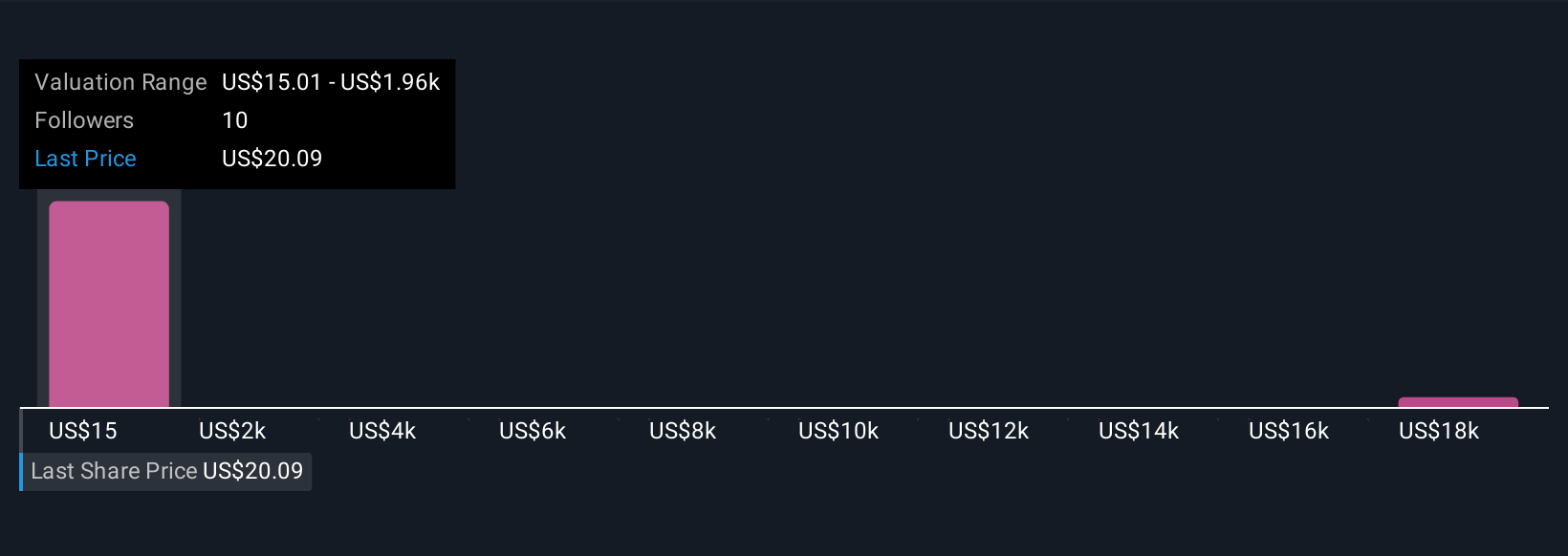

Five fair value estimates from the Simply Wall St Community for TEGNA range from as little as US$15.01 up to a striking US$19,461.32 per share. Many contributors see the challenge in offsetting traditional broadcast declines with digital revenue growth as a major factor, inviting you to compare your own outlook with these varied views.

Explore 5 other fair value estimates on TEGNA - why the stock might be a potential multi-bagger!

Build Your Own TEGNA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TEGNA research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TEGNA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TEGNA's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TEGNA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGNA

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives