- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Can Pinterest's (PINS) AI Shopping Push Reshape Its Global Growth Story?

Reviewed by Sasha Jovanovic

- In recent days, Pinterest reported growth in both monthly active users and revenue, alongside rapid advancements in its AI-powered product offerings and integration of shopping features.

- International markets are emerging as an important source of revenue upside for the company, with particularly strong performance seen in the "Rest of World" and Europe segments.

- We'll explore how Pinterest's evolving AI-driven shopping assistant capabilities could influence its investment outlook and growth profile.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Pinterest Investment Narrative Recap

To be a Pinterest shareholder, you need confidence that the company’s AI-powered product innovation and expanding international user base can translate into sustained revenue and margin growth, even as digital ad markets remain competitive. While recent news of continuing user and revenue growth, alongside industry-leading AI integration, points to positive momentum, the post-earnings dip underscores that near-term profitability guidance and ad pricing remain key short-term catalysts and risks; the impact of recent trading activity from funds like ARK Invest appears immaterial at this stage.

Pinterest’s latest advancements in AI-powered shopping assistants are especially relevant, features like enhanced visual search and conversational tools are designed to increase engagement and conversion rates, directly supporting the platform’s appeal to advertisers and its ability to drive ARPU improvements internationally.

However, in contrast, investors should be aware of ongoing risks tied to international monetization and the potential for ad pricing pressures in...

Read the full narrative on Pinterest (it's free!)

Pinterest's outlook anticipates $5.9 billion in revenue and $1.0 billion in earnings by 2028. This is based on a 14.6% annual revenue growth rate and a $0.9 billion decrease in earnings from the current $1.9 billion figure.

Uncover how Pinterest's forecasts yield a $40.91 fair value, a 60% upside to its current price.

Exploring Other Perspectives

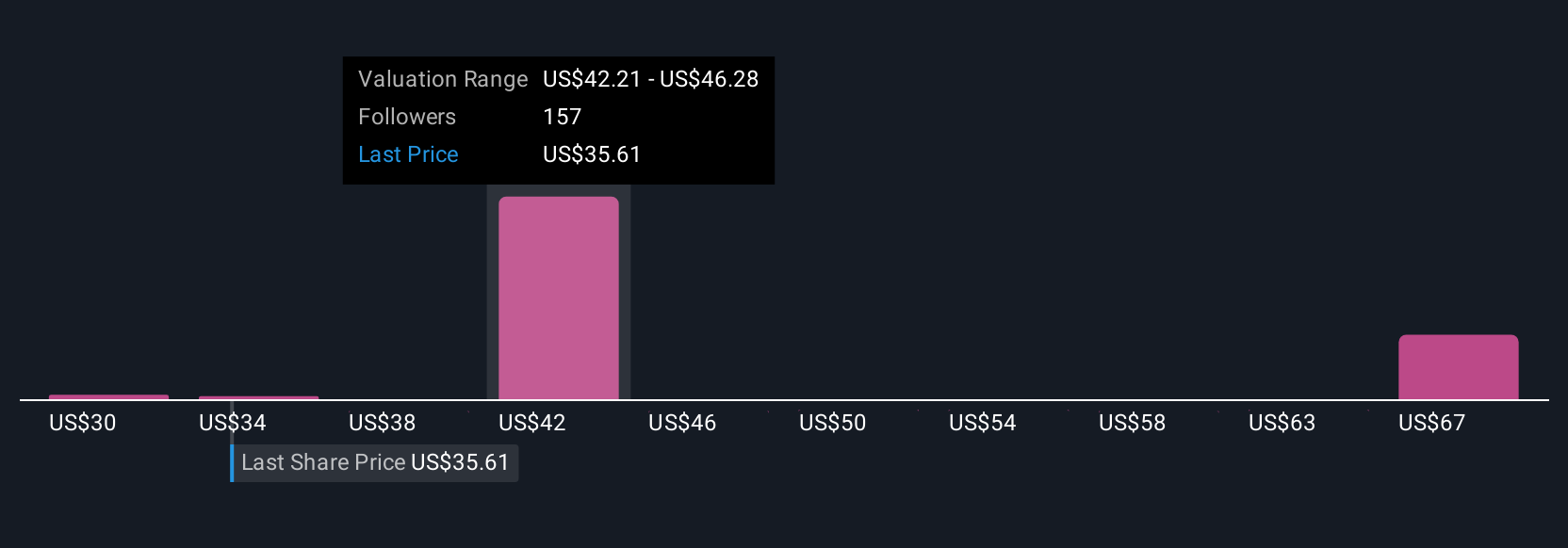

Sixteen members of the Simply Wall St Community estimate Pinterest’s fair value between US$32.65 and US$55.69, pointing to wide-ranging views on its current worth. While ambitious AI expansion excites some, persistent regional monetization gaps remind you that opinions on future performance vary widely, be sure to consider several viewpoints before deciding.

Explore 16 other fair value estimates on Pinterest - why the stock might be worth over 2x more than the current price!

Build Your Own Pinterest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pinterest research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pinterest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pinterest's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives