- United States

- /

- Entertainment

- /

- NYSE:SPHR

Sphere Entertainment (SPHR) Unprofitability Worsens 26.3% Annually, Challenging Recovery Narratives

Reviewed by Simply Wall St

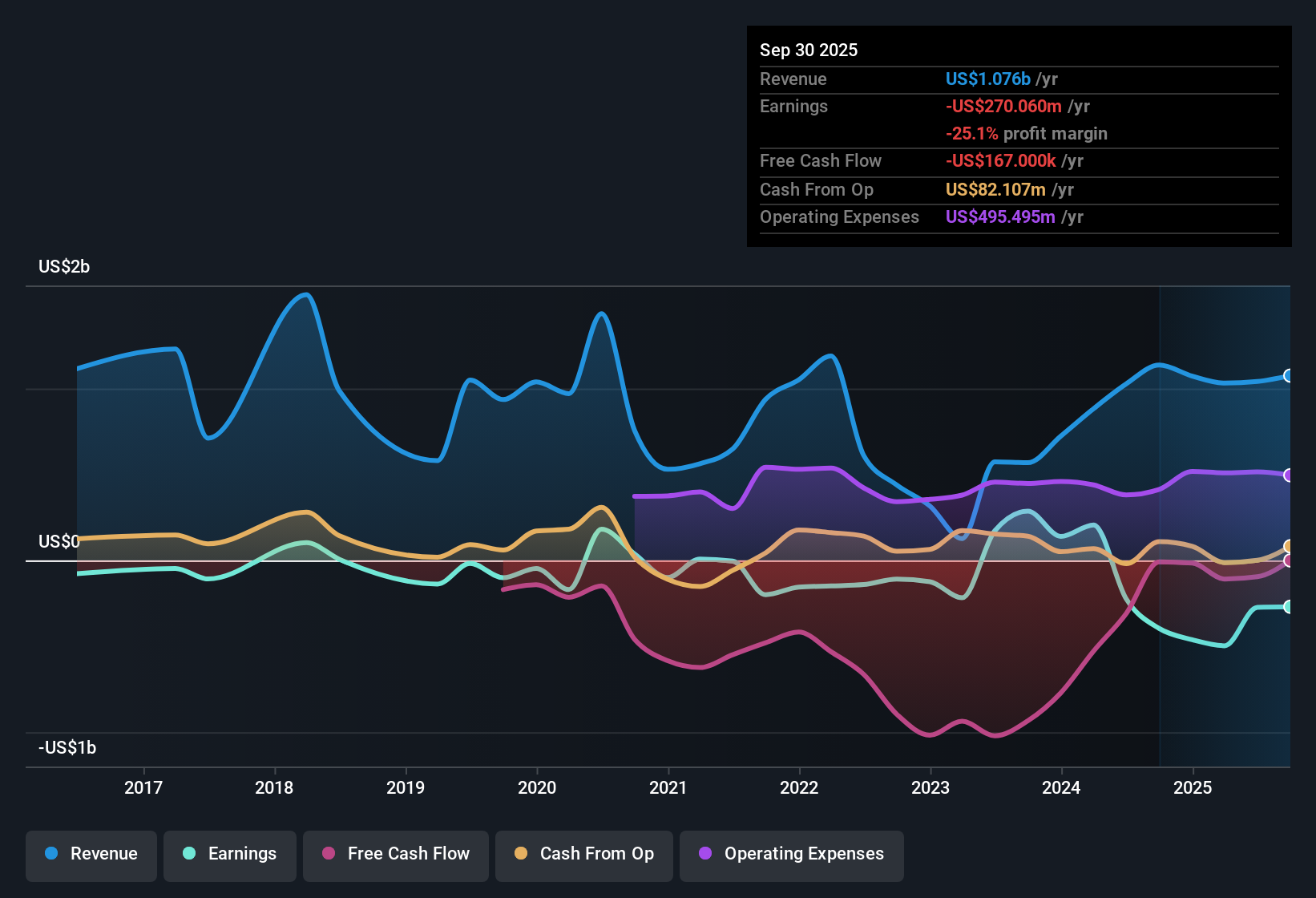

Sphere Entertainment (SPHR) remains in the red, with losses worsening by 26.3% per year over the past five years. Revenue is projected to rise at an annual rate of 6.3%, lagging the broader US market's expected 10.5% per year. The company’s net profit margin shows no signs of improvement. While Sphere Entertainment’s shares trade below estimated fair value and the Price-to-Sales ratio of 2.3x is attractive compared to peer averages, ongoing unprofitability and slower revenue growth will likely keep investors focused on the risks.

See our full analysis for Sphere Entertainment.Next up, we’ll see how these headline figures match with the leading narratives driving sentiment among investors and analysts.

See what the community is saying about Sphere Entertainment

Recurring Revenue Model Gathers Steam

- Sphere Entertainment is building a more predictable revenue foundation by expanding its slate of recurring events, including original Sphere Experiences, corporate gatherings, and concerts. Analysts highlight this as a material shift away from volatile one-off shows.

- Analysts' consensus view: Establishing a broad, recurring, and diversified event calendar is seen as key to supporting both future revenue growth and EBITDA stability.

- Consensus narrative notes proprietary immersive technology and an asset-light expansion strategy are expected to enable premium pricing and margin growth. This could position Sphere for higher-quality, recurring earnings streams as its branded content partnerships and event mix expand.

- However, critics note that success depends on consistently delivering hit events and experiences that differentiate Sphere from traditional venues, especially as consumer expectations rise with each new production.

- With multi-year branded content agreements and an increasing number of high-profile events, Sphere is moving toward greater revenue predictability than legacy live entertainment players.

What stands out: The consensus narrative sees recurring, high-margin events as crucial for Sphere’s ability to smooth earnings and demonstrate the value of its technology-centric venues, especially given the historical volatility in event-dependent revenue.

Consistent long-term revenue is one part of the story. See what others think about the big picture for Sphere in the full Consensus Narrative. 📊 Read the full Sphere Entertainment Consensus Narrative.Profit Margins Must Climb from Negative 26.3%

- Net profit margin remains deeply negative at -26.3%, and Sphere is not expected to achieve profitability within the next three years, even as the industry averages a positive margin of 9.4%.

- Analysts' consensus view: Bears highlight that despite premium pricing and high-tech offerings, persistent operating losses and steep capital expenditures are a real risk to realizing long-term earnings growth.

- Ongoing maintenance, upgrades, and international expansion could drive operating costs higher, making it harder to achieve margin gains or positive earnings even as revenue grows.

- A reliance on blockbuster content is another challenge. If new shows or partnerships fail to match demand for existing hits, margin pressure could intensify, validating cautious outlooks on profitability prospects.

Share Price Below Both Peer Average and DCF Fair Value

- At $69.46, Sphere’s current share price trades below the DCF fair value of $107.67 and also sits beneath analyst consensus price targets. Its Price-to-Sales ratio of 2.3x is lower than the peer group average (2.5x) but above the US Entertainment industry average (1.8x).

- Analysts' consensus view: Bulls cite attractive valuation signals relative to peer averages as a reward, while critics caution that Sphere still commands a premium over industry valuation benchmarks given its unproven path to profitability and slower forecasted revenue growth.

- This valuation tension is amplified by ongoing losses. The current PE is negative (-6.4x), and consensus estimates only become plausible if margins dramatically improve to industry averages within a few years, a scenario that remains far from certain for now.

- Investors who believe Sphere can unlock its technology and branded content model may see longer-term re-rating potential, but the near-term justification for any valuation premium is still under scrutiny given persistent losses.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sphere Entertainment on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interested in another angle? You can shape your own view on Sphere Entertainment and tell the story your way in just a few minutes. Do it your way.

A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Sphere Entertainment continues to struggle with persistent operating losses and volatile, event-driven revenues. This makes profitability and earnings stability an ongoing challenge.

If you want steadier prospects, use stable growth stocks screener (2077 results) to spot companies delivering consistent growth and reliable performance, regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives