- United States

- /

- Entertainment

- /

- NYSE:MSGE

Madison Square Garden Entertainment (MSGE): Assessing Valuation After Leadership Shakeup in Key Accounting Roles

Reviewed by Simply Wall St

Madison Square Garden Entertainment is seeing a major reshuffling within its accounting leadership, as the company announced the departure of its Senior Vice President, Controller & Principal Accounting Officer, quickly followed by key new appointments in these roles.

See our latest analysis for Madison Square Garden Entertainment.

All of this leadership movement comes as Madison Square Garden Entertainment's share price continues to gather momentum, climbing 24.2% over the last 90 days and notching a 37.2% year-to-date share price return. The stock's 1-year total shareholder return of 33.1% signals strong recent performance, with investors seemingly embracing both growth prospects and the company's evolving leadership.

If company shakeups have you hunting for new ideas, consider broadening your horizons and discover fast growing stocks with high insider ownership

With shares riding a wave of positive momentum, investors are now left to ponder whether Madison Square Garden Entertainment's strong performance still leaves room for upside, or if the stock's recent gains have already priced in its future growth potential.

Most Popular Narrative: 5% Undervalued

With the last close at $48.95 and the narrative highlighting a fair value of $51.50, analysts see modest upside for Madison Square Garden Entertainment. The narrative points to robust demand and new revenue streams as key reasons behind this pricing, setting up a deeper discussion of underlying drivers.

“Sustained strong demand for live events and premium in-person experiences is translating into record ticket sales and advance bookings for fiscal '26. With concerts and special events at both the Garden and theaters pacing ahead of prior years, this growth in volume and pricing is likely to drive meaningful increases in revenue and operating income.”

Want to know what’s fueling this bullish forecast? Discover the high-impact assumptions about demand, pricing power, and profit margins that underpin the narrative’s fair value. Skip the guesswork to see what number-crunching analysts are really betting on.

Result: Fair Value of $51.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential slowdowns in consumer discretionary spending or a weaker event calendar could quickly challenge this optimistic outlook for Madison Square Garden Entertainment.

Find out about the key risks to this Madison Square Garden Entertainment narrative.

Another View: Valuation Risk from Multiples

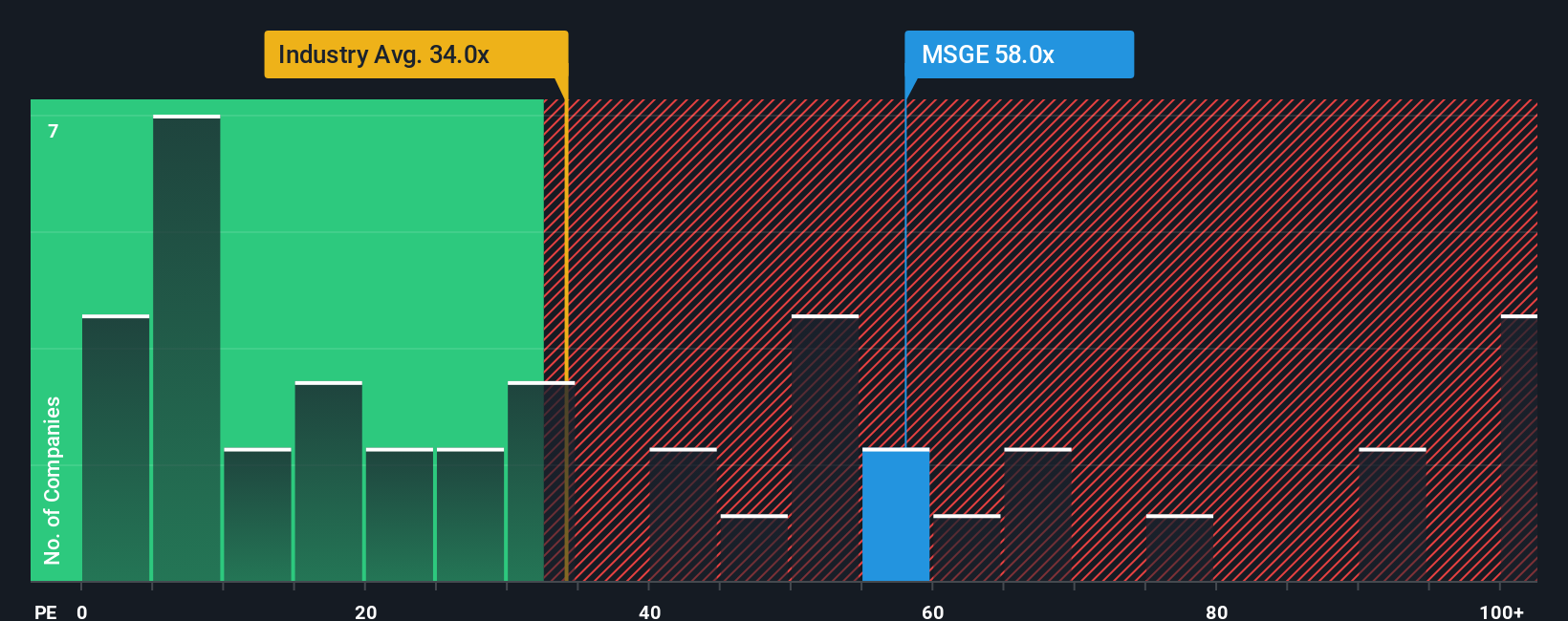

Looking beyond fair value models, the company’s current price-to-earnings ratio stands at 65.9x, which is markedly higher than the US Entertainment industry average of 20x, its peer group at 45.7x, and the market’s calculated fair ratio of 24.4x. Such a wide gap may suggest that optimism is already baked into the stock price, raising the stakes if expectations slip. Is the premium justified, or has the market run ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Madison Square Garden Entertainment Narrative

If you want to dig into the details and see things from your own perspective, it takes less than three minutes to craft your own take. Do it your way

A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There is a world of opportunity beyond a single stock. Don’t let your next big winner pass you by. Try these handpicked, high-potential investing routes on Simply Wall Street:

- Boost your income by targeting companies offering reliable yields above 3% with these 14 dividend stocks with yields > 3%.

- Ride the AI wave and track emerging innovators reshaping tomorrow’s economy with these 26 AI penny stocks.

- Capitalize on rapid disruption in quantum computing trends by unlocking these 27 quantum computing stocks packed with future-first technology leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGE

Madison Square Garden Entertainment

Through its subsidiaries, engages in live entertainment business.

Moderate growth potential with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success