- United States

- /

- Entertainment

- /

- NYSE:MSGS

Madison Square Garden Sports (MSGS): Evaluating Valuation After Historic Rangers GAME 7 Branding Deal and Profitability Turnaround

Reviewed by Kshitija Bhandaru

Something unusual just happened at Madison Square Garden Sports (MSGS) that should catch every investor’s eye. For the first time in the New York Rangers’ century-long history, their jerseys will prominently feature the GAME 7 brand patch, launching with a splash during the team’s centennial season. This milestone partnership is much more than a logo swap, as it promises crossover marketing, new merchandise drops, and fresh ways for fans and brands to connect at The Garden. Just as MSGS breaks into profitability after years in the red, this move signals a strategic play to boost both top-line growth and cultural clout.

This announcement is not emerging in a vacuum. Over the past year, MSGS shares have risen 7%, propelled by signs of improving returns on capital and management’s focus on extracting more value from existing assets. While recent initiatives and operational discipline are catching the market’s attention, the company has also increased efficiency and improved earnings, albeit while balancing higher current liabilities, a dynamic that investors haven’t overlooked. Momentum seems to be quietly building, as the stock has gained 14% in the past month alone.

With brand partnerships multiplying and financial performance turning the corner, the question remains: is this surge in MSGS’s share price just the beginning, or is the market already baking in all the future growth?

Most Popular Narrative: 14.5% Undervalued

According to the leading narrative, Madison Square Garden Sports is currently undervalued by 14.5% based on long-term catalysts and financial projections, when applying a discount rate of 9.77%.

Broader social media engagement and digital content initiatives, evidenced by strong growth in follower counts and exclusive in-arena and online merchandise offerings, establish an expanded, youthful fan base and unlock new digital monetization channels. This improves long-term revenue diversity and margin potential.

Curious what is unlocking this bullish valuation? The story driving this price tag hints at a growth runway built on aggressive earnings improvement, ambitious margin targets, and surging digital revenue. Want to see the hidden math behind this breakout projection and the surprising assumptions that fuel it? The full narrative pulls back the curtain on every detail.

Result: Fair Value of $261.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a drop in local media rights fees or lackluster performance from the Knicks or Rangers could quickly challenge bullish assumptions about MSGS’s outlook.

Find out about the key risks to this Madison Square Garden Sports narrative.Another View: Industry Ratio Reality Check

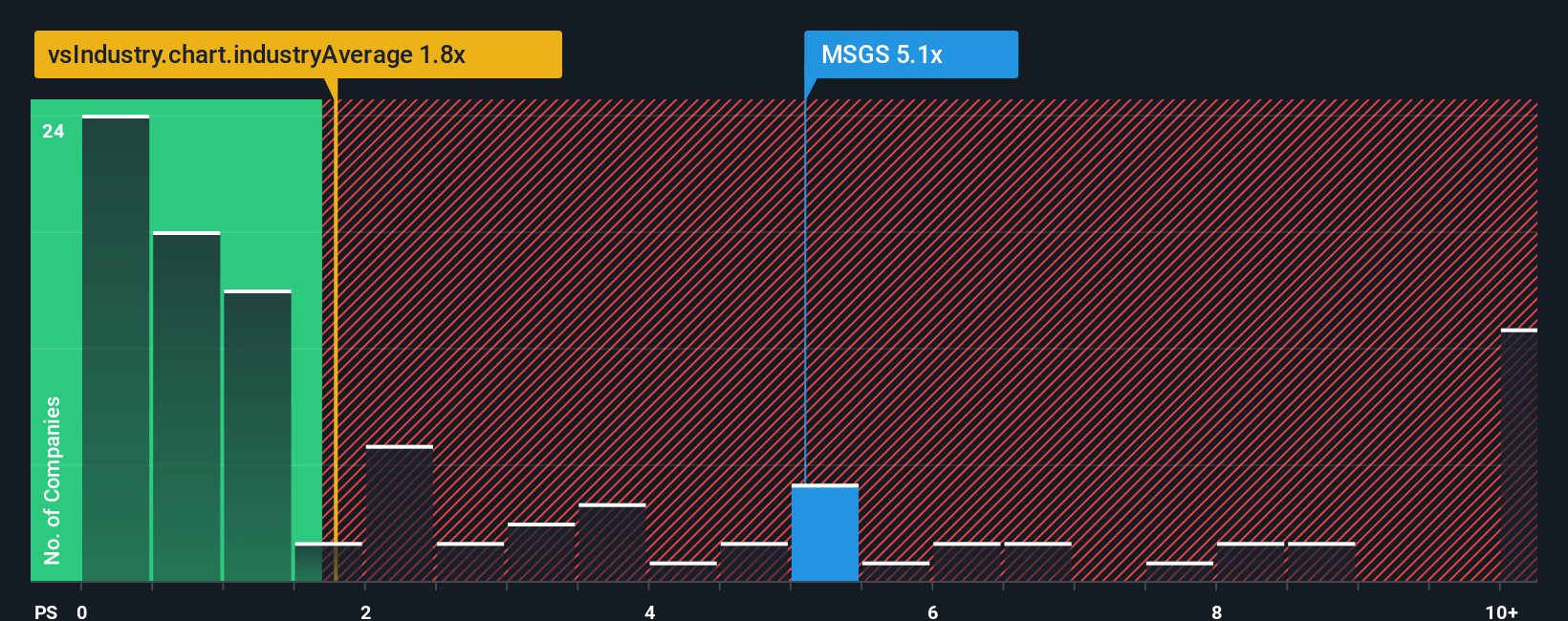

While the narrative method sees MSGS as undervalued, a simple look at its sales multiple tells a different story. Shares appear expensive compared to the broader US entertainment industry. Are markets betting on the future beyond the numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Madison Square Garden Sports Narrative

If you have a different take or prefer diving into the numbers on your own, you can craft your own perspective on MSGS in just minutes. Do it your way

A great starting point for your Madison Square Garden Sports research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself to just one opportunity. There’s a world of potential waiting if you know where to look. Use the Simply Wall Street Screener to uncover your next hidden gem before the crowd catches on.

- Tap into the hottest tech breakthroughs through AI-powered disruptors by checking out AI penny stocks and spot tomorrow’s leaders today.

- Grow your portfolio’s income by targeting stocks with generous yields and steady payments using the dividend stocks with yields > 3%.

- Seize remarkable value plays overlooked by the market with undervalued stocks based on cash flows and uncover companies trading at compelling discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGS

Madison Square Garden Sports

Operates as a professional sports company in the United States.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives