- United States

- /

- Entertainment

- /

- NYSE:SPOT

Spotify (NYSE:SPOT): Evaluating Valuation After Strong Q3 Results and Upbeat Guidance

Reviewed by Simply Wall St

Spotify Technology (NYSE:SPOT) just announced its third quarter earnings, delivering higher revenue and profitability compared to last year. The company also shared new guidance for the next quarter, which gives investors plenty to consider.

See our latest analysis for Spotify Technology.

Spotify’s impressive third quarter results have powered a strong rally, with the latest buyback and ambitious revenue guidance adding fuel to upbeat investor sentiment. While there has been some short-term volatility, the stock’s share price is up nearly 40% year-to-date, and its three-year total shareholder return of 675% stands out as exceptional, signaling momentum that few rivals can match.

If Spotify’s surge of activity has piqued your interest, this is a perfect time to discover fast growing stocks with high insider ownership.

With shares up sharply and analyst forecasts still pointing to further gains, the central question is clear: is Spotify undervalued at current levels, or are expectations for future growth already fully reflected in the price?

Most Popular Narrative: 9% Undervalued

Spotify’s most tracked narrative, authored by MichaelP, currently sees the stock as trading below fair value, with a calculated fair value of $703 per share against a recent close of $639.58. This sets up a bullish outlook grounded in the company’s future cash flow potential. But is this optimism justified? According to MichaelP, there is a clear catalyst that could change everything.

“I expect this to improve dramatically thanks to favourable cost structure changes, better operating expense control, less aggressive capex, and operating leverage achieved from scale. By mid 2029, I expect free cash flow margins to reach 9%, meaning €2.85bn Euros in mid 2029 FCF. While this is cash flow margins, to work within the valuator, I expect net profit margins to reach 6.7% by mid 2029, they're currently at 3.2%. This would make net income $2.1bn.”

Curious why this narrative sets such an ambitious fair value? The key lies in accelerating operating leverage, aggressive margin expansion, and a surprising profit outlook that bucks the sector’s norms. The real story emerges when you follow the cash to find out what growth assumptions back this bold forecast.

Result: Fair Value of $703 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressure from rivals or a slowdown in premium subscriber growth could disrupt Spotify’s trajectory and challenge these bullish assumptions.

Find out about the key risks to this Spotify Technology narrative.

Another View: What Do Multiples Say?

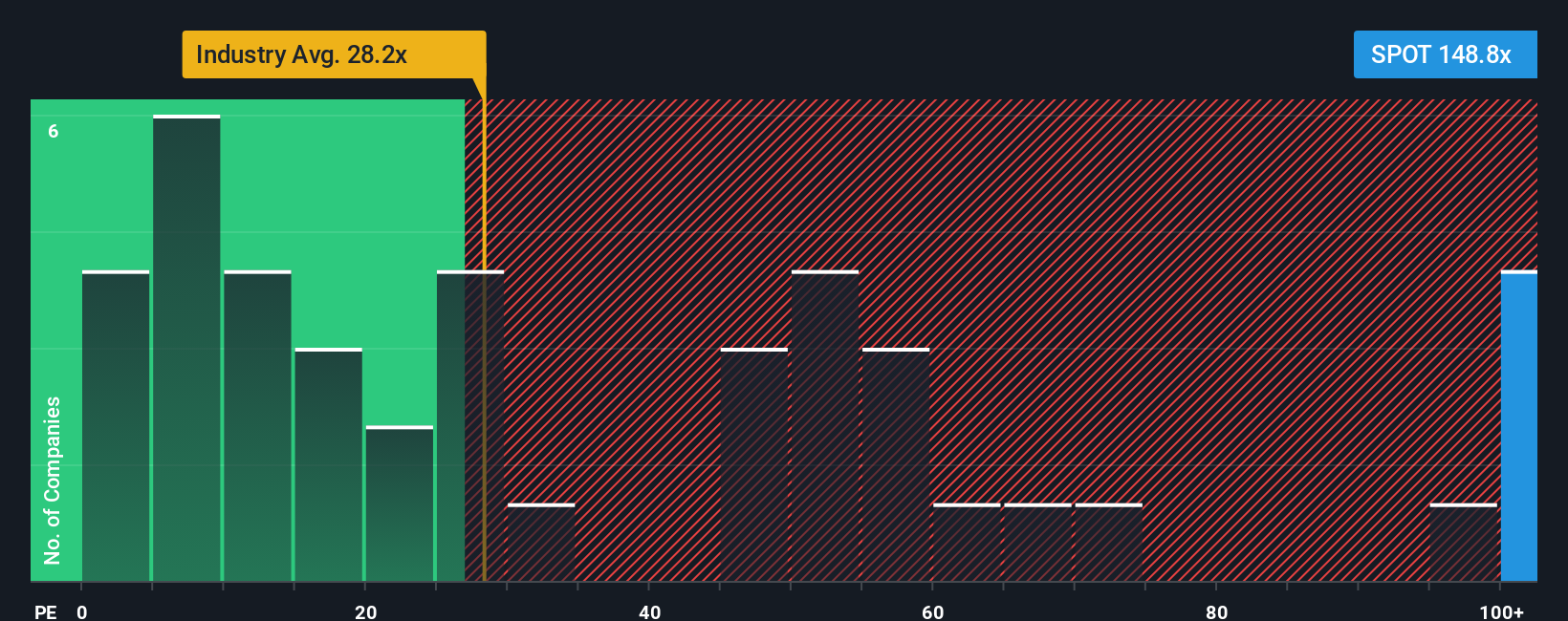

While the most popular valuation points to Spotify being undervalued, a look at its price-to-earnings ratio raises a caution flag. At 81x, the ratio is much higher than the US Entertainment industry average of 22.8x and also exceeds the peer average of 70.8x, as well as the fair ratio of 37.3x. This premium could imply elevated expectations and adds risk if growth falters. Does this exuberance signal real long-term strength or potential for a pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spotify Technology Narrative

If you see things differently or want to dig into the numbers on your own terms, crafting a personal narrative takes just a few minutes, so why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Spotify Technology.

Looking for more investment ideas?

Act now and uncover timely opportunities beyond Spotify by using the Simply Wall Street Screener. Don’t let another unique stock trend pass you by.

- Unlock growth potential and gain an edge in the market by browsing these 855 undervalued stocks based on cash flows. These are set for a re-rating based on robust cash flows and attractive valuations.

- Strengthen your portfolio with reliable income from these 15 dividend stocks with yields > 3%, offering yields above 3% and a track record of solid payouts.

- Get ahead of the next technological leap by scouting innovation leaders among these 25 AI penny stocks, who are at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives