- United States

- /

- Entertainment

- /

- NYSE:MCS

Marcus' (NYSE:MCS) Dividend Will Be $0.07

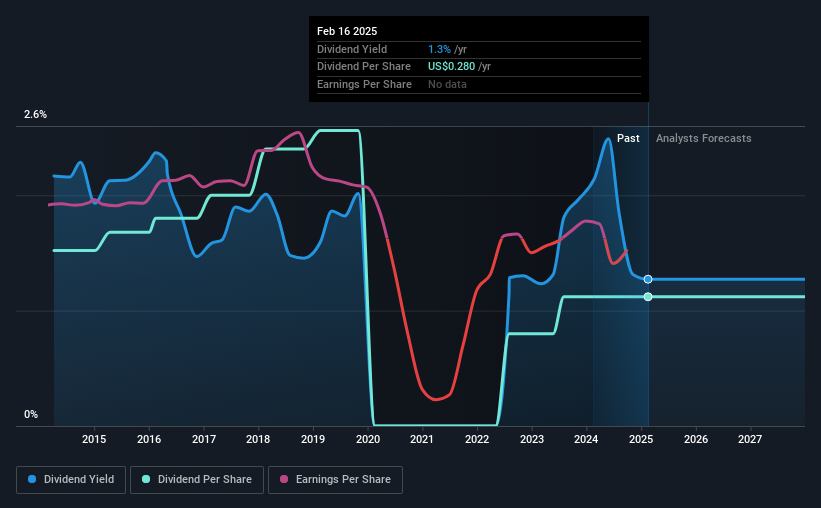

The board of The Marcus Corporation (NYSE:MCS) has announced that it will pay a dividend of $0.07 per share on the 17th of March. This means the annual payment is 1.3% of the current stock price, which is above the average for the industry.

See our latest analysis for Marcus

Marcus' Future Dividend Projections Seem Positive

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though Marcus isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

According to analysts, EPS should be several times higher next year. If the dividend continues along recent trends, we estimate the payout ratio will be 11%, so there isn't too much pressure on the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was $0.38 in 2015, and the most recent fiscal year payment was $0.28. The dividend has shrunk at around 3.0% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Marcus has seen EPS rising for the last five years, at 17% per annum. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. If the company can become profitable soon, continuing on this trajectory would bode well for the future of the dividend.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Marcus is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Marcus that investors need to be conscious of moving forward. Is Marcus not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MCS

Marcus

Owns and operates movie theatres, and hotels and resorts in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.