- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Does Emily Reuter Joining Pinterest’s Board Signal a New AI Commerce Strategy for PINS?

Reviewed by Sasha Jovanovic

- On September 18, Pinterest announced the appointment of Emily Reuter, Instacart’s Chief Financial Officer and former Uber executive, to its Board of Directors, underscoring the platform’s focus on AI-powered shopping experiences.

- This board addition, alongside a surge in analyst attention and sector-wide shifts linked to TikTok uncertainty, has increased investor focus on Pinterest’s efforts to expand its leadership in visual commerce and advertising technology.

- We’ll examine how Emily Reuter’s board appointment may shape Pinterest’s investment narrative as it prioritizes artificial intelligence-driven commerce growth.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Pinterest Investment Narrative Recap

To own Pinterest, investors need to believe that the company can deepen user engagement and increase monetization, especially through AI-driven commerce. The recent appointment of Emily Reuter to the Board does not materially change the most important short-term catalyst, continued growth in advertising revenue from AI-powered initiatives, nor does it fundamentally alter the biggest risk, which remains ad pricing pressure from international expansion and competition.

One recent announcement that stands out is Pinterest's collaboration with Instacart to enhance ad targeting using data from high-intent shoppers. This move speaks to how Pinterest is trying to build on its strengths in visual commerce and increase its revenue streams through deeper shopping integrations, supporting its broader efforts to boost profitability and user value amid rapid sector changes.

By contrast, investors should also be mindful that ongoing declines in ad pricing, especially in lower-monetizing markets, may still threaten…

Read the full narrative on Pinterest (it's free!)

Pinterest's narrative projects $5.9 billion revenue and $1.0 billion earnings by 2028. This requires 14.6% yearly revenue growth and a $0.9 billion decrease in earnings from $1.9 billion today.

Uncover how Pinterest's forecasts yield a $43.12 fair value, a 35% upside to its current price.

Exploring Other Perspectives

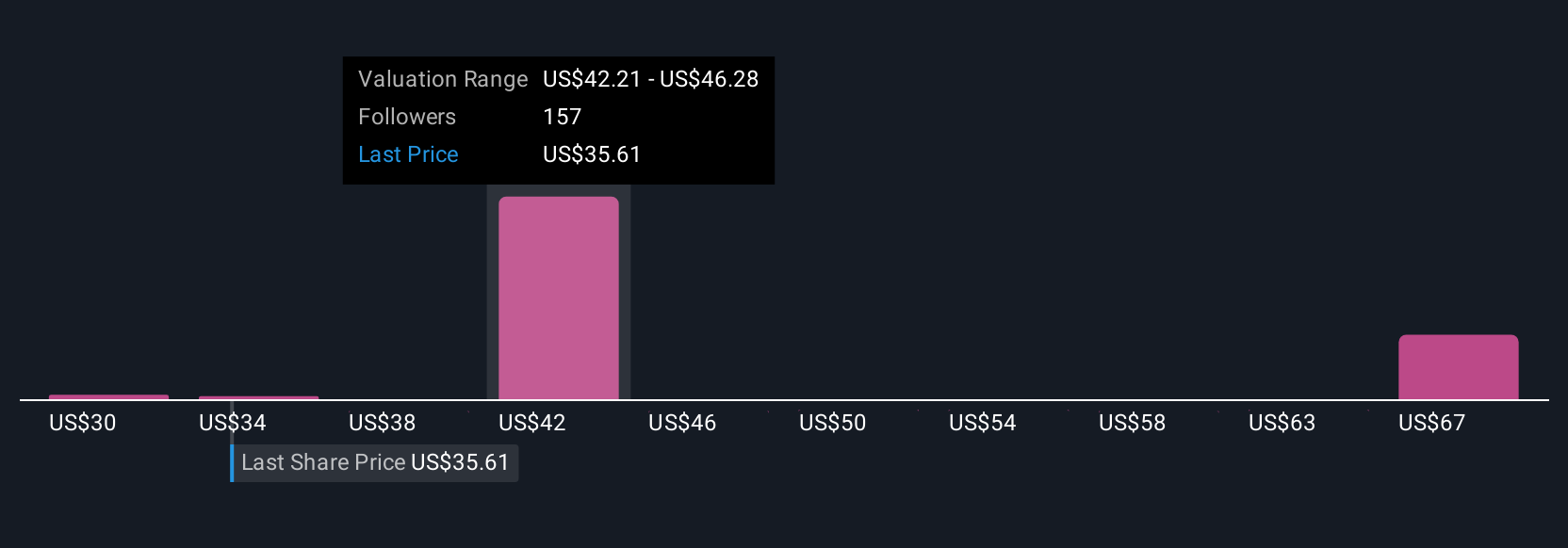

Nineteen members of the Simply Wall St Community estimate Pinterest’s fair value between US$30 and US$72.99 per share. While opinions differ widely, the company’s success may hinge on narrowing the gap between US and international monetization, a challenge that could affect long-term earnings and growth.

Explore 19 other fair value estimates on Pinterest - why the stock might be worth 6% less than the current price!

Build Your Own Pinterest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pinterest research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pinterest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pinterest's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives