- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Assessing Pinterest’s True Value After Recent Partnership Announcements and Share Price Dip

Reviewed by Bailey Pemberton

- Wondering if Pinterest could be a smart buy right now? Let us break down the numbers to get to the heart of the stock's true value.

- While the stock has seen a 3.6% gain over the last month and is up 8.2% year-to-date, the past week brought a slight dip of -2.6%, reflecting a market that is still adjusting its outlook.

- Recently, Pinterest has been in the headlines for new partnerships and platform improvements, fueling both optimism and debate among investors. These announcements have sparked fresh conversations about the company's long-term growth prospects and may explain some of the recent volatility in the share price.

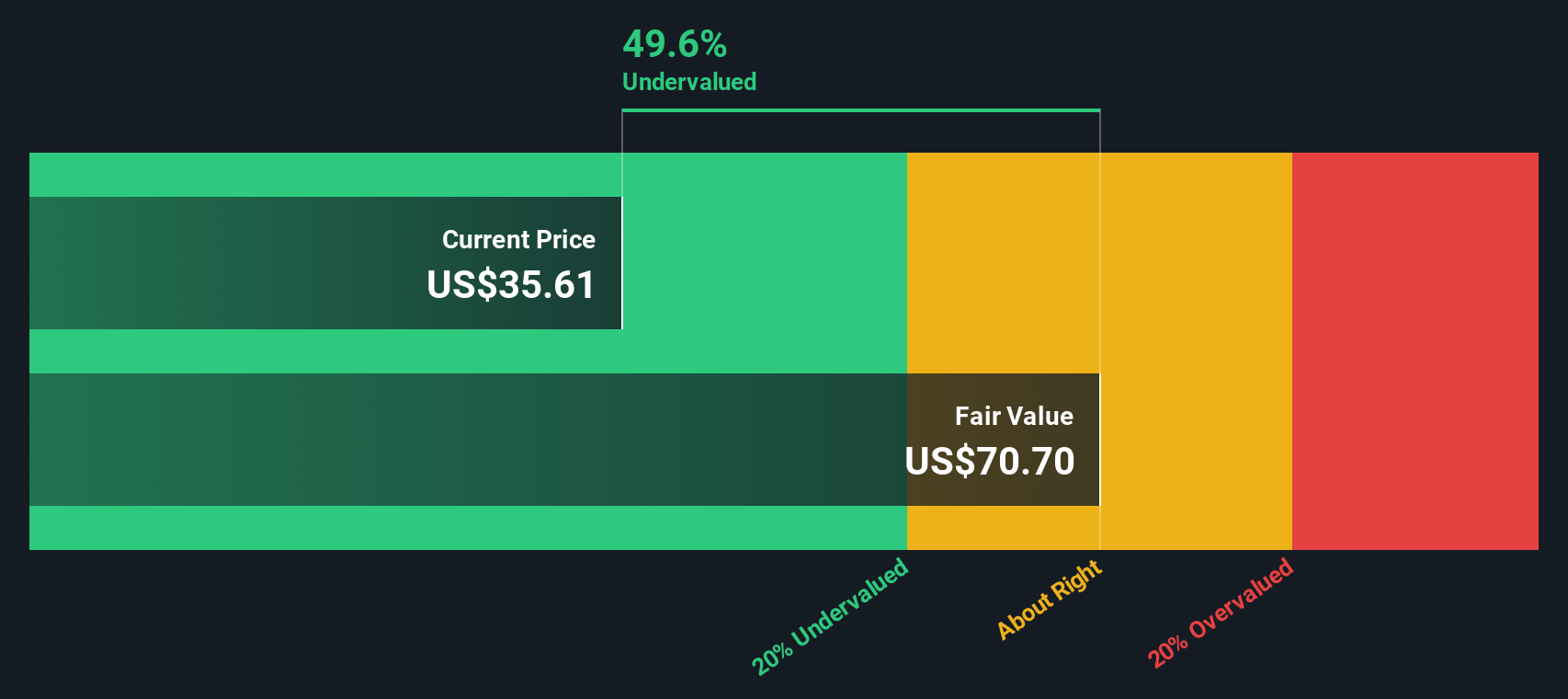

- On pure numbers, Pinterest scores a perfect 6 out of 6 on our undervaluation checks, which is a rare feat worth your attention. We will look at how this score is determined by various valuation approaches and discuss a smarter way to interpret what these numbers really mean as we wrap up.

Find out why Pinterest's 3.4% return over the last year is lagging behind its peers.

Approach 1: Pinterest Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today, providing a sense of what the business is truly worth right now. In Pinterest's case, this method centers on the company's Free Cash Flow, which is the cash left over after all its expenses and reinvestments.

Currently, Pinterest generates approximately $1.05 billion in Free Cash Flow. Analysts typically forecast up to five years of future results, with estimates indicating steady growth. By 2029, projections suggest that Pinterest’s Free Cash Flow could reach around $2.44 billion. Longer-range figures are extrapolated further by Simply Wall St’s model. These numbers are all given in US dollars.

Based on these cash flow forecasts and the 2 Stage Free Cash Flow to Equity model, Pinterest’s intrinsic fair value comes out to $73.26 per share. With the stock’s current market price well below this estimate, the DCF model suggests Pinterest is trading at a 54.8% discount to its calculated value. In plain terms, the shares look significantly undervalued according to this analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pinterest is undervalued by 54.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Pinterest Price vs Earnings

When a company is both established and profitable, the Price-to-Earnings (PE) ratio is a strong and intuitive valuation tool. It tells investors how much they are paying for each dollar of current earnings, making it particularly relevant for platforms like Pinterest that consistently generate profits.

The “right” PE ratio for any stock depends on factors such as expectations for future growth and the risks unique to the business and its sector. Fast-growing companies or those perceived as less risky typically warrant higher PE ratios, while slower-growing or riskier businesses might trade on lower multiples.

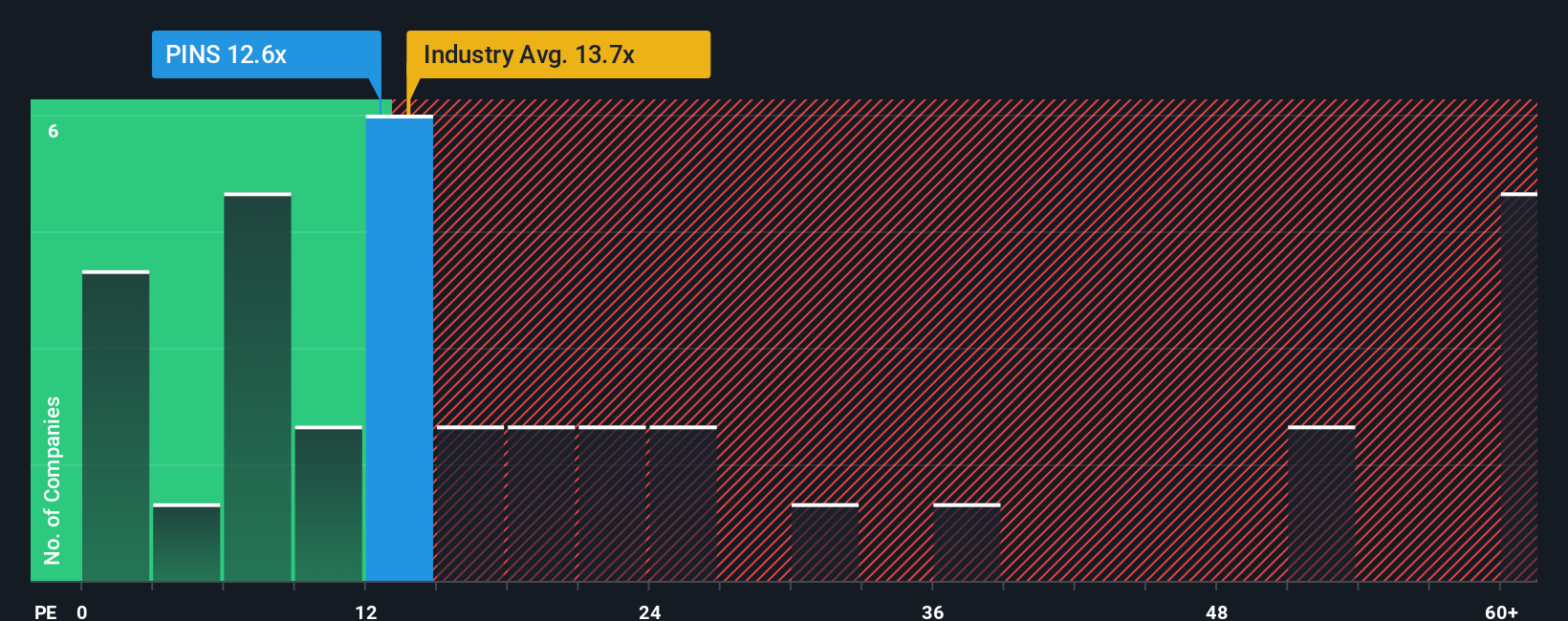

Pinterest currently trades at an 11.7x PE ratio. For context, the average PE ratio across its Interactive Media and Services industry is 16.5x, while key peers are priced much higher, averaging 48.6x. At first glance, this puts Pinterest well below these benchmarks, which could suggest a potential undervaluation.

This is where Simply Wall St's Fair Ratio comes into play. The Fair Ratio, calculated at 15.8x for Pinterest, takes a holistic view by weighing not just earnings growth, but also profit margins, market cap, industry dynamics, and company-specific risks. Unlike straightforward peer or sector comparisons, the Fair Ratio offers a more precise benchmark that is actually tailored to Pinterest's profile.

Comparing Pinterest’s actual PE ratio of 11.7x to its Fair Ratio of 15.8x suggests that the stock is undervalued on this metric, as it is trading at a noticeable discount to what would be expected based on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pinterest Narrative

Earlier, we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. These are dynamic investment stories that bring your view of Pinterest to life by connecting the company’s potential with the numbers you believe in, such as future revenue, profit margins, and what you think fair value really is.

A Narrative is simply your perspective on where Pinterest is headed. It shows the logic behind your assumptions and translates them into a clear valuation. It links the company’s story, a specific set of financial forecasts, and an updated fair value all in one place.

You can explore and create your own Narrative easily on Simply Wall St’s Community page, where millions of investors share, discuss, and update their outlooks in real time as new information (such as earnings or product news) becomes available.

These Narratives help you decide if Pinterest’s current price truly offers opportunity or risk by letting you compare your fair value to what the market is paying. This makes your decisions more transparent and grounded in both your convictions and the evolving facts.

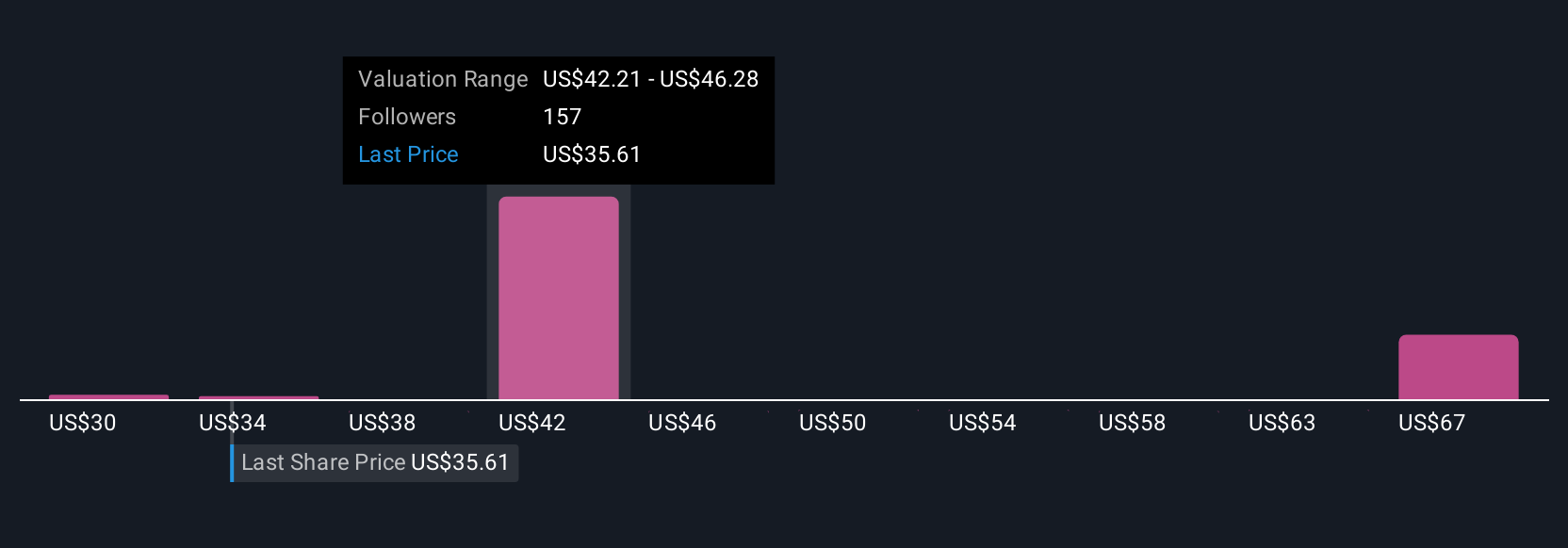

For example, some investors see Pinterest’s fair value as high as $109 based on advertising innovations and international growth, while others take a much more conservative view at $26, using assumptions about competition and monetization challenges. Your Narrative truly makes all the difference in how you invest.

Do you think there's more to the story for Pinterest? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives