- United States

- /

- Entertainment

- /

- NYSE:MANU

How Club Ownership Rumors Are Shaping Manchester United’s Stock Value in 2025

Reviewed by Bailey Pemberton

- Ever wondered if Manchester United's stock is playing offense or defense when it comes to value? You're not alone, and today's numbers might surprise you.

- The share price has zig-zagged lately, with a 4.6% jump over the last 30 days but still down 12.1% for the week and 5.6% year-to-date. This highlights just how quickly market perceptions can shift.

- Recent headlines have centered on proposed club ownership changes and fresh transfer rumors that have fans and investors speculating on the future. These news stories have sparked both optimism and uncertainty around the stock price.

- Right now, Manchester United scores a 2 out of 6 on our valuation checks, meaning it's undervalued in two categories. We will dig into what goes into these scores and what traditional valuation methods indicate, but stay tuned for a more advanced approach to understanding true value, which we will cover at the end.

Manchester United scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Manchester United Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and then discounting those figures back to today's value. This approach gives investors a sense of whether the current share price is a good deal compared to the calculated intrinsic value.

For Manchester United, current Free Cash Flow stands at approximately -£125 million. While this negative figure signals challenging recent financials, analyst forecasts project a steady climb, with Free Cash Flow expected to reach £181 million by 2028. For the following years, projections continue to rise, although at a slowing pace, with estimates reaching around £281 million by 2035. Keep in mind, estimates beyond 2028 are extrapolated using historical growth patterns rather than specific analyst predictions.

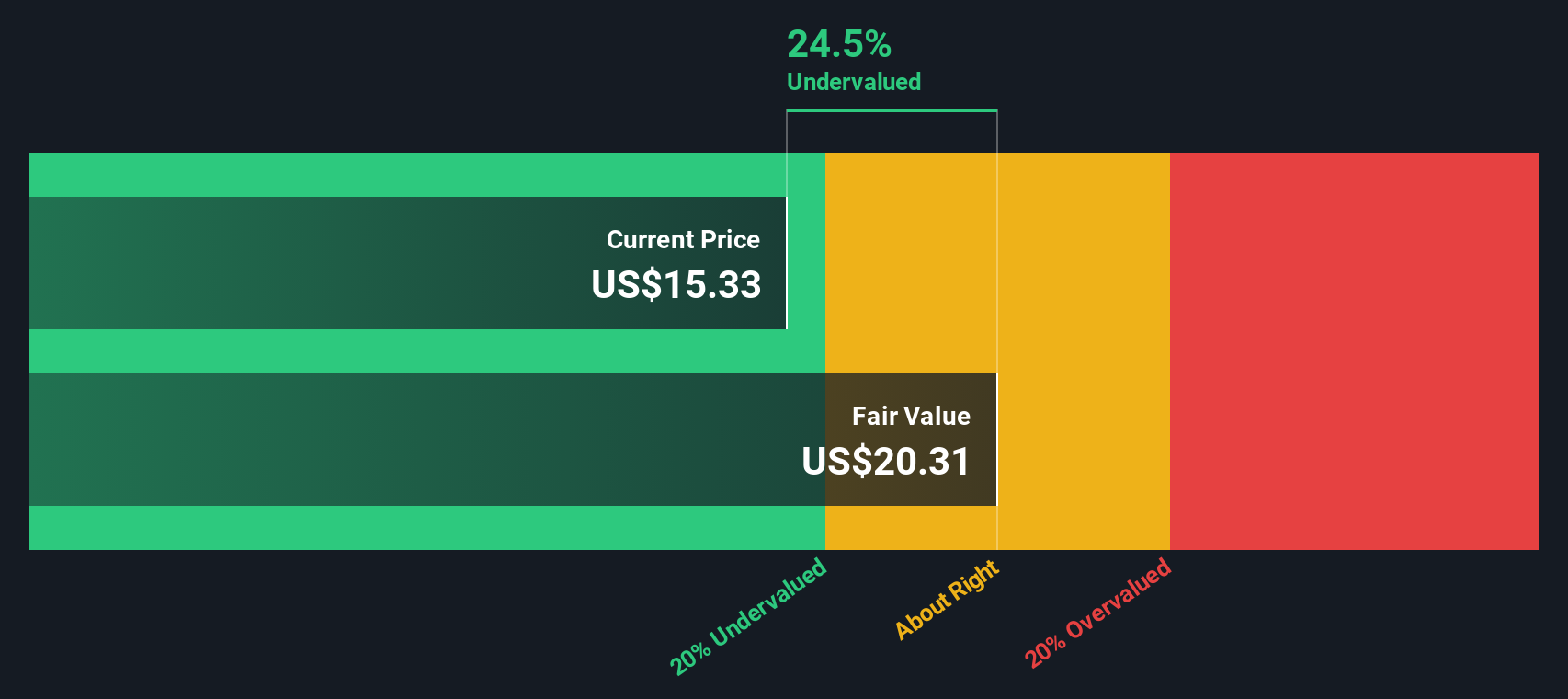

Applying this 2 Stage Free Cash Flow to Equity model, the DCF calculation leads to an estimated intrinsic value of $20.23 per share. This implies that the stock is trading at a 20.8% discount to its intrinsic value, making it appear undervalued based on this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Manchester United is undervalued by 20.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Manchester United Price vs Sales

The Price-to-Sales (P/S) ratio is a favored valuation gauge for businesses like Manchester United, particularly when a company is not currently profitable or profits are volatile but revenues remain substantial and relatively steady. The P/S ratio allows investors to compare what the market is willing to pay for each dollar of sales, making it a practical alternative when traditional earnings-based metrics are not as revealing.

A company’s “normal” or fair P/S multiple is influenced by factors such as its expected revenue growth, business risks, and how its margins compare to others in its industry. Higher growth expectations and stronger margins can lead to justified higher P/S ratios, but increased risks or industry headwinds may bring them down.

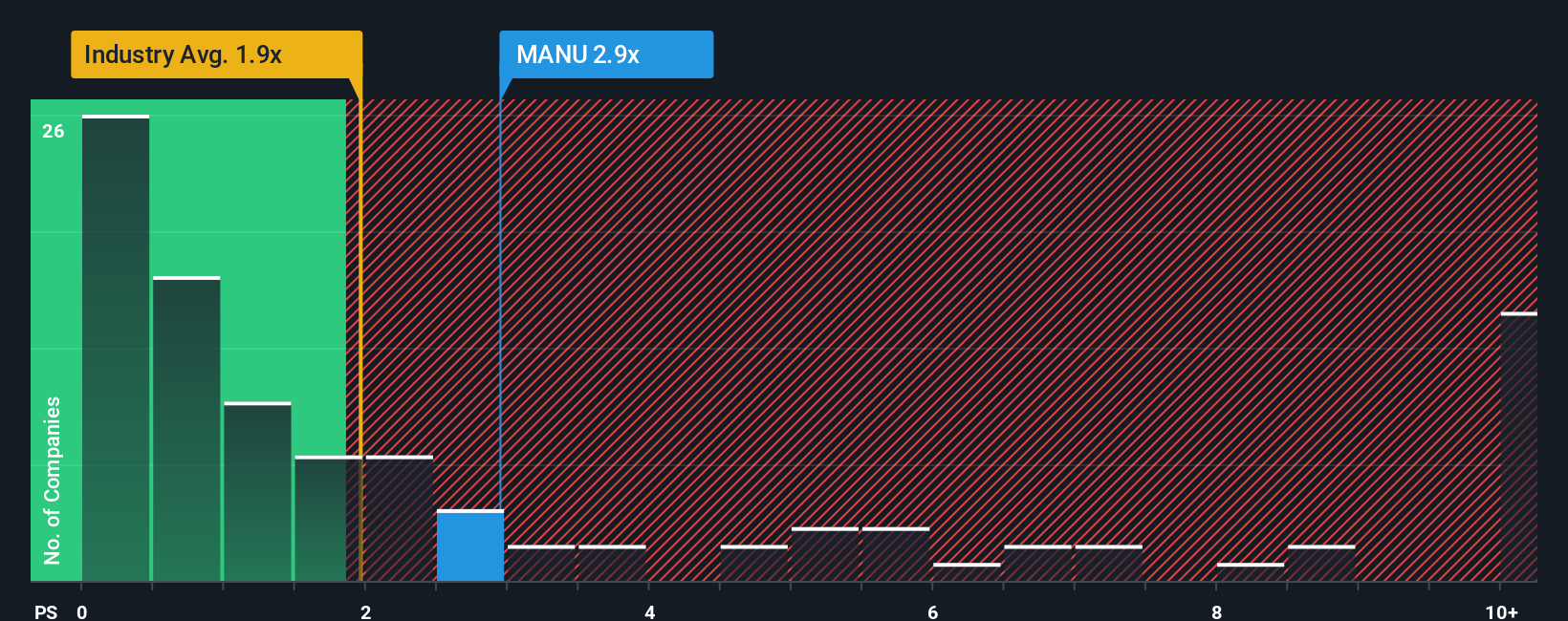

Manchester United currently trades at a P/S ratio of 3.15x, noticeably higher than the Entertainment industry average of 1.59x and its immediate peer average of 1.41x. Instead of simply relying on these market comparisons, Simply Wall St’s proprietary “Fair Ratio” metric takes a more holistic approach, factoring in unique company-specific traits including growth outlook, business risks, profit margins, industry context and market cap. For Manchester United, the calculated Fair Ratio is 2.13x, reflecting what would be a balanced price given these factors. This method offers a more nuanced benchmark for valuation than just industry or peer multiples. Since the current P/S is significantly above the Fair Ratio, the stock appears to be overvalued on this basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Manchester United Narrative

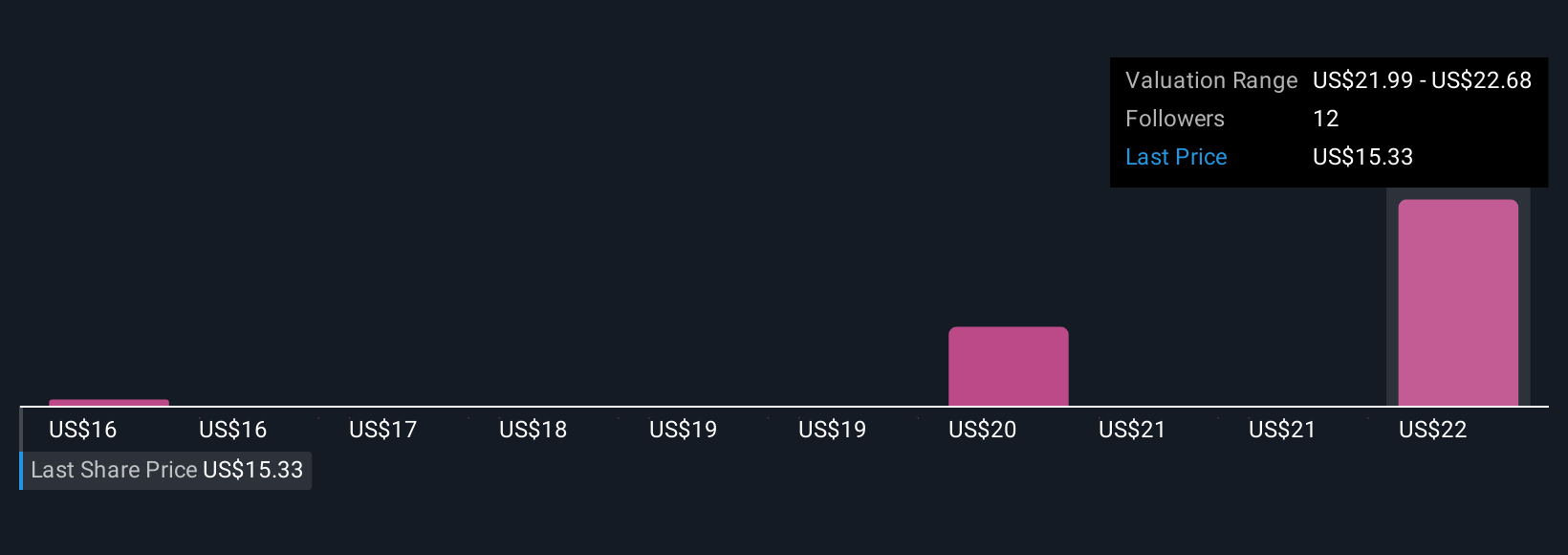

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, reflecting the underlying reasons behind your assumptions for fair value, growth, and future performance. This approach empowers you to connect the company’s unique story to your financial forecast and then tie that directly to a fair value, moving beyond just numbers on a page.

Narratives make investing more accessible and intuitive, and they are available on Simply Wall St’s Community page, trusted by millions of investors worldwide. By creating or joining Narratives, you can easily monitor how your view stacks up against the market by comparing your Fair Value to the current Price. This can help you decide when to buy or sell.

Best of all, Narratives update dynamically as soon as new news or earnings come in, keeping your perspective fresh and relevant. For example, some investors see Manchester United’s future as bright and value the shares at a premium, while others apply more caution and arrive at a much lower valuation, all based on their unique stories and expectations.

Do you think there's more to the story for Manchester United? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MANU

Manchester United

Operates a professional sports team in the United Kingdom.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives