- United States

- /

- Entertainment

- /

- NYSE:RBLX

Roblox (RBLX): Evaluating Valuation After Q3 Revenue Surge and Sharp Post-Earnings Share Price Drop

Reviewed by Simply Wall St

Roblox (RBLX) shares took a sharp turn after the company’s third-quarter earnings report. The stock climbed on record bookings and revenue, then dropped over 20% as management flagged ongoing losses and coming margin pressure.

See our latest analysis for Roblox.

Roblox shares have seen wild swings lately, with a 1-day share price bounce of 5.5% quickly overshadowed by a punishing 15% drop over the last month. While blockbuster growth and viral engagement have fueled long-term optimism, evident in a remarkable 1-year total shareholder return of nearly 104% and over 190% in three years, the recent correction shows momentum is taking a breather as investors weigh hefty spending and elevated valuations against Roblox’s ambitious growth story.

If you’re curious about what’s moving in the broader tech and gaming scene, it’s a great moment to discover See the full list for free.

With the stock falling sharply despite surging growth, the question now is whether this pullback leaves Roblox trading at a rare discount, or if investors are still fully pricing in every bit of future upside.

Most Popular Narrative: 27.4% Undervalued

According to the most widely followed narrative, Roblox’s fair value estimate stands at $147.26, which is over $40 higher than its last close of $106.84. With the gap this wide, the narrative suggests much stronger underlying prospects than what the current market price reflects.

Enhanced monetization tools and a growing older user base are unlocking new, higher-margin revenue sources and strengthening long-term topline growth prospects. Escalating costs, dependence on viral content, and competitive pressures risk long-term profitability if user growth and monetization fail to match heavy investments and expansion ambitions.

Curious what makes analysts so bullish here? The true driver of this rich narrative is a bold set of financial assumptions about platform growth, margin inflection, and a profit multiple that is more aggressive than most stocks ever achieve. Want to peek at the hidden levers setting this target so high? The details may surprise you.

Result: Fair Value of $147.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including surging developer payouts and intensifying competition. Either of these factors could compress margins and dampen future growth expectations.

Find out about the key risks to this Roblox narrative.

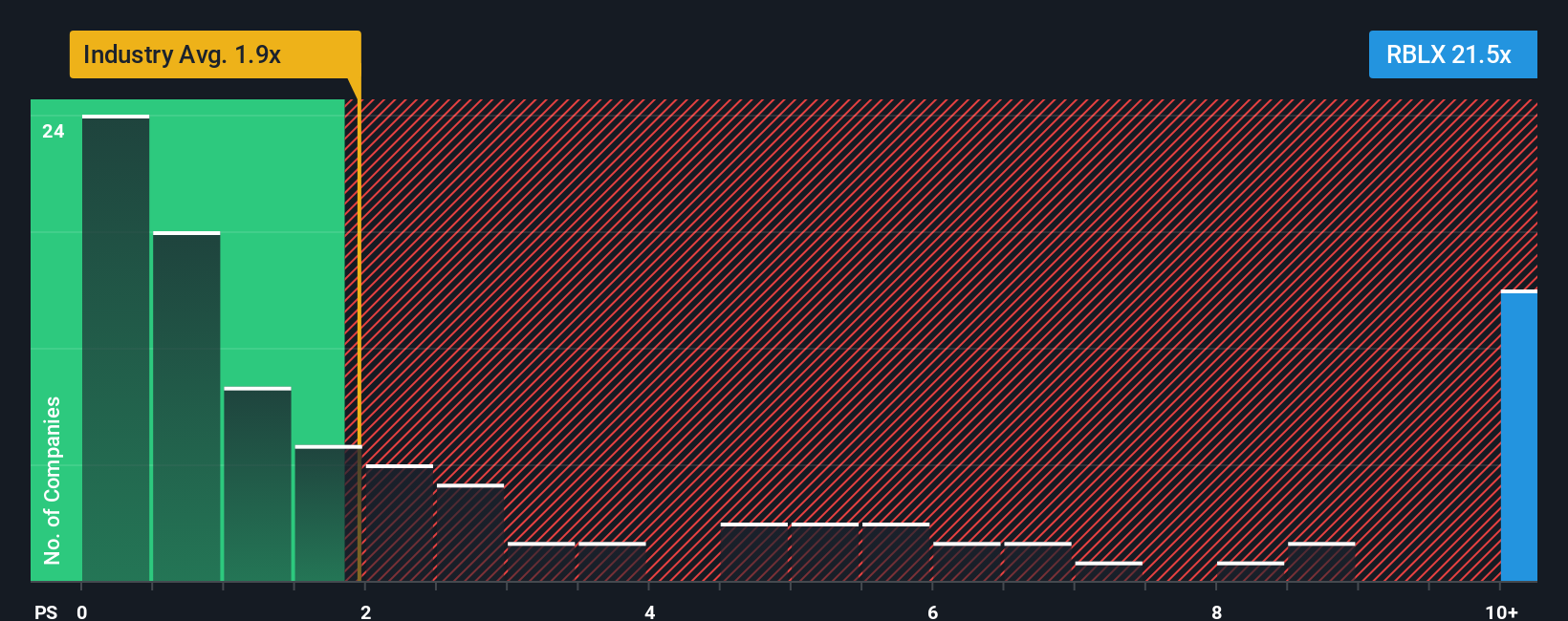

Another View: Sky-High Sales Ratio Raises Questions

Looking at the price-to-sales ratio, Roblox trades at 16.8 times revenue, which is far more expensive than both the US Entertainment industry average of 2 times and the peer average of 5.4 times. Even compared to its estimated fair ratio of 5.7, that is a big gap. This signals significant valuation risk if growth does not deliver; could the market be overestimating Roblox's future prospects?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roblox Narrative

If you see the numbers differently or want to experiment with your own forecasts, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Roblox research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip away when you could be gaining an edge with timely stock picks backed by real fundamentals and emerging trends.

- Capture income potential and boost portfolio stability with these 16 dividend stocks with yields > 3%, featuring companies delivering consistent yields above 3%.

- Spot innovation early by targeting these 32 healthcare AI stocks, where healthcare and artificial intelligence combine for breakthrough growth opportunities.

- Tap into explosive possibilities with these 82 cryptocurrency and blockchain stocks as digital assets and blockchain reshape the investing landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives